The IPOX® Week - January 2, 2023

Headlines:

- IPOX® 100 U.S. (ETF: FPX) lags S&P 500, outperforms other innovation funds.

- IPOX® Growth Infusion outpaces S&P 500 by +742 bps. on high IPO M&A .

- IPOX® SPAC (SPAC) fell -23.95%. 86 U.S. SPACs launched in 2022.

- International deal flow dominated as U.S. firms postponed listings.

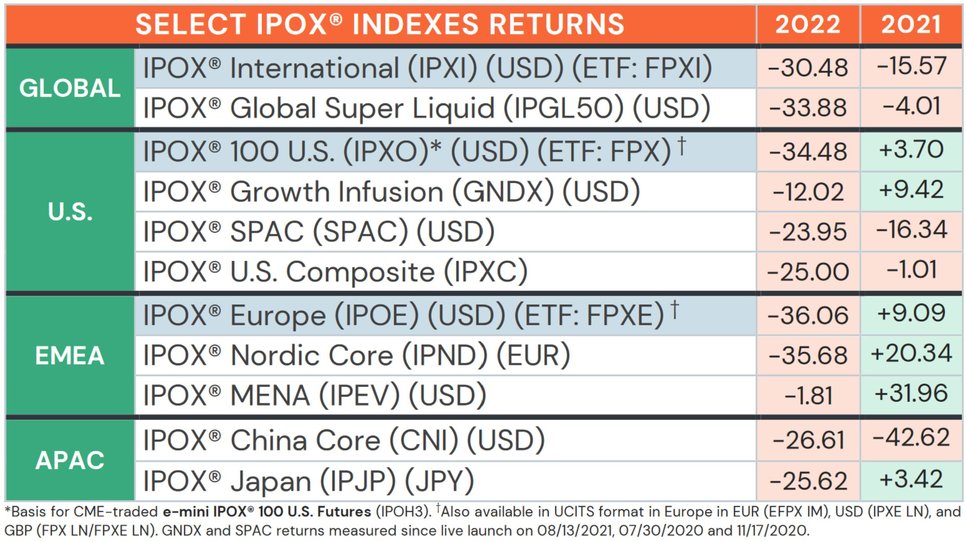

2022 IPOX® PERFORMANCE REVIEW: In a turbulent year with record-breaking inflation, surging interest rates, the Russia-Ukraine war and the aftermath of the COVID pandemic, the IPOX® Indexes traded lower alongside other world equity indexes. In the U.S., e.g., the growth-focused IPOX® 100 U.S. (ETF: FPX) declined by -34.48% YTD, lagging the S&P 500 (ETF: SPY), benchmark for U.S. stocks. Still, our main U.S. index successfully defended its position as benchmark for innovation, as the index and linked ETF (FPX) outperformed other funds such as the ARK Innovation ETF (ARKK US: -66.97%) by +3186 bps., the Renaissance IPO ETF (IPO ETF: -57.26%) by +2215 bps., as well as the MSCI ACWI IMI Innovation Index (MXACIINO Index: -35.72%) by +135 bps., respectively. Globally, the strengthening U.S. dollar weighed on our international indexes such as the IPOX® Europe (ETF: FPXE), which dropped -36.06%, while the IPOX® International (ETF: FPXI) declined by -30.48%. Bright spots were noted in the relative strength of the newly launched Middle East-focused IPOX® MENA (IPEV: -1.81%), which fell marginally as a record $23 billion were raised in the region’s IPO boom. In the far east, the IPOX® Japan (IPJP: -25.62%) outperformed the Tokyo Stock Exchange’s innovation-focused TSE Mothers Index (TSEMOTHR: -26.07%) by +45 bps. YTD. Furthermore, our innovative, large-cap heavy and super-liquid IPOX® Growth Infusion (GNDX: -12.02%) took a massive +742 bps. from the S&P 500, as IPO M&A activity, the index’s focus, surged as large incumbent firms continue to seek growth by acquiring newly listed firms.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: Amid surging commodity prices, energy firms featured strongly in the performance rankings. In the IPOX® 100 U.S. (ETF: FPX), firms representing the sector surged +25.56% on average, while those in the IPOX® Europe (ETF: FPXE) gained +64.34% amid the European energy crisis. Here, companies displaying outsized returns included LNG firm New Fortress Energy (NFE US: +75.72%), oil & gas firm HighPeak Energy (HPK US: +56.22%) and Belgian oil shipping firm Euronav (EURN BB: +102.76%). Furthermore, we found strong, albeit more dispersed performance across health care. For example, while clinical biotechnology firms Prometheus Biosciences (RXDX US: +178.20%) and Vaxcyte (PCVX US: +101.56) surged on positive trial results, German COVID-vaccine maker BioNTech (BNTX US: -40.95%) fell as the pandemic subsided. Amid 2022’s new listings that entered the IPOX® Indexes this year, notable gains were recorded by Saudi IT services firm Elm (ELM AB: +159.38%), Intel AI driving spin-off Mobileye (MBLY US: +66.95%) and travel retailer China Tourism Duty Free (1880 HK: 47.85%), amongst others.

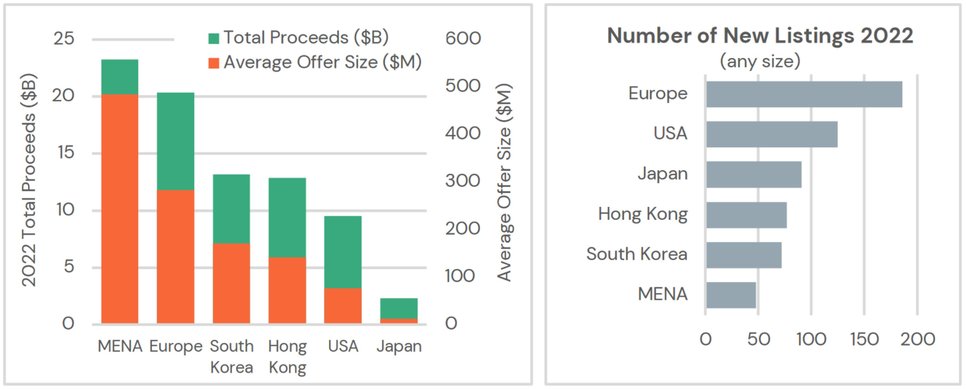

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK:At least 297 sizable (>$25m offer) listings started trading globally (excluding China Mainland and India) in 2022, raising more than $85B and gaining on average +32.35% based on the difference between the final offer price and Friday’s close. The largest IPO in 2022 was completed by South Korean EV battery manufacturer LG Energy Solution (373220 KS: +45.17%, $10B offer), followed by German luxury car maker Porsche (P911 GR: +14.45%, $9B offer) and Dubai utility Dewa (DEWA UH: -6.45%, $6B offer). In the U.S., sizable offers by 38 firms raised a total of $8.4B, gaining +4.78% to-date on average. Here, the largest listing was launched by AIG spin-off, insurance firm Corebridge Financial (CRBG US: -4.48%, $1.7B offer). Taking all new listings of any size into account, Europe (i.e. Western and Eastern Europe) saw the most New Listings, while the MENA region saw relatively few listings but raised significantly more money as average offer sizes were larger. In the U.S., the deal flow was dominated by smaller listings with an average offer size of just $76 million, compared to $333 million in 2021.

OUTLOOK FOR 2023: As the deal flow in 2022 subsided, a large number of companies postponed their IPOs to wait for better market conditions. Large IPOs towards the end of last year (e.g. Porsche, Mobileye) have been seen as a sign that the IPO market will re-ignite in the near future, as many firms are eager to raise money despite lower valuations. With a growing number of cash-rich firms looking to grow by acquiring newly listed firms at lower prices (i.e. “IPO M&As”), IPOs have remained an interesting asset class in 2022. This year, IPO hopefuls that could come to market at lower valuations (e.g. Instacart, Klarna, Reddit, Stripe) may become attractive investment opportunities.

THE IPOX® SPAC (SPAC): The Index, currently composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage, finished the year down -23.95%. In 2022, 86 SPACs raised $13 billion, down 86% and 92% respectively from 2021 when there were 613 SPACs raising $162 billion. Poor de-SPAC performance and accelerated liquidation further deepened the SPAC market. A total of 133 SPACs announced a merger target and 104 completed business combinations. 141 SPACs opted to liquidate funds, more than the total number of SPAC liquidations in history, as companies were unable to identify or complete the merger within time limit and the new exercise tax spurred SPAC sponsors to rush to liquidation early. There are still 390 SPACs actively searching for targets. The largest SPAC IPO in 2022 belonged to Screaming Eagle Acquisition, the 9th SPAC formed by former MGM CEO Harry Sloan, raising $750m. The largest liquidation was Bill Ackman’s largest SPAC in history, Pershing Square Tontine. The most-valued SPAC merger MSP Recovery (MSPR US: -83.94%) was completed this year, the Medicare reimbursement recovery firm was valued at $32.6b before collapsing. Some of the better performing de-SPACs this year include workforce lodging provider Target Hospitality (TH US: +325.28%), biopharmaceutical company Immunovant (IMVT US: +108.33%) and Bowling alley operator Bowlero (BOWL US: +49.45%).

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.