The IPOX® Week - September 5, 2023

Headlines:

- Strong September start for IPOX® ETFs, heavyweight Airbnb joins S&P 500.

- IPOX® MENA continues momentum to new high, amid BRICS expansion.

- Arm debuts 9/14. Instacart, Klaviyo, ADES, Birkenstock to launch in September.

- IPOX® SPAC (SPAC) gains +3.21%. No new SPACs launch in U.S. last week.

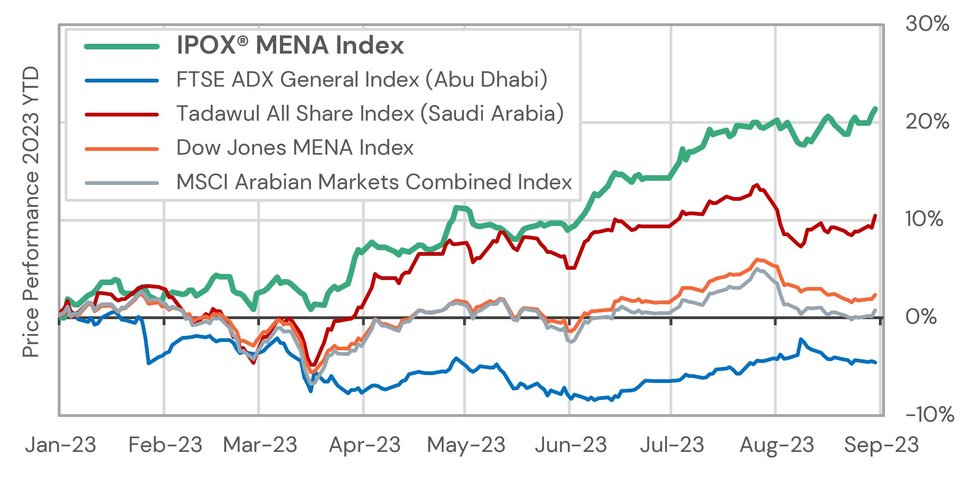

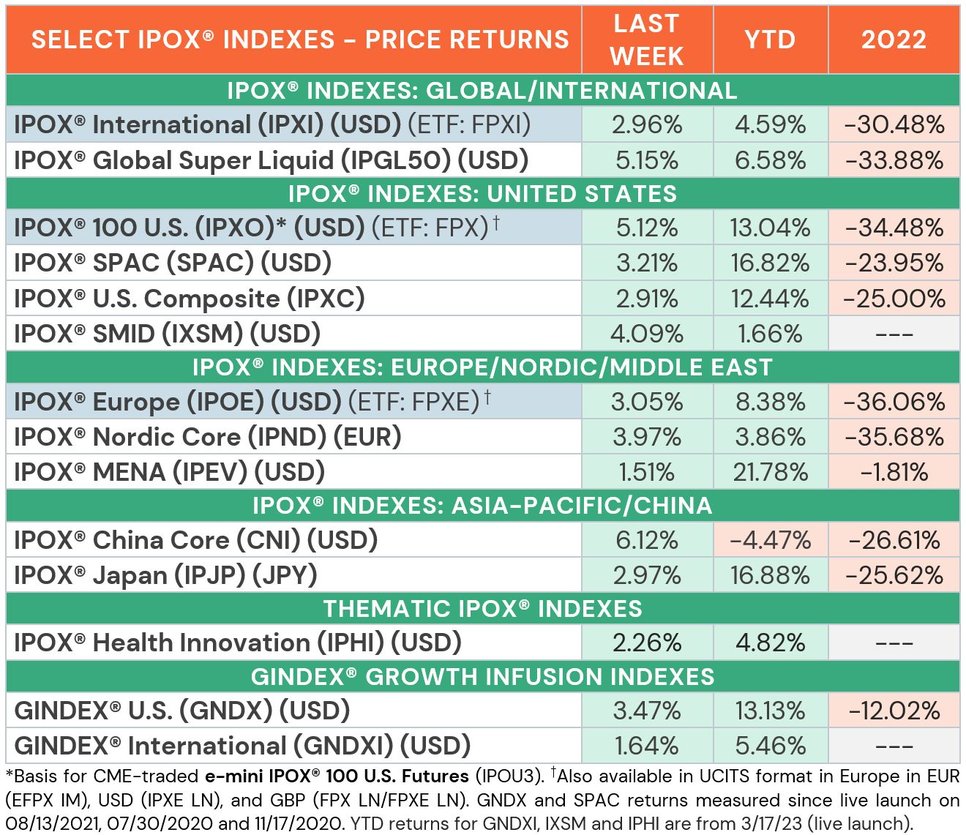

WEEKLY IPOX® PERFORMANCE REVIEW: At the end of a tough month for global equities, the IPOX® Indexes recorded a strong September start, beating major benchmarks across the board. In the U.S., short-term treasury yields fell as unemployment numbers rose and average hourly earnings only gained 0.2%, reinforcing expectations that the Fed may pause rate hikes this month. Amid a renewed decline in volatility (VIX: -16.52%) to the lowest weekly level since February 2020, the IPOX® 100 U.S. (ETF: FPX) soared +5.12% to +13.04% YTD, taking a massive 262 bps. from the S&P 500 (SPX) and 145 bps. from the Nasdaq 100 (NDX) last week. In Europe, inflation data was in focus, with sticky Eurozone August CPI data, while year-on-year core inflation dropped slightly, creating uncertainty over the ECB’s policy going forward. Nevertheless, the IPOX® 100 Europe (+3.05%, ETF: FPXE) outperformed the STOXX 50 Europe (SX5L) in August, gaining 186 bps. on the benchmark quarter-to-date. Internationally, the largest gains were seen in the IPOX® China (CNI: +6.12%), as China’s Caixin Manufacturing PMI unexpectedly rose above the midpoint, signaling growth rather than contraction. Amid talks of Saudi Arabia and the UAE joining the BRICS Bloc, the IPOX® MENA (IPEV: +1.51%) climbed to another new all-time high, outperforming most other major regional indices (see graph below). The IPOX® International (ETF: FPXI) gained anew, adding +2.96% to +4.59% YTD, beating the MSCI World (ex-USA) Index (MXWOU) again last week, taking 32 bps. from the benchmark.

GINDEX® PERFORMANCE REVIEW: Our innovative large-cap, super liquid portfolios with focus on acquirers of recent IPOs (IPO M&As) both gained last week. The U.S.-focused GINDEX® U.S. (GNDX: +3.47%) climbed to +13.13% YTD, while the international portfolio of the GINDEX® International (GNDXI: +1.64%) has improved by +5.46% since 3/17.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by “Internet of Things” cloud management firm Samsara (IOT: +22.45%), which soared to a new post-IPO high after posting Q2 earnings. EV maker Rivian (RIVN US: +16.14%) climbed after appointing previous Porsche North America president Gruner as new Chief Commercial Officer. Large cap heavyweight accommodation rental firm Airbnb (ABNB: +5.49%) added +6% in post-market trading on Friday, after S&P announced the inclusion to the S&P 500 benchmark. Speed camera maker, de-SPAC Verra Mobility (VRRM US: -8.40%), dipped after its accountant, Ernst & Young, resigned. Norwegian Internet browser firm Opera (OPRA US: +16.19%) topped the IPOX® 100 Europe (ETF: FPXE), resurging after its previous post-earnings dip. Swedish renewable wind energy firm OX2 (OX2 SS: -13.82%) fell as after-tax profits and operating margins slumped in Q2. Danish pharma firm Novo Nordisk (NOVOB DC: +1.82%), maker of diet drugs Ozempic/Wegovy reached a new high, becoming Europe’s largest firm by market capitalization after overtaking fashion giant LVMH. In the IPOX® International (ETF: FPXI), heavyweight holding Chinese E-commerce giant Pinduoduo (PDD US: +29.26%) operator of App Store chart leader, online shop Temu, rocketed after earnings. Entertainment producer STAR CM Holdings (6698 HK: -54.67%) plummeted for a third week after halting hit TV show The Voice of China.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 2 sizable IPOs started trading last week, gaining +63.25% from offer price to Friday’s close. Real estate development firm Kuru Grup (KZGYO TI: +32.95%, $38m offer) listed in Turkey, while industrial lubricant specialist PSP Specialities (PSP TB: +93.55%, $61m) surged in Thailand.

2 sizable international deals are expected next week. Tuesday: Chinese tumor immunotherapy developer ImmuneOnco Biopharmaceuticals (1541 HK, $41m offer) in Hong Kong. Wednesday: Turkish retailer of mother and baby products Ebebek (EBEBK TI, $70m offer).

After a quiet month for new listings, September is expected to see an uptick in deal flow with major IPOs from chipmaker Arm (14/9; up to $7b offer), online shopping app Instacart (around $1b offer), marketing firm Klaviyo (est. valuation $9b), German footwear maker Birkenstock (est. valuation $8b) and Saudi state fund-backed oil driller Ades (around $1b offer, largest in Saudi Arabia this year).

THE IPOX® SPAC (SPAC): The Index of 50 constituents at both the pre- and post-consummation stage surged +3.21% to +16.82% YTD. IPOX® SPAC movers included autoimmune diseases-focused pharma company Immunovant (IMVT US: +19.59%) and Bitcoin miner Bitdeer Technologies Group (BTDR US: -9.21%) after SEC delayed decision on potential Spot Bitcoin ETF. Other SPAC news: 1) No SPAC Announced Merger Agreement. 2) 4 SPACs Approved/Completed Business Combinations, e.g., Fifth Wall Acquisition III completed merger with parking garage owner Mobile Infrastructure Corp (BEEP US: +12.81%). 3) 2 SPACs announced liquidation. 4) No SPACs launched last week.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.