Introduction:

Context Analytics (CA) works with brokerage firms to bring the uncorrelated and predictive power of social media to their customers. For this blog, we will explore the CA widget implementation for Lightspeed Trader.

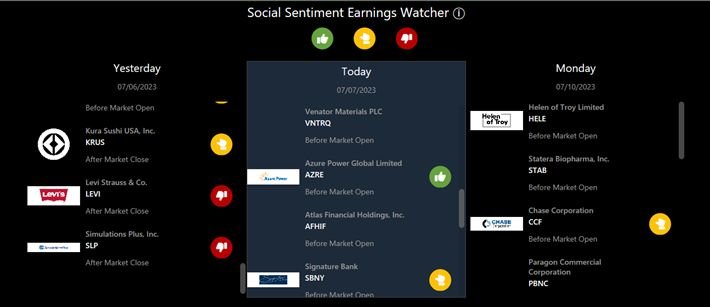

CA’s Social Sentiment Earnings Watcher provides investors with recent earnings events from the previous day, the current day, and the following day, along with the securities’ real-time social sentiment. The green “thumbs up” symbol indicates companies with positive social sentiment (S-Score > 1). The yellow “sideway thumb” indicates a company with neutral social sentiment (S-Score between -1 and 1). The red “thumbs down” indicates a company with negative social sentiment (S-Score < -1). All sentiment score values are updated with real-time Twitter conversations.

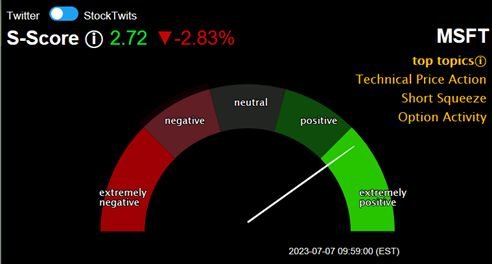

The Sentiment Odometer gives an easy-to-read visual of an individual security’s social sentiment for both Twitter and StockTwits, updating every minute. S-Score is a normalized representation of social sentiment of a security in the past 24 hours compared to its own 20-day baseline. The top topics on the top right provide context around the trending topics being discussed on the security in real-time on Twitter and StockTwits, which contributed to the sentiment S-Scores.

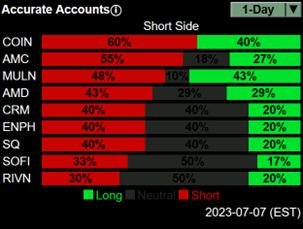

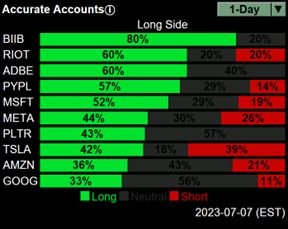

The Accurate Account widgets offer a unique viewpoint by aggregating expectations from Twitter users who are historically proven accurate, both on the long and short side over specific time horizons. Each ticker has a corresponding percentage based on conversations from these accurate accounts mentioning either Long positions (green), Short positions (red), and Neutral positions (dark grey). Different outlook horizons can be selected at 1-Day, 2-Day, 1-Week, 1-Month.

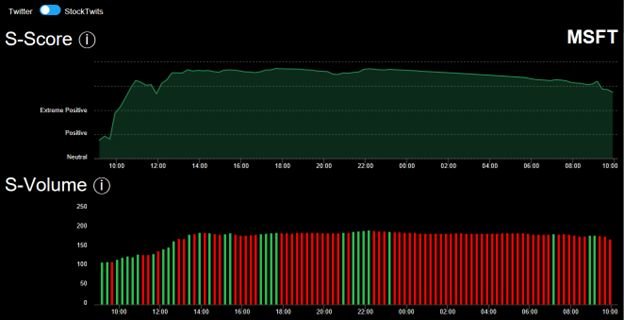

The CA Sentiment Trend widget provides a 24-hour snapshot of a given security’s S-Score and S-Volume. The Y-axis for S-Score ranges from ‘Extreme Negative’ (S-Score < -2) to ‘Extreme Positive’ (S-Score > 2). S-Volume is the indicative tweet volume used to compute the sentiment estimate. This is the number of unique Tweets arriving in a 24-hour interval from certified CA accounts. Both graphs are interactive, giving investors the ability to hover over a specific data point within the 24-hour window.

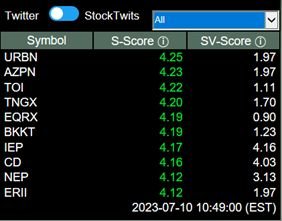

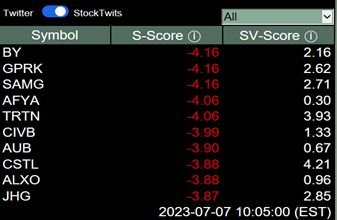

The Top and Bottom 10 Sentiment widgets provide a preview of the Top 10 tickers with the highest/lowest S-Score every minute for both Twitter and StockTwits. SV-Score is the normalized value of S-Volume (Z-score of S-Volume). This value is computed like S-Score. There is also a dropdown menu on the top right to select a specific conversation to see the most positive/negative securities being mentioned in those topics. Below is a screenshot of the different topics that can be filtered on:

By leveraging Context Analytics widgets and analyzing social sentiment across securities from different sources, investors can potentially increase returns. For more information, click the button below or email us at [email protected] .

Options Risk Disclosure:

Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Options trading subject to eligibility requirements.

Active Trading with Lightspeed:

Lightspeed provides professional traders with all the tools required to help them find success in stock trading, and we have been developing and honing our active trader platform to offer an optimal user experience. With the intuitive interface layouts and institutional quality stock and options scanners, we aim to help traders reach their goals, no matter what their strategy is. We also offer our clients some of the lowest trading fees in the industry.

For more information on a professional trading platform with Lightspeed, please call us at 1-888-577-3123, request a demo, or to open an account.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple order types and routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.