The IPOX® Week - December 12, 2022

Headlines:

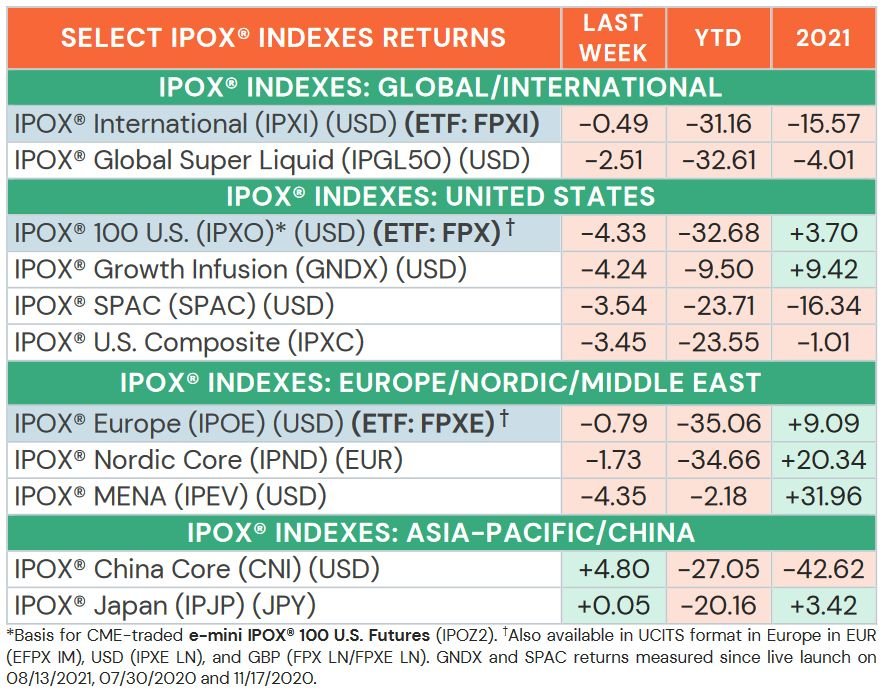

- Most IPOX® Indexes traded lower last week, IPOX® 100 U.S. sheds -4.33%.

- IPOX® Europe (ETF: FPXE) ends 7-week winning streak, loses -0.79%.

- IPOX® SPAC (SPAC) drops -3.54%. No U.S. SPACs launched last week.

- IPOX® holding Porsche enters Germany’s DAX 40. 12 IPOs this week.

WEEKLY IPOX® PERFORMANCE REVIEW: Amid big swings in U.S. yields amid recession fears, Friday’s discouraging U.S. Producer Price Index and increased U.S. equity risk (VIX: +19.78%), the IPOX® Indexes traded lower ahead of futures expirations week. In the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX) declined by -4.33% to -32.68% YTD, outpacing U.S. small-caps, while lagging the S&P 500 (ETF: SPY), benchmark for U.S. stocks. Internationally, the IPOX® International (ETF: FPXI) declined by -0.49% to -31.16%. Again, widely dispersed gains throughout the index’s portfolio were characterized by another big jump in China-linked exposure, with big gains in the IPOX® China (CNI: +4.80%) amid a reversal in the country’s zero-COVID policy. In other international markets, the IPOX® Europe (ETF: FPXE) fell -0.79%, ending its record-breaking week-on-week rally after gaining +20.13% in 7 weeks. With the FIFA World Cup in Qatar entering its final week, the IPOX® MENA (IPEV: -4.35%) dropped sharply on big stock overhang. The IPOX® Japan (IPJP: +0.05%) gained marginally as two large IPOs are expected to list in Tokyo this week.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by biotech firm Prometheus Biosciences (RXDX US: +175.50%), which surged after announcing new Phase 2 trial data for a new Inflammatory Bowel Disease (IBD) drug. Both cloud-based development platform Gitlab (GTLB US: +12.36%) and leisure cloth firm Academy Sports & Outdoors (ASO US: +9.07%) also gained after beating earnings estimates. The index’s laggards were led by neuroscience biotech Karuna Therapeutics (KRTX US: -16.70%) amid a leadership shake up, while beleaguered crypto exchange Coinbase (COIN US: -15.59%) fell to a new post-IPO low. Outsized moves in the IPOX® Europe (ETF: FPXE) were recorded by car part maker Vitesco (VTSC GR: +8.16%) and GSK Consumer Healthcare spin-off Haleon (HLN LN: +7.94%), which surged after the Illinois-filed lawsuit surrounding the antacid drug Zantac was dismissed. With positive reopening news out of China, returns across the IPOX® International (ETF: FPXI) were again widely spread and included Chinese social media platform Kuaishou (1024 HK: +16.83%) and travel retailer China Tourism Duty Free (1880 HK: +9.44%). Indonesian super-app GoTo (GOTO IJ: -29.55%) continued to fall steeply amid analyst reports of a looming cash crunch.

IPOX® PORTFOLIO HOLDING NEWS: 1) IPOX® Europe (ETF: FPXE) and IPOX® International (ETF: FPXI) constituent, luxury car maker Porsche (P911 GR: -5.23%) set to enter German DAX 40 benchmark on December 16. 2) Healthcare provider UnitedHealth’s (UNH US: +0.57%) purchase of rival LHC Group (LHCG US) expected to close in Q1 2023. 3) Tech investor Softbank (9434 JP: +0.95%) CEO Masayoshi Son increases stake, fuels rumors mill of plans to take firm private in the future. 4) IPOX® Europe (ETF: FPXE) holding, Swedish private equity firm EQT (EQT SS: +0.83%) eyes Morgan Stanley’s 40% stake in German wind park developer PNE (PNE3 GR).

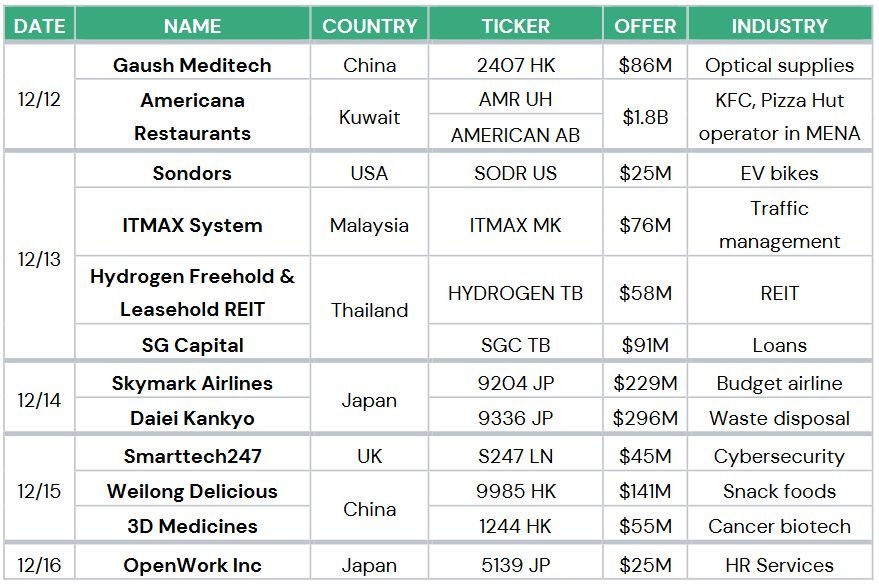

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK:4 sizable IPOs started trading globally last week, gaining on average +6.04% based on the difference between the final offer price and Friday’s close. Italian hydrogen firm Erredue (RDUE IM: +1.25%) and Swedish wireless communication firm LumenRadio (LUMEN SS, +26.05%) gained. Chinese insurance firm Sunshine Insurance (6963 HK, +0.00%) traded flat, while Thai pet food maker i-Tail (ITC TB: -3.13%) fell. In the U.S., micro-cap lab-grown diamond maker Adamas One (JEWL US: +18.44%) gained after pricing their IPO for a $11m offer size, down from the initially planned $34m.

This week, at least 12 firms are expected to go public internationally:

OTHER NEWS: 1) Vietnamese EV firm Vinfast files for U.S. IPO. 2) Aramco refiner Luberef prices $1.3B IPO at top end of range. 3) Xiamen International Bank mulls $1.3B H.K. IPO. 4) Anta Sports weighs IPO of Finland’s Wilson tennis racket maker Amer, could raise over $1B.

THE IPOX® SPAC (SPAC): The Index fell -3.54% to -23.71% YTD. IPOX® SPAC Leaders included workforce accommodations provider Target Hospitality (TH US: +1.74%) and broadband network firm AST SpaceMobile (ASTS US: -26.63%). Other SPAC news: 1) 9 SPACS Announced Merger Agreement include a) Ares Acquisition (AAC US: +0.30%) with nuclear power firm X-energy and b) Golden Falcon Acquisition (GFX US: +0.10%) with Turkish air freight carrier MGN Airline. 2) 1 SPAC Approved and Completed Business Combination include InterPrivate II Acquisition with car sharing platform Getaround (GETR US: -66.11%). 3) 3 SPACs terminated merger include a) the $9bn deal between Concord Acquisition (CND US: +0.00%) and stablecoin issuer Circle and b) the $1bn deal between Gores Holdings VIII (GIIX US: +0.50%) and plant-based fiber packaging firm Footprint. 4) 15 SPACs announced liquidation and redemption. 5) No new SPAC launched last week.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Indexes continue outperformance of benchmarks amid global rout

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.