The IPOX® Week - January 23, 2023

Headlines:

- IPOX® 100 U.S. (ETF: FPX) trades lower along S&P 500 benchmark.

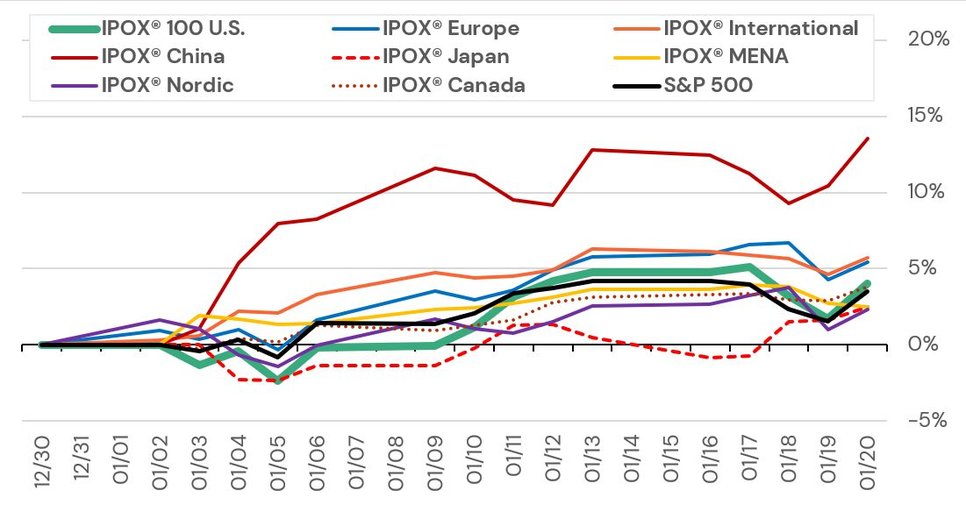

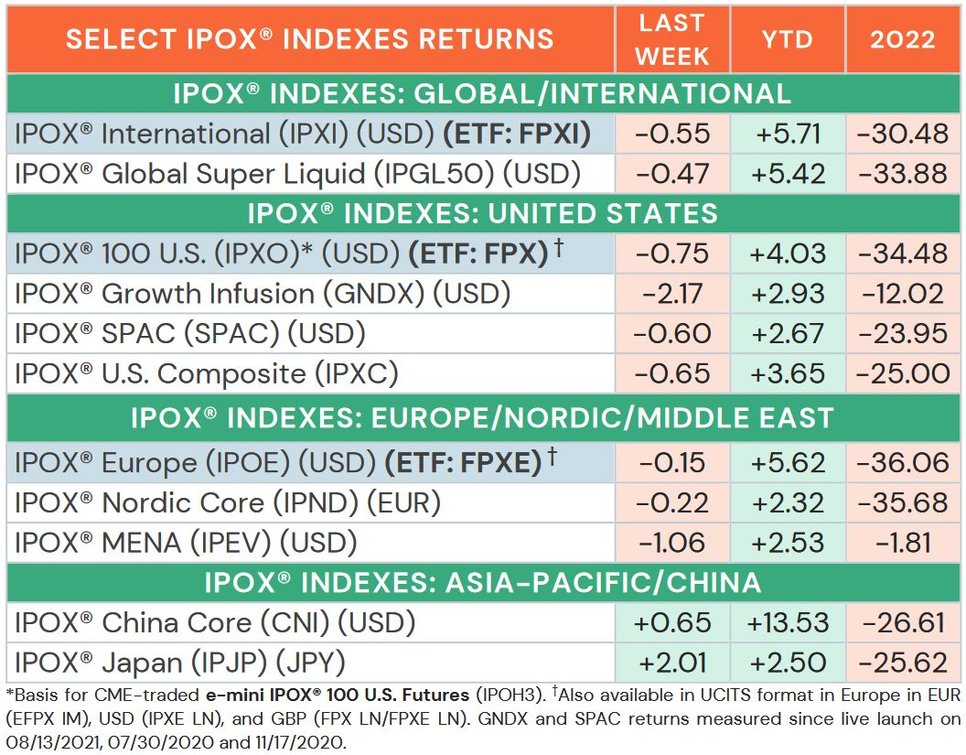

- Global IPOX® Indexes show stronger performance than U.S. counterparts.

- IPOX® SPAC (SPAC) falls -0.60%. No U.S. SPACs launched last week.

- Several IPOX® holdings reach post-IPO high; 3 new +$100m U.S. IPO filings.

WEEKLY IPOX® PERFORMANCE REVIEW: The IPOX® Indexes finished the shortened equity options expirations week with mixed results. Amid a weaker bond market, hawkish comments from Federal Reserve and European Central Bank officials and an increase in volatility (VIX: +8.17%), U.S. equities traded lower as the S&P 500 (SPX: -0.65%) benchmark managed to move past its 200-day moving average after rallying Friday. As tech stocks gained amid news of layoffs and Netflix's (NFLX US: +2.90%) increase in subscribers, our growth-heavy IPOX® 100 U.S. (ETF: FPX) traded slightly lower than the S&P 500, losing -0.75% to +4.03% YTD). Globally, we are noticing better performance in our main international indexes YTD (see below). For example, the IPOX® Europe (ETF: FPXE) only fell slightly by -0.15% to +5.62% YTD, while the our global proxy for innovation, the IPOX® International (ETF: FPXI) fell -0.55% to +5.71% YTD. In East Asia, the IPOX® China (CNI: +0.65% to +13.53% YTD) continued to gain, while the IPOX® Japan (IPJP) climbed +2.01% after the Bank of Japan defied market bets and announced the continuation of its low interest rate policy.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by life insurance company Jackson Financial (JXN US: +13.27%), food delivery app Doordash (DASH US: +10.85%) and entertainment firm Warner Music Group (WMG US: +9.18%), while transplantation specialist Transmedics (TMDX US: +5.63%) and recent addition GE Healthcare (GEHC US: +2.03%) reached new post-IPO highs. Shale gas firm Profrac (ACDC US: -10.67%) fell as their 2022 acquisition U.S. Well Services had three patents invalidated after a dispute with fracking giant Halliburton. In the IPOX® Europe (ETF: FPXE), defense firm Hensoldt (HAG GR: +13.88%) gained amid news of delivering air defense radars to Ukraine. As Germany opened their first LNG terminal last week, Norway-listed LNG tanker operator Hafnia (HAFNI NO: +9.36%) gained substantially alongside oil shipping firm Euronav (EURN BB: +7.81%). Swedish protein biotech Olink (OLK US: -16.98%) fell sharply, closing the week at the price of their newly announced secondary offering at $20/shr. In the IPOX® International (ETF: FPXI), newly added education firm Koolearn Technology (1797 HK: +13.82%), airport shop operator China Tourism Duty Free (1880 HK: +5.22%) and LNG factory builder Technip Energies (TE FP: +6.06%) all reached new post-IPO highs, while the laggards were led by British Forex fintech Wise (WISE LN: -14.42%), which fell after committing to pass on the benefits of higher interest rates to customers.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 6 sizable IPOs started trading internationally last week, gaining +24.08% on average, based on the difference between the final offer price and Friday’s close. 4 companies listed in Hong Kong: Fruit retailer Pagoda (2411 HK: +5.54%), beauty services provider Beauty Farm (2373 HK: +60.46%), graphite electrode manufacturer Sanergy (2459 HK: +3.12%) and Alibaba-backed music talent agency Yuehua Entertainment (2306 HK: +37.99%). Noble gas supplier TEMC (425040 KS: +4.29%) started trading in South Korea, while energy transformer maker Astor (ASTOR TI: +33.04%) started trading in Turkey. No sizable IPOs are scheduled for this week.

IPO News: 1) Bain Capital mulls IPO of airline Virgin Australia. 2) Chinese pork producer Muyuan and manufacturer Sanhua plan to raise $2.5b in Zurich GDR sales. 3) Greek government plans IPO to sell 30% stake in Athens International Airport. 4) Spanish material firm Cosentino picks banks for summer IPOs at possible $3b valuation. 5) Abu Dhabi National Oil selects banks for mega IPO of LNG unit Adnoc Gas. 6) Several firms file for U.S. IPOs with +$100m offer size: Hypertension drug maker Mineralys (MLYS US), oil & gas producer TXO Energy Partners (TXO US), Chinese LiDAR firm Hesai (HSAI US).

THE IPOX® SPAC (SPAC): The Index, composed of 50 high conviction plays trading at both the pre- and post-consummation stage declined to +2.67% YTD. IPOX® SPAC members with notable moves last week include beaten-down biotech ProKidney (PROK US: +12.34%), amid last week’s positive trial data. Payment data processor Priority Technology (PRTH US: -19.34%) plunged anew despite new partnership announcement. Other SPAC news include: 1) 3 SPACs Announced Merger Agreement include Ross Acquisition II (ROSS US: +0.15%) with Alzheimer’s and Parkinson’s diseases drug developer APRINOIA Therapeutics. 2) No SPAC Approved or Completed Business Combination. 3) Only 1 SPAC announced liquidation. 4) 1 SPAC terminated merger agreement as FoxWayne Acquisition (FOXW US: +4.48%) and Toronto-based dating app developer Clover mutually terminated the deal. 5) While no definitive agreement been signed, Onyx Acquisition I (ONYX US: +0.10%) has announced that it is in advanced discussion with private equity firm Helios Investment Partners to create a listed energy transition infrastructure platform that focuses on natural gas and low-carbon energy infrastructure development in Africa. 5) No new SPAC launched last week in the U.S .

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.