The IPOX® Week - January 9, 2023

Headlines:

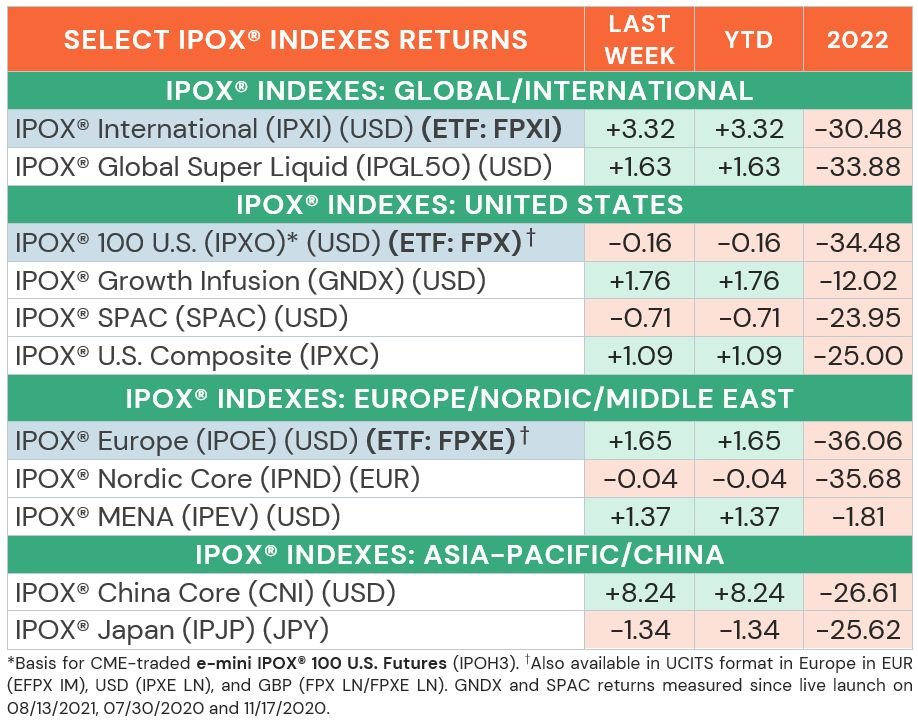

- Global IPOX® Indexes trade higher in first week of 2023, U.S. index lags.

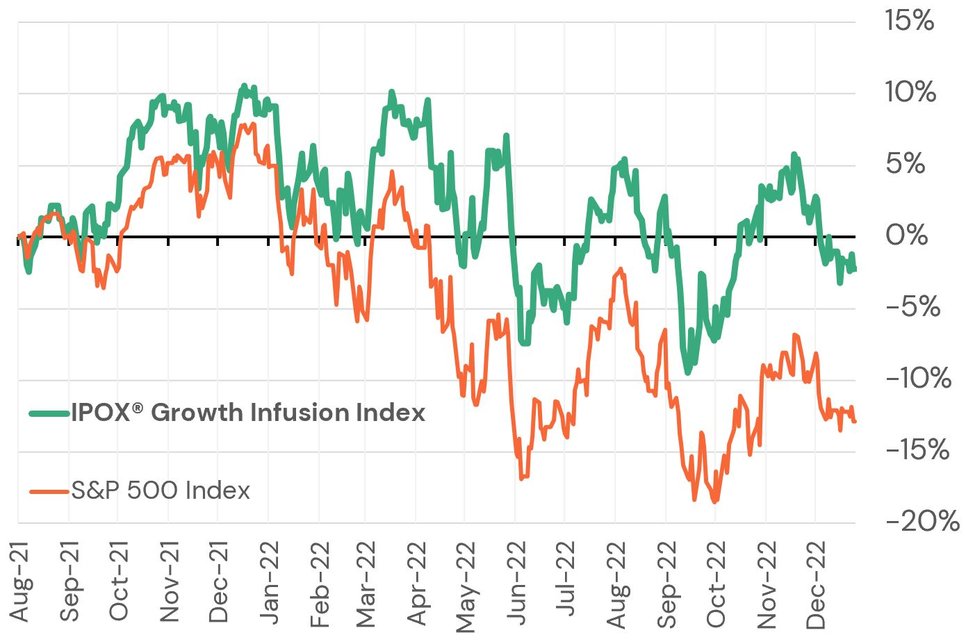

- IPOX® Growth Infusion (GNDX) outperforms S&P 500 Index anew.

- IPOX® SPAC (SPAC) drops -0.71%. No U.S. SPACs launched last week.

- GE Healthcare gains on debut. J&J to list consumer healthcare unit Kenvue.

WEEKLY IPOX® PERFORMANCE REVIEW: In the first week of the new year, the IPOX® Indexes traded higher, on average. During the shortened trading week in the U.S., equities came out on top amid “goldilocks” data of weakening inflation, lower unemployment figures and slowing wage growth. As U.S. 30-year bond yields and volatility dropped (VIX: -2.49%), the growth-focused IPOX® 100 U.S. (ETF: FPX) fell marginally to -0.16% YTD, lagging the S&P 500 (ETF: SPY), benchmark for U.S. stocks. Internationally, the IPOX® International (ETF: FPXI) surged to +3.32% YTD amid a recovery in Chinese stocks, as Japan’s equities traded lower. Here, the IPOX® China (CNI) skyrocketed +8.24%, while the IPOX® Japan (IPJP) fell -1.34% amid the Bank of Japan’s policy changes on bond buying. In other international markets, the IPOX® Europe (ETF: FPXE) gained +1.65% as German CPI fell more than expected. The Middle East-focused IPOX® MENA (IPEV: +1.37%) gained despite falling commodity prices. In IPO M&A action, the super-liquid IPOX® Growth Infusion (GNDX) gained +1.76%, taking +29 bps. from the S&P 500 to +1067 bps. of outperformance since launch in August 2021 (see below)

.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by entertainment firm Warner Bros Discovery (WBD US: +20.04%) and financial services firm Block (SQ US: +9.65%), which both surged after analyst upgrades. Consumer healthcare firm Bausch + Lomb (BLCO US: +7.53%) gained amid publication of new clinical trial data. The index’s laggards included high beta, growth-heavy stocks such as software firms Zoominfo Technologies (ZI US: -16.72%), Gitlab (GTLB US: -15.71%) and Datadog (DDOG: -13.25%). In the IPOX® Europe (ETF: FPXE), the new Spanish IBEX 35 benchmark member Unicaja Banco (UNI SQ: +17.07%) gained alongside German automotive supplier Vitesco Technologies (VTSC GR: +13.00%) and Tencent-investor Prosus (PRX NA: +12.94%). Swedish biotech firm Olink (OLK US: -21.29%) plunged despite newly published positive analyst ratings. The IPOX® International (ETF: FPXI) saw highly dispersed moves with outsized gains in China-linked exposure, i.e. tech giant Alibaba (BABA US: +20.50%), e-commerce firm Pinduoduo (PDD US: +16.44%) and video platform Kuaishou (1024 HK: +10.69%), while Thai Life Insurance (TLI TB: -6.71%) led the index’s laggards.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: As global IPO activity has yet to restart in the new year, only one sizable IPO started trading globally last week. Malaysian shipping packaging firm L&P Global (LPBHD MK) surged +70.00% after raising $38 million. In the U.S., the General Electric healthcare tech unit, medical imaging giant GE Healthcare (GEHC US), started trading independently, gaining +5.27% after Wednesday’s spin-off. The firm that was immediately added to the S&P 500 upon launch is seen positively by analysts (P/E = 10, i.e. better than competitor Siemens Healthineers) and will replace Eli Lilly (LLY US) in the IPOX® 100 U.S. (ETF: FPX) from Monday, January 9th.

This week, at least 3 firms are expected to launch sizable offers internationally. Monday: Hong Kong educational examination services provider Fenbi (2469 HK, $25m offer). Thursday: Chinese hydrogen fuel cell firm Sinohytech (2402 HK, $172m offer) and Malaysian semiconductor contract manufacturer NationGate (NATGATE MK, $62m offer). In the U.S., we will keep an eye on the micro-cap IPO of Ginny Hilfiger-led clothing company MGO Global (MGOL US, $21m offer). The firm that owns the rights to sell apparel featuring Argentinian World Cup winner Lionel Messi is expected to trade Friday.

OTHER NEWS: 1) Johnson & Johnson files for the IPO of unit Kenvue, the largest global pure-play consumer health company by revenue. 2) Saudi PIF-backed food maker Olam Agri picks banks for $1b IPO in Singapore. 3) U.S. pharma firm Baxter (BAX US) to spin off kidney care and acute therapeutics units within next 12-18 months. 4) U.S. insurance firm Skyward Specialty files for $136m IPO. 5) Tokyo Gas (9531 JP) nears $4.6b deal to buy U.S. shale gas driller Rockcliff from private-equity firm Quantum Energy. 6) Microsoft-backed A.I. firm OpenAI in talks for tender offer that would value it at $29b.

THE IPOX® SPAC (SPAC): The Index currently composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage closed lower on first week of trading in new year to -0.71% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include latest addition biopharmaceutical company Alvotech (ALVO US: +7.30%) as FDA accepted its application of biosimilar to Johnson & Johnson acquired Janssen’s Stelara. Lithium battery maker Enovix (ENVX US: -35.29%) plunged following a special presentation as the company is expecting further delays in production ramp. Other SPAC news from last week: 1) 6 SPACs Announced Merger Agreement include StoneBridge Acquisition (APAC US: +0.05%) with Jakarta-based fintech DigiAsia. 2) 2 SPACs Approved or Completed Business Combination include Model Performance Acquisition with animation and entertainment company MultiMetaVerse (MMV US: +53.03%). 3) 2 SPACs terminated merger agreements include DTRT Health Acquisition (DTRT US: -0.05%) with in-home care services provider Consumer Direct. 4) 4 SPACs announced liquidation. 5) No new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.