The IPOX® Week - March 6, 2023

Headlines:

- IPOX® 100 U.S. (ETF: FPX) soars on big rally in small- and mid-cap picks.

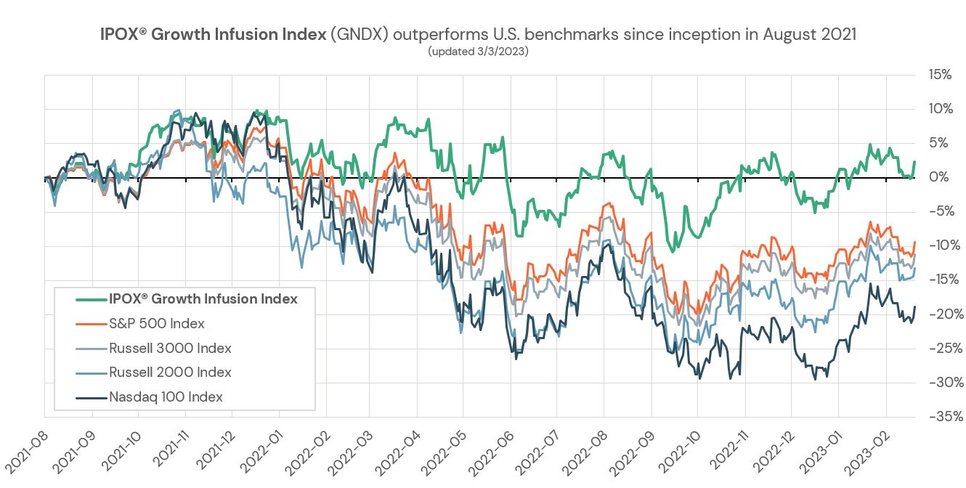

- IPOX® Growth Infusion continues outperformance over key U.S. benchmarks.

- IPOX® SPAC (SPAC) gains +1.69%. 1 U.S. SPAC launched last week.

- SoftBank’s Arm picks New York over London, confirms U.S. as best IPO Market.

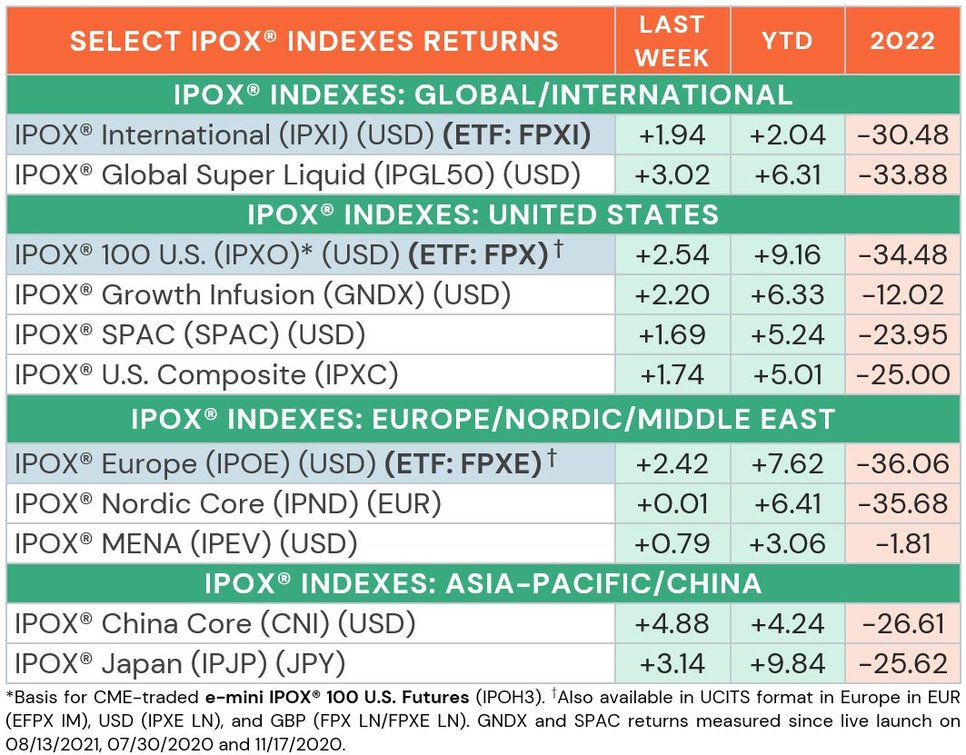

WEEKLY IPOX® PERFORMANCE REVIEW: U.S. equities saw the best week since late January after surging on Friday, as yields on the benchmark 10-year U.S. Treasury notes dipped back below the key 4% level. The IPOX® Indexes started the month with strong performances, outperforming major benchmarks anew. In the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX) surged +2.54% to +9.16% YTD as big post-earnings rallies in select small- and mid-cap holdings pushed our index past the S&P 500 (ETF: SPY) for the 5th week, taking another +61 bps. from the U.S. benchmark. Globally, the IPOX® Europe (ETF: FPXE) climbed +2.42% to +7.62%, overtaking the STOXX Europe 50 YTD to +56 bps. outperformance. Backed by strong showings in Europe as well as the rebounding IPOX® China (CNI: +4.88%) and IPOX® Japan (IPJP: +3.14%), the IPOX® International (ETF: FPXI) gained +1.94% to +2.04 YTD. The unique IPO M&A portfolio strategy of our super-liquid large cap IPOX® Growth Infusion (GNDX: +2.20%) continues to pay off well against key benchmarks (see below).

IPOX® PORTFOLIO STOCKS IN FOCUS:The IPOX® 100 U.S. (ETF: FPX) upside performance was driven by outliers with large swings after earnings, e.g. “Internet of Things” firm Samsara (IOT US: +21.45%), payment processor Shift4 (FOUR US: +24.97%) and DevOps firm GitLab (GTLB US: +20.53%). Quarterly reports also impacted health care providers Agilon Health (AGL US: +19.41%) and industry peer Alignment Healthcare (ALHC: -18.02%). Cloud-based education provider Powerschool (PWSC: -13.89%) dropped after announcing a secondary offering. The IPOX® Europe (ETF: FPXE) was led by Italian pharmaceutical glass ampule maker Stevanato (STVN US: +18.91%), while compatriot chip testing firm Technoprobe (TPRO IM: -13.37%) fell on weak outlooks. The biggest movers in the IPOX® International (ETF: FPXI) included resurging Chinese agri-food e-commerce firm Pinduoduo (PDD US: +14.30%), Israeli solar power equipment developer SolarEdge (SEDG US: +10.35%) and Chinese online education firm Koolearn (1797 HK: -11.27%).

Several IPOX® Holdings reached new post-IPO highs this week, e.g., our most recent IPOX® Watch feature, organ transplantation firm TransMedics (TMDX US: +4.73%), Danish pharma giant and Wegovy maker Novo Nordisk (NOVOB DC: +1.21%), Belgian vehicle glass repair firm D’Ieteren (DIE BB: +5.25%), Austrian hydropower technology specialist Andritz (ANDR AV: +2.00%), German radar maker Hensoldt (HAG GR: +7.70%), Swedish steel maker Alleima (ALLEI SS: +3.53%) and medical imaging spin-off GE Healthcare (GEHC US: +1.81%), among others.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK:Indonesian mining services firm Hillcon (HILL IJ: +20.80%) was the only sizable IPO last week. 5 large IPOs are expected to start trading this week. Monday: Taiwanese solar power generator HD Renewable Energy (6873 TT, $46m offer). Thursday: U.S. fracking sand producer Atlas Energy (AESI US, $414m offer). Friday: Hong Kong online finance education provider JF Wealth (9636 HK, $143m) and Indonesian palm oil farm operator Nusantara Sawit Sejahtera (NSSS IJ, $30m).

Other IPO News: 1) Abu Dhabi’s Adnoc Gas $2.5b IPO draws in $124B in orders. Country’s largest ever IPO starts trading March 13. 2) SoftBank ditches London for Arm IPO, picks New York for higher liquidity. Valuation of up to $70b expected. 3) Swedish private equity firm EQT plans $3.2b IPO for Swiss skincare business Galderma. 4) Chinese Xiaomi/Bain-backed energy start up Newlink Group picks U.S. over Hong Kong for upcoming $400m IPO. 5) German gearbox maker Renk eyes IPO at $3b valuation. 6) Japanese digital bank SBI Sumishin Net Bank set to re-open Japanese IPO market with $440m offer on March 29. 7) Italy lottery operator Lottomatica files for $1b IPO. 8) Olam Group’s food ingredients unit ofi plans London/Singapore listing by the end of 2023.

THE IPOX® SPAC (SPAC): The Index currently composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage rose +1.69% to +5.24% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include Swiss inflammation-focused biopharmaceutical company MoonLake Immunotherapeutics (MLTX US: +22.28%) continued to climb amid strong momentum. Cruise ship spas operator OneSpaWorld (OSW US: -6.97%) retrieved from last week’s all-time-high. Other SPAC news from last week: 1) 7 SPACs Announced Merger Agreement include Plum Acquisition I (PLMI US: +0.20%) with solid-state battery maker Sakuu. 2) 2 SPACs Approved Business Combination include European Biotech Acquisition with Swiss eye drop company Oculis (OCS US: +1.30%) and Israeli cyber security firm Hub (HUBC US: -82.22%) with Mount Rainier Acquisition Corp. 3) 8 SPACs announced or commenced liquidation. 4) 1 SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.