How to Read an Options Chain

The first step in becoming a world-class chef is to learn how to read a recipe. When it comes to being a successful options trader, it all starts with being able to read and understand an option chain. Option quotes have a lot more moving parts than the typical stock quote and may be intimidating to someone who is used to trading stocks. Here’s an overview of all the info that can be found in an option chain and what everything means.

Information about different contracts

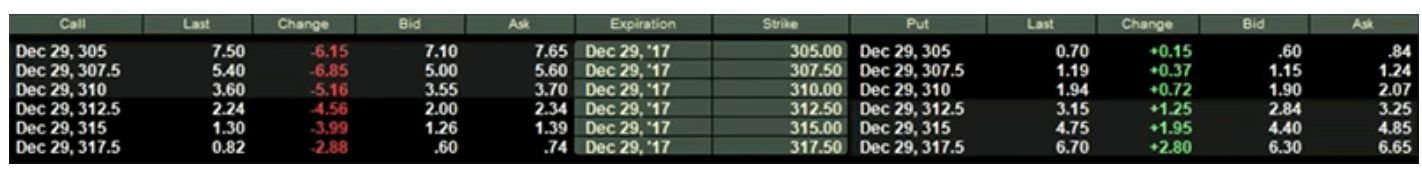

The first major difference between an option chain and a stock quote is that there are dozens of different options contracts for any given stock. For example, here’s what that looks like in the Lightspeed platform. These are all options chains for Tesla.

Once you have entered the stock ticker of the underlying stock, the first piece of information to confirm in the options chain is the expiration date, the date on which an option contract either expires worthless or is exercised to purchase or sell the underlying shares of stock.

The number next to the expiration is the strike price, which is the price at which the underlying shares of stock will be purchased or sold if the contract is executed.

Information about single contracts

Once you have selected a specific stock and a specific expiration date, you can see information on both put and call options for each strike price. Notice how the left side of the screen is devoted to Call options while the right is for Put options, and they are centered around the expiration and strike.

For each put and call contract at a specific date and strike price, you can see price quotes and trading information for that day. Much of this information is nearly identical to the type of information you would typically see on a stock quote. “Last” indicates the price at which the contract was last traded. “Change” is an indication of how much the price of an option has fluctuated from its previous day’s closing price. “Bid” is the current price a buyer is willing to pay for a particular contract. “Ask” is the current price a seller is willing to accept for the same contract, and the difference between the bid and the ask is the “spread.”

Using options strategies

Options trading opens a window to an entire universe of more elaborate strategies. The Options Order Entry window will construct those strategies for you, whether it’s a straddle, strangle, or butterfly.

The platform also includes a profit-loss chart to let you see what has to happen for any specific trade to be profitable.

Trade stock, options and futures

Lightspeed offers active and professional traders accurate market data, complex order management, executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.