The IPOX® Week - April 24, 2023

Headlines:

- IPOX® 100 U.S. rises, S&P 500 / Nasdaq 100 decline during expiration week.

- IPOX® Health Innovation and IPOX® SMID surge on big IPO M&A boom.

- IPOX® SPAC (SPAC) gains +1.81%. One U.S. SPAC launched last week.

- Liquor firm ZJLD aims to revive Hong Kong market in $676m IPO this week.

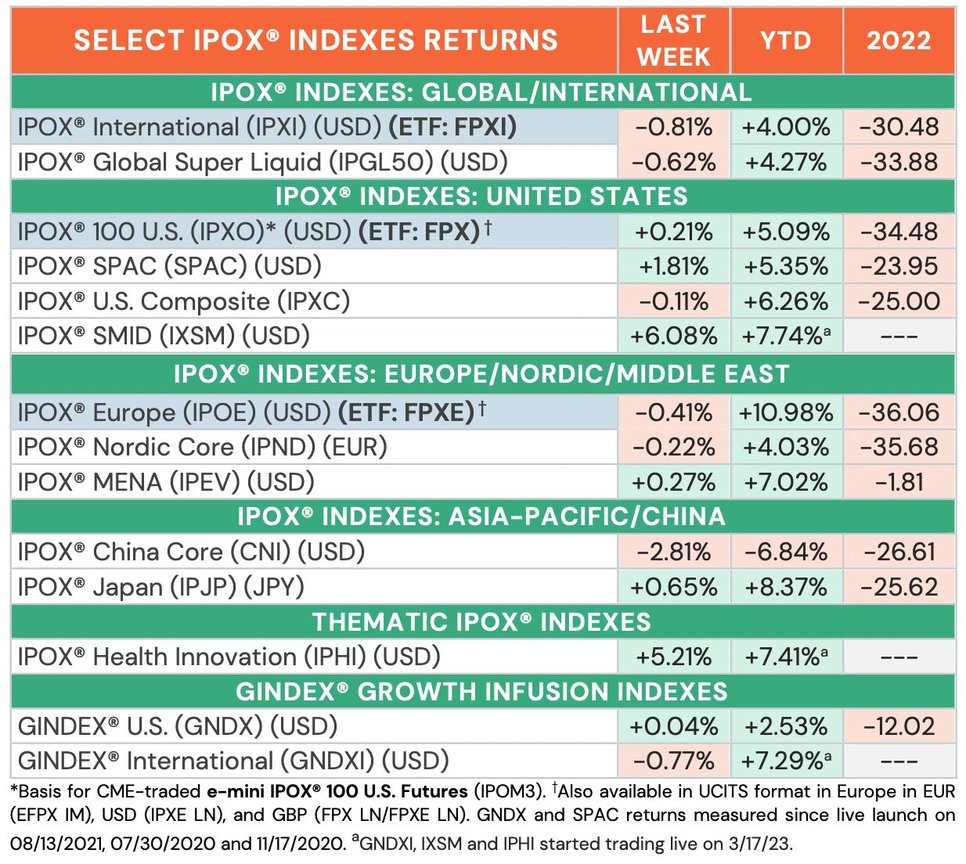

WEEKLY IPOX® PERFORMANCE REVIEW: The broad-based IPOX® Indexes traded relatively flat during last week’s U.S. options expiration week with IPOX® Specialty Exposure soaring. In light of mixed U.S. and European economic data, higher U.S. interest rates across the yield curve and mute U.S. equity risk (VIX: -1.76%), the IPOX® 100 U.S. (ETF: FPX) – benchmark for key U.S. Equity Capital Markets events including IPOs, Spin-offs and IPO M&A - added +0.21% to +5.09% YTD, outperforming the S&P 500 (SPX: -0.10%), benchmark for U.S. stocks. Amid more corporate IPO M&A and the decline in select European growth stocks after the unexpectedly big jump in the British CPI increased the likelihood of further rates hikes across Europe, the IPOX® Europe (ETF: FPXE) shed -0.41% to +10.98% YTD, lagging the broad European market. With Middle-Eastern Markets closed, more weakness in the IPOX® China (CNI: -2.81%) also pressured the IPOX® International (ETF: FPXI). We also note with great interest the fantastic week for the small/mid-cap focused IPOX® SMID (IXSM: +6.08%) and biotech-focused IPOX® Health Innovation (IPHI: +5.21%), which were taken live earlier in the month. Both IPOX® Strategies surged last week as analysts predict M&A to boost the sector, identifying several IPOX® holdings as potential future acquisition targets, i.e. Karuna Therapeutics (KRTX US), Pliant Therapeutics (PLRX US) and Shockwave Medical (SWAV US), the latter being pursued by Boston Scientific (BSX US).

IPOX® PORTFOLIO STOCKS IN FOCUS: In the IPOX® 100 U.S. (ETF: FPX), the Health Care sector dominated as cancer-focused Prometheus Biosciences (RXDX US: +70.22%) skyrocketed after pharma giant Merck (MRK US) announced plans to bolster their drug portfolio by acquiring the 2021 IPO while transplantation medicine specialist Transmedics (TMDX US: +33.97%) surged to a new post IPO-high after an analyst report suggested that the firm could beat revenue estimates. Moreover, leaked trial data sent Legend Biotech (LEGN US: +31.46%) higher as results show massive perceived benefits in cancer patients. Healthcare firm Agilon Health (AGL: -12.12%) was pressured as the insider sales continued. The IPOX® Europe (ETF: FPXE) was led by Middle East-focused payments fintech Network International (NETW LN: +31.02%). The firm has extended its recent gains to +61.91% amid a bidding war between private equity firms Brookfield and CVC. Swiss biotech MoonLake Immunotherapeutics (MLTX US: +13.84%) also surged amid reports of the firm’s management meeting with a private equity investor. Swedish car maker Volvo Car (VOLCARB SS: -11.87%) plunged on worsening sentiment in the car industry. In the IPOX® International (ETF: FPXI), we note another great week for Japanese SoC chipmaker Socionext (6526 JT: +16.84%) which continues to post new post-IPO highs after doubling to +100.09% YTD. Chinese education services provider New Oriental (EDU US: +14.35%) also rose after beating revenue estimates. Taiwanese EV component supplier Yageo (2327 TT: -10.40%) fell after earnings. Other holdings reaching new post-IPO highs last week include biotech takeover candidate Apellis Pharmaceuticals (APLS US: +6.55%), Ozempic/Wegovy blockbuster diet drug maker IPO M&A Novo Nordisk (NVO US: +2.40%), medical imaging giant GE Healthcare (GEHC US: +4.99%), healthcare spin-off Haleon (HLN LN: +2.15%) and warehouse automation firm Symbotic (SYM US: +9.38%).

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 6 notable IPOs started trading last week, gaining an average of +8.72% based on the difference between the final offer price and Friday's close. The biggest debut belonged to Rakuten Bank (5838 JP: +37.86%), largest offer in Japan since Softbank in December 2018. 3 firms launched GDR offers in Europe: Chinese semiconductor firm Yangzhou Yangjie Electronic Technology (YJET SW: 0.00%) and industrial automation firm Zhejiang Supcon Technology (SUPCON SW: +0.22%) launched in Switzerland, while Taiwanese pharma firm PharmaEssentia (PHECR LX: -7.08%) listed in Luxembourg. Electrical engineering firm Europower Enerji (EUPWR TI: +10.00%) hit its daily limits after its debut in Turkey. Indonesian EV industry supplier Merdeka Battery Materials (MBMA IJ: +11.32%) gained in Jakarta debut. In London, engineering company Dowlais (DWL LN: -17.81%) started trading independently at a $2b market cap after its spin off from car industry supplier Melrose Industries (MRO LN).

UPCOMING DEALS: 3 sizable IPOs are planned for this week. Tuesday: Japanese investment management firm Rheos Capital Works (7330 JP, $32m offer). Thursday: Chinese baijiu liquor producer ZJLD (6979 HK, $676m offer) – first company of its kind to list outside Mainland China; Contract researcher MedSci Healthcare (2415 HK, $86m)

OTHER IPO NEWS: 1) Event ticketing company SeatGeek files for U.S. IPO after previous $1b valuation. 2) Italian gambling firm Lottomatica prices $660m Milan IPO. 3) British Co-operative Bank mulls IPO, estimated at £1.3b value. 4) French carmaker Renault picks banks for Q4 IPO of EV unit Ampere. 5) China aims to encourage Hong Kong IPOs of mainland firms.

THE IPOX® SPAC (SPAC): The Index added +1.81% to +5.29% YTD. The biggest movers included telemedicine company Hims & Hers Health (HIMS US: +19.67%). While Iceland-based Humira biosimilar developer Alvotech (ALVO US: -11.73%) continued to drop, await FDA review. Other SPAC news from last week: 1) 4 SPACs Announced Merger Agreement include ESGEN Acquisition (ESAC US: +1.33%) with Florida-based residential rooftop solar provider Sunergy Renewables. 2) 2 SPACs Approved Business Combination, both waiting for deal completion. 3) 1 SPAC announced liquidation. 4) 1 new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.