The IPOX® Week - December 11, 2023

Headlines:

- IPOX® 100 U.S. (ETF: FPX) outperforms S&P 500 for 4th consecutive week.

- IPOX® large-cap holdings Uber and Carrier Global gain on positive news.

- Thematic IPOX® Indexes in focus as IPOX® ESG (IPXT) outshines S&P 500.

- IPOX® SPAC (SPAC) slips -0.11% to 17.84% YTD. 1 new SPAC launched.

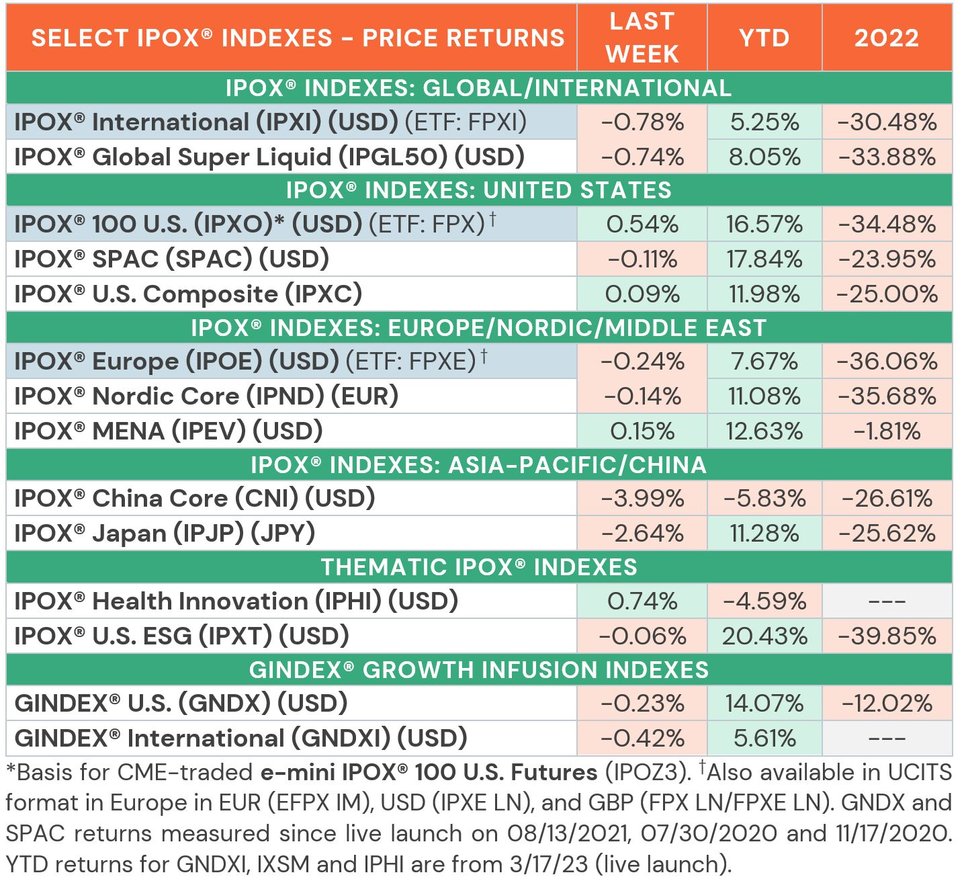

WEEKLY IPOX® PERFORMANCE REVIEW: The IPOX® Indexes traded mixed last week with strong relative performance of our U.S.-focused indexes. Here, solid U.S. jobs data and improving consumer sentiment suggests that a recession might be avoided. This led long-term yields marginally lower, while short-term yields gained on reduced rate cut expectations. Equities retained the upper hand as volatility fell to pre-pandemic levels (VIX: -2.22%). On the back of select large-cap holdings, our diversified innovation-focused IPOX® 100 U.S. (ETF: FPX) added +0.54% to +16.57% YTD last week and continued its rally against the S&P 500 for the 4th consecutive week, during which our index has taken a massive 698 bps. from the benchmark. Internationally, the USD-denominated IPOX® Europe (ETF: FPXE) slipped -0.24% to +7.67% YTD as the Eurozone expects lower interest rates, sending the German DAX benchmark to a new all-time high as Germany’s export-heavy industry is set to benefit from a weaker Euro. Internationally, we noted mixed results for our Asia-focused exposure. The IPOX® China (CNI: -3.99%) fell as credit rating agency Moody’s put China on a downgrade warning. Still, the IPOX® Japan (IPJP: -2.64%) showed relative strength taking 105 bps. from the TSE Growth Market 250 (TSEMOTHR) benchmark but was impacted from speculation that Japan’s negative rate policy is coming to an end. These developments weighed on the IPOX® International (ETF: FPXI), which dropped -0.78% to +5.25% YTD. Looking at our thematic offerings, the biopharma-focused IPOX® Health Innovation (IPHI: +0.74%) was our best-performing index last week, while the IPOX® U.S. ESG (IPXT: -0.06%) slipped to +20.34% YTD, still beating the S&P 500 Price Index in 2023 by 42 bps.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) outperformed on the gains of two of its largest holdings: Uber Technologies (UBER US: +7.59%) surged after news that the ride-hailing app is being added to the S&P 500 benchmark. Best-in-class climate solutions provider Carrier Global (CARR US: +3.85%), 4th largest holding in our index, gained on plans to focus on its air conditioning business after technology conglomerate Honeywell plans to buy Carrier’s home security unit for $4.95 billion. Software development platform GitLab (GTLB US: +12.83%) led the index after reporting a 32% growth in revenue. Customer experience management SaaS business Sprinklr (CXM US: -31.09%) plunged despite beating revenue expectations as management issued guidance on growth deceleration. The IPOX® International (ETF: FPXI) was led SK IE Technology (361610 KS: +25.91%) and large-cap holding Ecopro BM (247540 KS: +11.76%) as South Korean battery firms experience a resurgence after short-selling was banned in the country. In the IPOX® Europe (ETF: FPXE), Swiss pharma firm Pharvaris (PHVS US: +36.74%) soared on positive clinical trial data, while recent mega-IPO chip designer Arm (ARM US: +5.21%) gained amid strong results for Qualcomm’s new high-end Arm-based chip, which beats Apple’s M2 chip in performance and attracts a growing number of PC makers to replace AMD/Intel chips.

IPO MARKET REVIEW AND OUTLOOK: 7 sizable firms started trading across the global equity universe tracked by IPOX® last week with the average (median) equally-weighted deal adding +7.69% (-2.93%) based on the difference between the respective final offering price and Friday’s close. Amid continuing deal flow in the Middle East, the largest IPO last week was Abu Dhabi crypto mining firm Phoenix Group (PHX UH: +50.00%), which raised $370 million in the first crypto firm to debut in the region. Dubai state-owned taxi operator Dubai Taxi Co (DTC UH) gained +18.92% after raising $315 million on high investor appetite, being 130-times oversubscribed.

As the IPO pipeline is winding down ahead of the holidays, only 3 firms are expected to list next week, the largest being Polish real estate developer Murapol (MUR PW) on Friday. Planning to raise $125 million, the listing ends a two-year drought on the Warsaw exchange. Battery materials firm LS Materials (417200 KS, $65m offer) will debut in Seoul on Tuesday, aiming to capitalize on the boom in South Korean EV stocks,. The firm’s parent LS Group was spun-off from electronics conglomerate LG in 2003 and continues to be controlled by LG’s founding Koo family. For more information about upcoming and recent listings visit the IPOX® IPO Calendar.

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage fell -0.11% to +17.84% YTD. IPOX® Swiss biopharmaceutical company MoonLake Immunotherapeutics (MLTX US: +20.17%) gained most, as rumors on takeover interest resurfaced. Warehouse automation company Symbotic (SYM US: -11.28%) fell on profit taking. Other SPAC news from last week: 1) 4 SPACs Announced Merger Agreement include Zalatoris II Acquisition (ZLS US: +0.28%) with European modular construction company Eco Modular. 2) 4 SPACs Approved Business Combinations include 10X Capital Venture Acquisition II completed merger with African Alfalfa farm African Agriculture (AAGR US: -75.56%). 3) At least 4 SPACs announced to liquidate. 4) 1 new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.