The IPOX® Week - December 27, 2022

Headlines:

- IPOX® 100 U.S. (ETF: FPX) outperforms Nasdaq 100 by 95 bps., lags S&P 500.

- IPOX® Europe (ETF: FPXE) outperforms amid strong value performance.

- IPOX® SPAC (SPAC) gains +0.33%. Two U.S. SPACs launched last week.

- Several IPOX® holdings at post-IPO high. High deal flow in Asia and MENA.

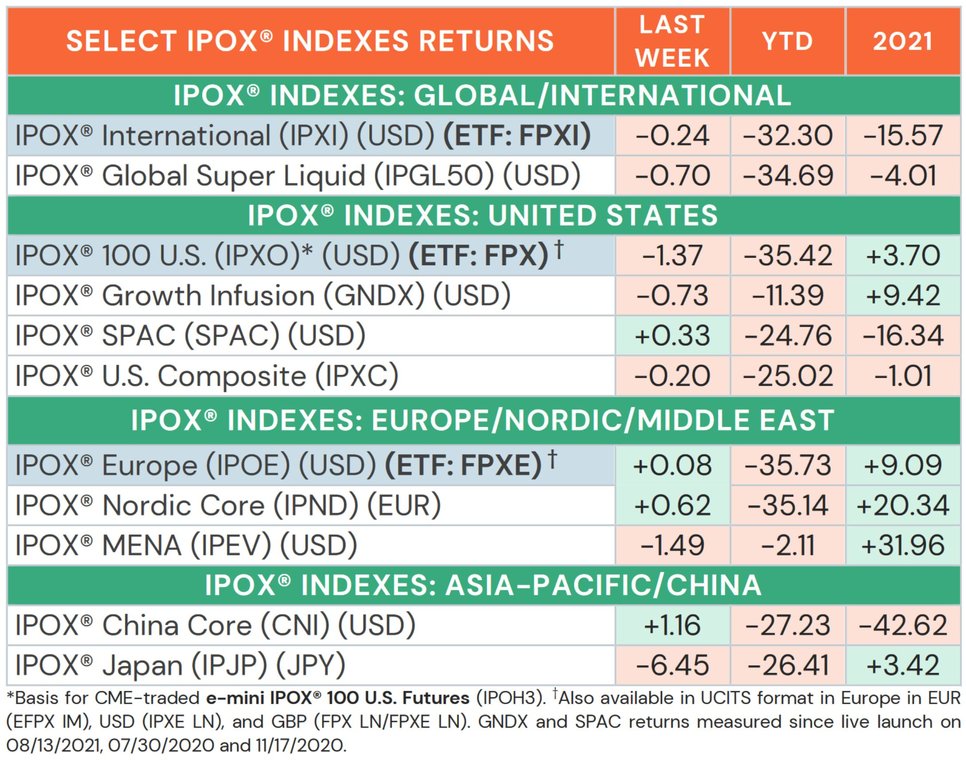

WEEKLY IPOX® PERFORMANCE REVIEW: Amid the tug-of-war between bonds and equities, decreasing volatility (VIX: -7.74%) and new inflation data, the IPOX® Indexes traded mixed in post futures & option expiration week. In the U.S., e.g., the growth-focused IPOX® 100 U.S. (ETF: FPX) declined by -1.37% to -35.42% YTD, lagging the S&P 500 (ETF: SPY), benchmark for U.S. stocks. Still, our main U.S. index outperformed the Nasdaq 100 (ETF: QQQ) by +95 bps., as short-selling weighed on growth stocks such as Tesla (TSLA US: -18.03%) amid rising interest rates. Internationally, we noted relative strength in the IPOX® Europe (ETF: FPXE), which gained slightly (+0.08% to -35.73% YTD) as the strong performance of value stocks propped up the index. Despite a rebound in the IPOX® China (CNI: +1.16%), the IPOX® International (ETF: FPXI) declined by -0.24% to -32.30% YTD. Here, we noticed weakness in our Japanese holdings, as the IPOX® Japan (IPJP: -6.45%) fell amid a strengthening Yen after the BoJ’s decision to raise rates. Despite this, our index outperformed the Tokyo Stock Exchange’s innovation-focused TSE Mothers Index (TSEMOTHR) by +227 bps. last week. Ahead of the strongly awaited IPO of Aramco unit Luberef, the IPOX® MENA (IPEV: -1.49%) fell amid end-of-year profit taking.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by neuroscience-focused biotech firm Cerevel Therapeutics (CERE US: +21.26%), which surged after announcing positive results for a schizophrenia drug. Amid an increase in commodity prices last week, oil and gas firms Profrac Holding (ACDC US: +16.08%) and Highpeak Energy (HPK US: +10.33%) gained. EV firm Rivian (RIVN US: -14.86%) dropped after being caught in the crossfire amid short-selling of rival Tesla. In the IPOX® Europe (ETF: FPXE), Spanish savings bank Unicaja Banco (UNI SQ: +10.83%) topped the index after news that it will replace soon-to-be delisted Siemens Gamesa in Spain’s benchmark index IBEX 35. Swedish renewable energy firm OX2 (OX2 SS: +8.04%) gained after winning a contract to construct one of the largest solar farms in Central and Eastern Europe. British cross-border transaction fintech Wise (WISE LN: -9.75%) dropped after news that the company would start to offer interest-yielding savings accounts. The IPOX® International (ETF: FPXI) was headed by education firm Koolearn Technology (1797 HK: +29.76%) which joined the index in our December rebalancing and ended the week on a new post-IPO high, alongside several other IPOX® Holdings, e.g. GSK consumer healthcare spin-off Haleon (HLN LN: +3.63%), Danish pharma giant Novo Nordisk (NVO US: +0.73%), Thai retailer Centrail (CRC TB: +4.00%), U.S. insurer Arch Capital (ACGL US: +3.85%), Chinese retailer China Tourism Duty Free (1880 HK: +3.81%), Norwegian logistics firm Höegh Autoliners (HAUTO NO: +5.55%).

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 10 sizable listings started trading globally last week, gaining on average +16.45% based on the difference between the final offer price and Friday’s close. The largest new listing this week was Saudi communication cables maker Riyadh Cables (RIYADHCA AB: -9.19%), which raised $378m, followed by the $187m IPO of Turkish natural gas distributor Ahlatci Dogal (AHGAZ TI: +20.98%). Gaining listings included Japanese food producer St Cousair (2937 JP: +55.50%), Thai sports apparel maker Warrix Sports (WARRIX TB: +17.46%), Thai retailer Moshi Moshi (MOSHI TB: +77.38%), South Korean veterinary diagnostics firm BioNote (377740 KS: +12.78%) and Hong Kong medical devices maker Orbusneich (6929 HK: +3.98%). Japanese medical software maker GENOVA (9341 JP: -3.50%), Saudi plastics maker Saudi Top (SAUDITOP AB: -10.68%) and Chinese cosmetics firm Chicmax (2145 HK: -0.20%) all fell.

This week, at least 4 firms are expected to go public internationally. Wednesday: Swiss GDR sale of Chinese polyester textiles maker Jiangsu Eastern Shenghong (DFSH SW, $718M offer). Thursday: Hong Kong film and music rightsholder Star CM Holdings (6698 HK, $67M offer). Friday: AustAsia (2425 HK, $27M), dairy subsidiary of Indonesian agri-food firm Japfa and Chinese cryotherapy specialist Cryofocus Medtech (6922 HK: $26M).

OTHER NEWS: 1) $1.3 billion IPO of Saudi Aramco unit Luberef with 230% oversubscription, trading date to be announced. 2) Canadian asset management firm CI Financial (CIX CN) files confidentially for IPO of $134 billion U.S. unit. 3) Chinese Domino’s Pizza franchinsee DPC Dash postpones Hong Kong IPO due to market conditions. 4) Solar panel maker Longi Green Energy to raise $4 billion in super-sized Swiss GDR sale. 5) Web hosting arm of German internet giant United Internet eyes €5 billion valuation in 2023 IPO.

THE IPOX® SPAC (SPAC): The Index, currently composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage, added +0.33% last week to -24.76% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include latest addition biopharmaceutical company Alvotech (ALVO US: +29.87%) as FDA closer to approve its biosimilar to AbbVie’s Humira while chronic kidney disease-focused biotech ProKidney (PROK US: -18.37%) continued to drop. Other SPAC news from last week: 1) 4 SPACs Announced Merger Agreement include 10X Capital Venture Acquisition III (VCXB US: -2.63%) with electrical Infrastructure maintenance and recovery services provider Sparks Energy. 2) 2 SPACs Approved or Completed Business Combination include Crescent Cove Acquisition with Geely-backed automotive software and hardware developer tech start-up Ecarx (ECX US: -21.02%). 3) 2 SPACs terminated merger agreements include a) Aries I Acquisition (RAM US: +0.64%) and metaverse infrastructure firm Infinite Assets and b) ex-NYSE president’s SPAC Far Peak Acquisition (FPAC US: +0.40%) with cryptocurrency platform Bullish. 4) Another massive 19 SPACs announced liquidation. 5) 2 new SPACs launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.