The IPOX® Week - December 4, 2023

Headlines:

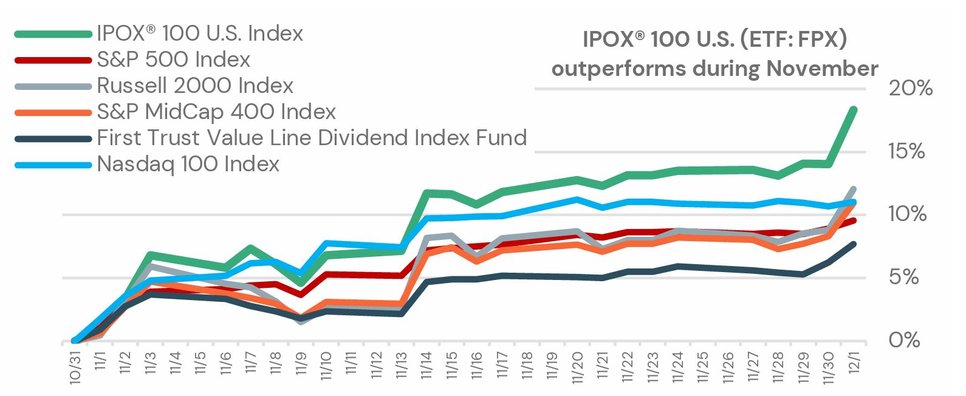

- IPOX® 100 U.S. (ETF: FPX) soars after best month in 3 years, beating peers.

- IPOX® International records largest monthly gain since 2009, holding PDD soars.

- IPOX® members Uber and Builders FirstSource gain as new S&P 500 entries.

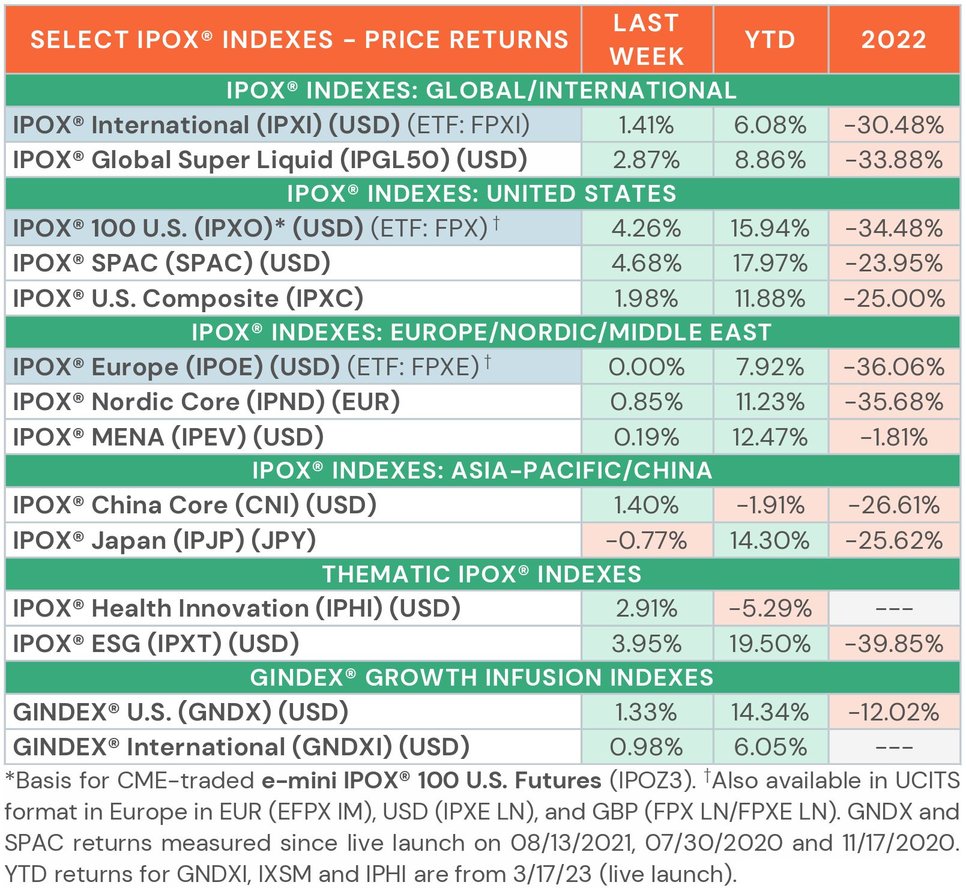

- IPOX® SPAC (SPAC) adds 4.68% to 17.97% YTD. No new SPACs launched.

WEEKLY IPOX® PERFORMANCE REVIEW: Amid plunging 30-year treasury yields on speculation of upcoming Fed policy easing, the IPOX® Indexes started December on the strong momentum of a very successful November. In the U.S., the innovative small-cap heavy IPOX® 100 U.S. (ETF: FPX) surged into the weekend, adding +4.26% last week to pass the technical barrier of 4000 points on the back of a massive +14.02% gain in November, which was the largest monthly surge in 3 years, leaving all major benchmarks behind (see below). The index is set to advance further early next week as the addition of ride sharing app Uber (UBER US) to the S&P 500 benchmark was announced after Friday’s close, sending our index’s top holding more than +5% higher in after-hours trading. Building supply material firm Builders FirstSource (BLDR US), member of our successful basket of IPO acquirers GINDEX® U.S. (GNDX: +1.33%) also joins the benchmark. Globally, the IPOX® International (ETF: FPXI) saw its best monthly performance since 2009 (+13.35%), gaining +1.41% last week. The rally in European markets was cut short after comments by ECB policy makers dampened expectations of interest rate cuts next year. Here, the IPOX® Europe (ETF: FPXE) ended the week unchanged.

IPOX® PORTFOLIO STOCKS IN FOCUS: Siemens-backed renewable energy services firm Fluence Energy (FLNC US: +36.64%) led the IPOX® 100 U.S. (ETF: FPX) after stellar earnings last week, while eye health pharma Apellis Pharmaceuticals (APLS US: +27.23%) rallied Friday as the FDA updated the label of its main drug Syfovre with a “benign” caution after side effects. Chinese e-commerce giant PDD Holdings (PDD US: +22.38%), largest holding of the IPOX® International (ETF: FPXI), soared as the success of its international store Temu took the crown from former leader Alibaba (BABA US: -5.73%). In the IPOX® Europe (ETF: FPXE), British subsea offshore equipment firm Ashtead Technology (AT/ LN: +26.65%) surged on boosted profit guidance. We note that new recent IPO entries, footwear and mattress maker Birkenstock (BIRK US: +14.97%), as well as e-marketing firm Klaviyo (KYVO US: +10.75%) climbed as enthusiasm for new listings returns to the market, sending both firms back above their initial offer price.

IPO MARKET REVIEW AND OUTLOOK: 6 sizable firms started trading across the global equity universe tracked by IPOX® last week with the average (median) equally-weighted deal adding +68.74% (+61.03%) based on the difference between the respective final offering price and Friday’s close. Here, we note high activity in the Indian market, with 5 new debuts. The largest IPOs were automotive engineering conglomerate Tata Technologies (TATATECH IN: +144.14%, $365m offer) and government-owned green energy financing entity Indian Renewable Energy Development Agency (IREDA IN: +96.09%, $258m offer). 5 listings are set for next week, with strong focus on Asia. The largest IPO is expected to launch in Dubai, as state-owned taxi operator Dubai Taxi Co (DTC UH) is set to raise $315 million. For more information about upcoming and recent listings visit the IPOX® IPO Calendar.

We also notice an uptick in firms planning for large IPOs in the U.S. in early 2024: Restaurant operator Panera Brands, fast-fashion giant Shein, Chinese industrial supplies firm ZKH Group, former JPMorgan unit HPS Investment Partners have all filed with the SEC already, while cold storage logistics firm Lineage Logistics, social media site Reddit, Kim Kardashian’s fashion brand Skims, cloud security firm Rubrik and healthcare finance firm Waystar are set to finalize their listing plans.

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage rallied +4.68% to +17.97% YTD. IPOX® SPAC Leader was pet sitter platform Rover (ROVR US: +26.44%) as the pet care is to be acquired by Blackstone in a $2.3 billion all-cash deal. Mexican household products seller Betterware de Mexico (BWMX US: -5.58%) fell. Other SPAC news from last week: 1) 2 SPACs Announced Merger Agreement include DUET Acquisition (DUET US: +0.19%) with Singapore-based social media platform Fenix 360. 2) 2 SPACs Approved Business Combinations include Adit EdTech (ADEX US: -19.58%) approved merger with bitcoin self-mining company Griid Infrastructure (GRDI US: TBD). 3) At least 6 SPACs announced intend to liquidate. 4) No new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.