The IPOX® Week - February 13, 2023

Headlines:

- IPOX® 100 U.S. (ETF: FPX) drops amid weakness in growth stocks.

- IPOX® Europe, Nordic & Japan Indexes outperform peer benchmarks anew.

- IPOX® SPAC (SPAC) falls -0.32%. 2 U.S. SPACs launched last week.

- U.S. IPOs open strongly, raising $1.1b. German Web hoster Ionos falls.

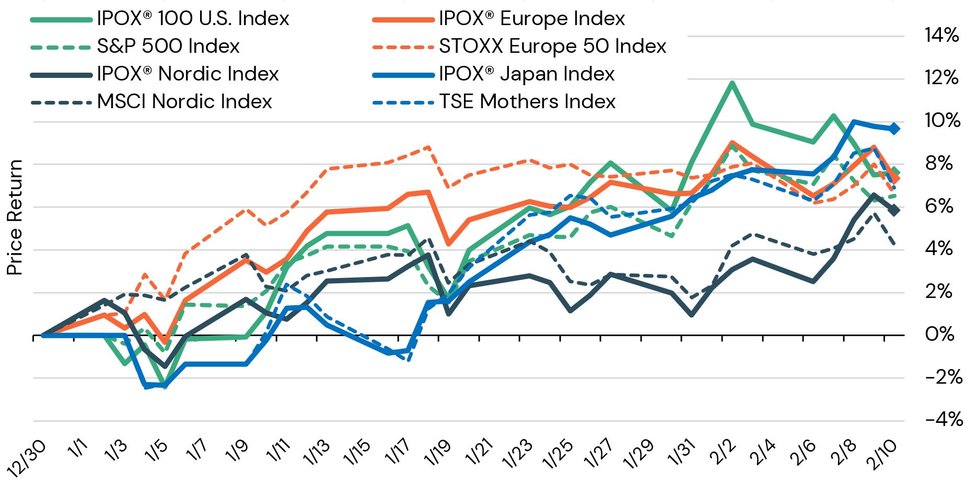

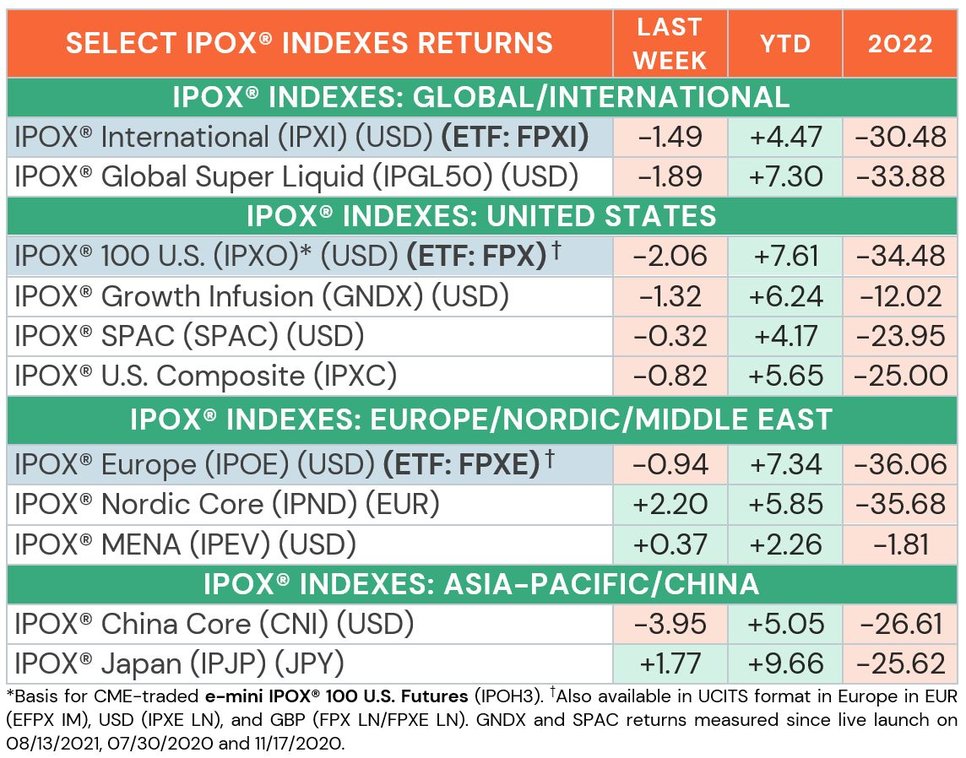

WEEKLY IPOX® PERFORMANCE REVIEW: As negative sentiment from surprisingly strong U.S. employment numbers carried over into last week, U.S. equities finished lower amid cautionary FED signaling and technical reversals in the bond market. Amid increasing yields and mute earnings in select growth stocks, the IPOX® Indexes traded mixed. In the U.S. the growth-heavy IPOX® 100 U.S. (ETF: FPX) fell -2.06% to +7.61% YTD, still outpacing the U.S. benchmark S&P 500 (SPX) in 2023. Abroad, we note relative strength as several of our international indexes extended their outperformance against index peers (see below). In Europe, the IPOX® Europe (ETF: FPXE, -0.94%) beat the STOXX Europe 50 (SX5L: -1.31%) anew, taking +69 bps. from the benchmark YTD. Likewise, our Scandinavia-focused IPOX® Nordic (IPND: +2.20%) surged ahead of the MSCI Nordic Index (MXND: -0.46%) to +158 bps. YTD. In Asia, the IPOX® Japan (IPJP: +1.77%) continues to climb and now leads the TSE Mothers Index (TSEMOTHR: -0.38%) by +276 bps. YTD amid outsized performance in Japanese mid-cap holdings including chipmaker Socionext (6526 JT: +45.69% YTD), brokerage services firm M&A Research (9552 JT: +40.35% YTD) and diamond maker EDP Group (7794 JP: +54.34% YTD). Continuing U.S./China political tensions weighted on the IPOX® China (CNI: -3.95%) and IPOX® International (ETF: FPXI, -1.49%), respectively.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by biopharma company Prometheus Biosciences (RXDX US: +6.18%) and energy storage firm WillScot Mobile Mini (WSC US: +6.18%), which reached a new post-IPO high after getting positive analyst ratings. After announcing layoffs, software development website GitLab (GTLB US: -20.36) fell alongside other growth stocks, e.g., fintech Block (SQ US: -11.19%). In the IPOX® Europe (ETF: FPXE), remote computing firm TeamViewer (TMV GR: +17.94%) jumped after announcing a buyback program, while British oil & gas giant BP (BP/ LN: +15.21%) recorded the highest earnings in the company’s 114-year history. A new record high was recorded by Austrian portfolio stock Bawag Group (BG AV: +3.84%) while luxury watch retailer Watches of Switzerland (WOSG LN: -15.62%) sank after disappointing U.S. sales. The IPOX® International (ETF: FPXI) was topped by British electrical contractor nVent Electric (NVT US: +10.73%, new post-IPO high). For the second week running, index laggards mainly consisted of China-linked holdings, e.g., video app Kuaishou (1024 HK: -11.48%).

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 5 large IPOs started trading last week, adding +10.09% on average, based on the difference between the final offer price and Friday’s close. Web hoster Ionos (IOS GR: -10.86%), unit of German internet giant United Internet, failed to impress after pricing at the bottom of the range. In the U.S., 3 IPOs with valuations above $1 billion surged after upsizing their offers. Chinese LiDAR market leader Hesai (HSAI US: +16.84%), solar energy equipment maker NEXTracker (NXT US: +29.21%) and pharma firm Mineralys Therapeutics (MLYS US: +15.25%) opened the 2023 U.S. IPO window with a strong showing. In Italy, electric motor manufacturer Eurogroup Laminations (EGLA IM: +0.00%) traded flat after raising $426m in their Milan IPO. 2 sizable IPOs are expected for this week: Californian Electric motorcycle firm Sondors (SODR US, $25m offer) and Indonesian mining services provider Hillcon (Ticker pending, $58m) are expected to trade on Wednesday.

Other IPO News: 1) Washington-based Mediterranean fast casual restaurant chain Cava files confidentially for IPO. 2) Energy firm Pertamina Geothermal Energy finished bookbuilding, aims to revive Indonesia’s IPO market with $650m listing. 3) U.K. regulator is under fire after mulling relaxed regulations to attract London listing of Softbank’s chipmaker Arm, which says IPO preparations for 2023 listing are “well advanced”. 4) Telekom Austria plans to list towers business by year end. 5) Pharmacy giant CVS buys 2020 IPO Oak Street (OSH US) in 10.5b deal. 6) Vietnamese EV firm Vinfast fires U.S. CFO, raising questions about planned +$1b U.S. IPO. 7) South Korean delivery app Oasis prices $164m IPO this week, aims to revive Korean market with largest listing since September 2022. 8) Liquor maker Guotai weighs $500m Hong Kong IPO. 9) Philippine poultry giant Bounty mulls $500m IPO.

THE IPOX® SPAC (SPAC): The Index, composed of 50 high conviction plays trading at both the pre- and post-consummation stage fell -0.32% to +4.17% YTD. IPOX® SPAC movers include Swiss inflammatory diseases biotechnology company MoonLake Immunotherapeutics (MLTX US: +22.66%) while mobile medical services and transportation provider DocGo (DCGO US: -10.42%) slumped. Other SPAC news from last week: 1) 3 SPACs Announced Merger Agreement include Compute Health Acquisition (CPUH US: +0.10%) with non-surgical gastric balloon capsule maker Allurion. 2) 6 SPACs Approved or Completed Business Combination include AMCI Acquisition II with carbon capture and transformation company LanzaTech Global (LNZA US: -23.96%). 3) 2 SPACs announced or commenced liquidation. 4) 2 new SPACs launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.