The IPOX® Week - February 6, 2023

Headlines:

- Ahead of big week for earnings, IPOX® 100 U.S. (ETF: FPX) adds +1.69%.

- IPOX® Europe (ETF: FPXE) outpaces European Market anew. China slumps.

- IPOX® SPAC (SPAC) adds +1.29%. 1 U.S. SPAC launched last week.

- IPO window opens globally as IONOS, NEXTracker, Mineralys line up.

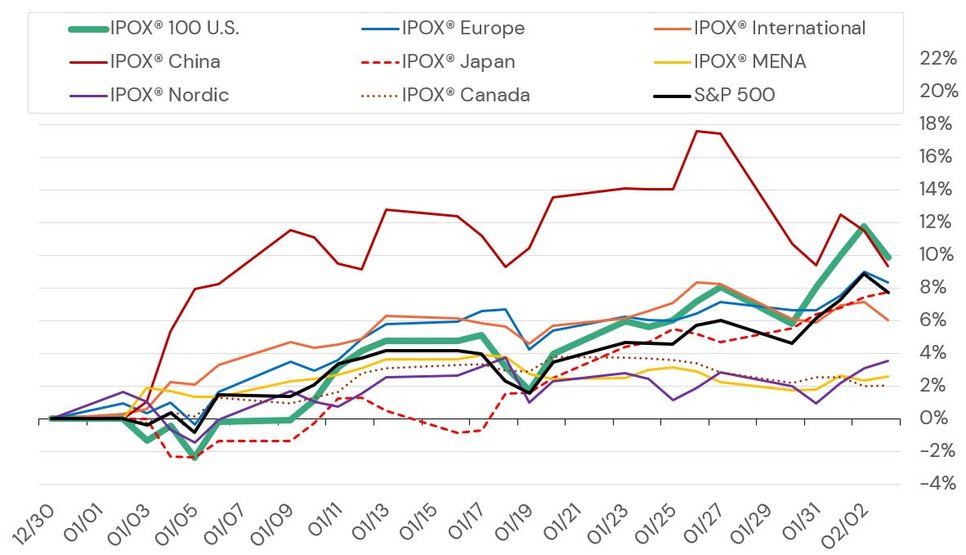

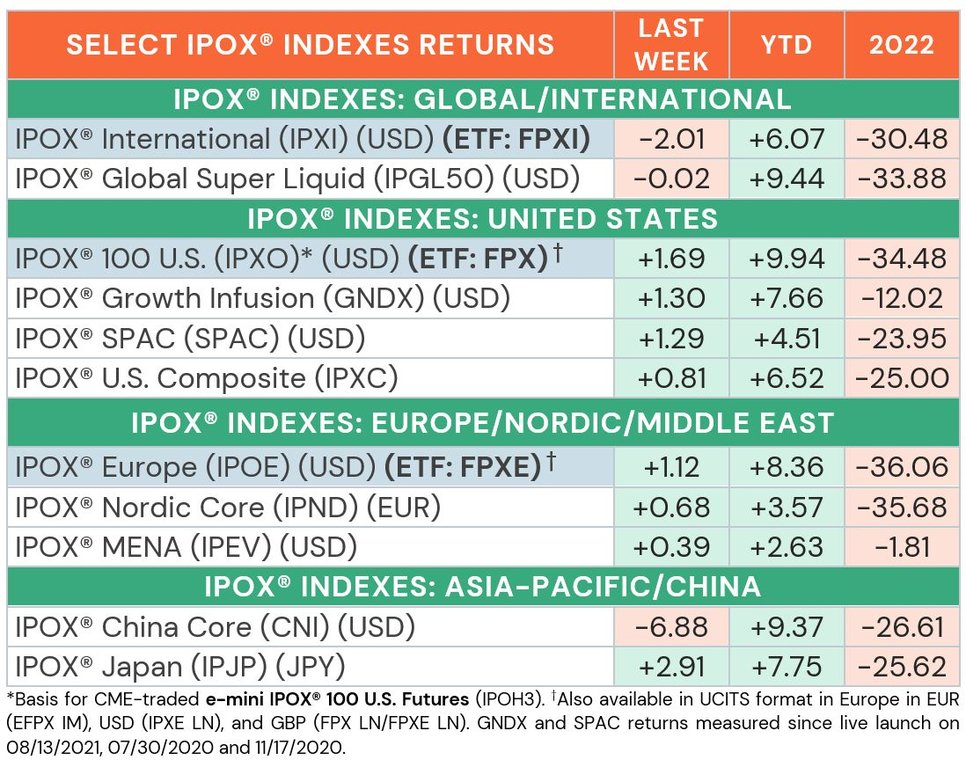

WEEKLY IPOX® PERFORMANCE REVIEW: Amid mixed U.S. earnings, exuberant U.S. employment numbers driving a sharp reversal in U.S. rates and the U.S. dollar towards the week-end and big risk appetite driving technical buying of global equities through Thursday, the IPOX® Indexes finished higher last week. Ahead of a busy week for IPOX® earnings, in the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX) added +1.69% to +9.94% YTD, closing above the key 200-day moving average for the first time since March 2022 and slightly outpacing the S&P 500 (SPX), benchmark for U.S. stocks. We also note more strength for the IPOX® Europe (ETF: FPXE, +1.12%) and IPOX® Japan (IPJP: +2.91%) which both surged ahead of their respective benchmarks last week, while profit taking and increasing U.S./China political tensions weighted on the IPOX® China (CNI) and IPOX® International (ETF: FPXI), respectively. The IPO-M&A-focused defensively positioned IPOX® Growth Infusion (GNDX) added +1.30% to +7.66% YTD, +849 bps. ahead of the S&P 500 (SPX) Y/Y.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by biopharma company Vertex (VERX US: +20.50%), which rocketed as the European Medicines Agency validated an authorization application for two of their drugs. Self-driving car sensor maker Mobileye (MBLY US: +19.53%) surged after their well-received earnings report. Despite a beat in earnings, accounting software maker Bill.com (BILL US: -21.18%) fell sharply due to a weakened outlook. In the IPOX® Europe (ETF: FPXE), most upside focus was on French pharmaceutical ingredients firm EuroAPI (EAPI FP: +16.46%) amid positive news that production was restarted at their Budapest site following the discovery of manufacturing faults. British Forex fintech Wise (WISE LN: +14.64%) reversed the recent slump, while Spanish bank Unicaja Banco (UNI SM: -9.94%) fell after earnings. The IPOX® International (ETF: FPXI) saw losses in most of its China-linked portfolio holdings, including e-commerce firms Alibaba (BABA US: -10.18%) and Pinduoduo (PDD US: -8.63%), while German premium car maker Porsche (P911 GR: +8.00%) rose to a post-IPO high. U.S. pharma IPO M&A Regeneron (REGN US: +5.43%), French energy transition firm Technip Energies (TE FP: +1.80%), German automotive supplier Vitesco (VTSC GR: +3.62%), Saudi investment firm Elm (ELM AB: +6.86%) and Australian lottery operator Lottery Corp. (TLC AU: +4.70%) all reached new post-IPO highs towards Friday's close.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 2 sizable IPOs started trading last week, adding +108.71% on average, based on the difference between the final offer price and Friday’s close. Diet-focused pharma firm upsized Structure Therapeutics (GPCR US: +73.33%) surged after listing in the U.S. on Friday, while car part maker Samkee EV (419050 KS: +144.09%) listed In South Korea. With the U.S. IPO window opening, the largest domestic deal of the week belongs to Solar energy equipment maker JP Morgan-led NEXTracker (NXT US, $500m offer) which is expected to trade Friday, together with clinical stage hypertension pharma firm Mineralys Therapeutics (MYLS US, $160m offer). The IPO of China-linked Hesai Group (HSAI, $171m offer), a provider of LiDAR products for autonomous vehicles and other applications, is imminent as pricing is expected Wednesday. Abroad, the IPO of German web-hosting firm IONOS (IOS GR, $590m offer) is the only sizable listing planned for this week. The firm targets a valuation of $3.4b with trading set to start Wednesday. Owners United Internet (UTDI GR) and private equity firm Warburg Pincus are each selling 15% of their stake and will keep around 60% and 10% of the company, respectively.

Other IPO News: 1) Oilfield services firm and frac sand miner Atlas Energy Solutions (AESI US) files for IPO. 2) Italy's electric motor firm EuroGroup aims for $1b market cap in $485m Milan IPO. 3) Australia-focused Constance Iron plans $72m IPO in London. 4) Greece selects BofA and Morgan Stanley for $1.1b IPO of Athens Airport, biggest IPO in the country since 2000. 5) Indonesian Pertamina Geothermal Energy kicks off $653m IPO. 6) Chinese battery firm CATL plans to sell GDRs worth $5 billion in Switzerland.

THE IPOX® SPAC (SPAC): The Index of 50 high conviction plays trading at both the pre- and post-consummation stage added +1.29% to +4.51% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include facial treatment system provider Beauty Health (SKIN US: +12.47%) and workforce lodging and temporary modular housing company Target Hospitality (TH US: -6.81%). Other SPAC news: 1) 3 SPACs Announced Merger Agreement e.g., L Catterton Asia Acquisition C (LCAA US: +0.99%) with Singapore-based luxury EV maker Lotus Tech. 2) 2 SPACs Approved or Completed Business Combination include Pono Capital with Japanese flying motorbike ALI Technologies (AWIN US: TBA). 3) 7 SPACs announced or commenced liquidation. 4) 1 new SPAC launched last week in the U.S. 5) Outside our index, we noted the acquisition of 2020 de-SPAC, engineering services company Atlas Technical Consultants (ATCX US: +116.73%), which surged after an offer by private equity firm GI Partners.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.