The IPOX® Week - January 1, 2024

Headlines:

- Most IPOX® Indexes gain in 2023, U.S. outperforms International.

- GINDEX® U.S. (GNDX) ends near all-time high. IPOX® ESG soars past S&P.

- Key Trends drive big jump in select holdings. IPOX® SPAC rises +23.64%.

- 1,452 IPOs launch in 2023. India, MENA focus. Plenty of Deals seen in 2024.

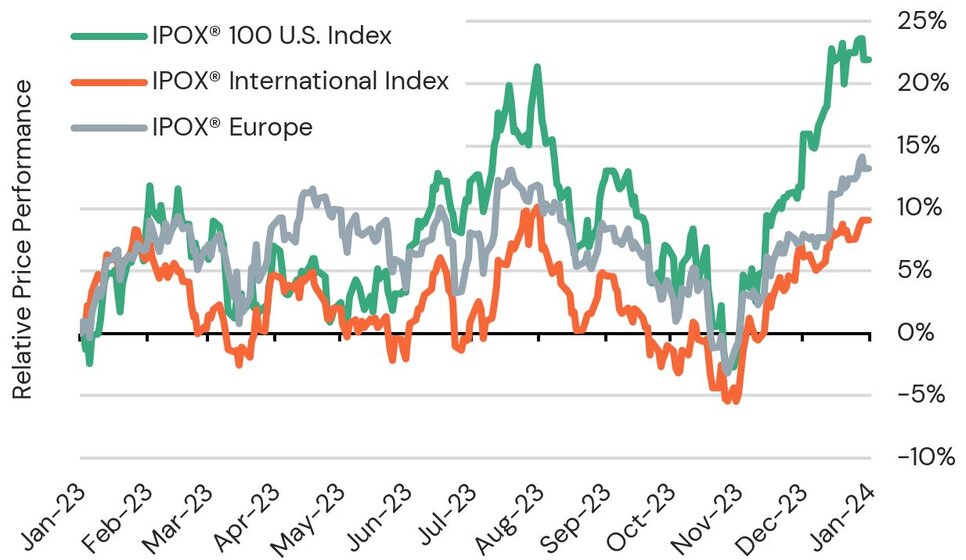

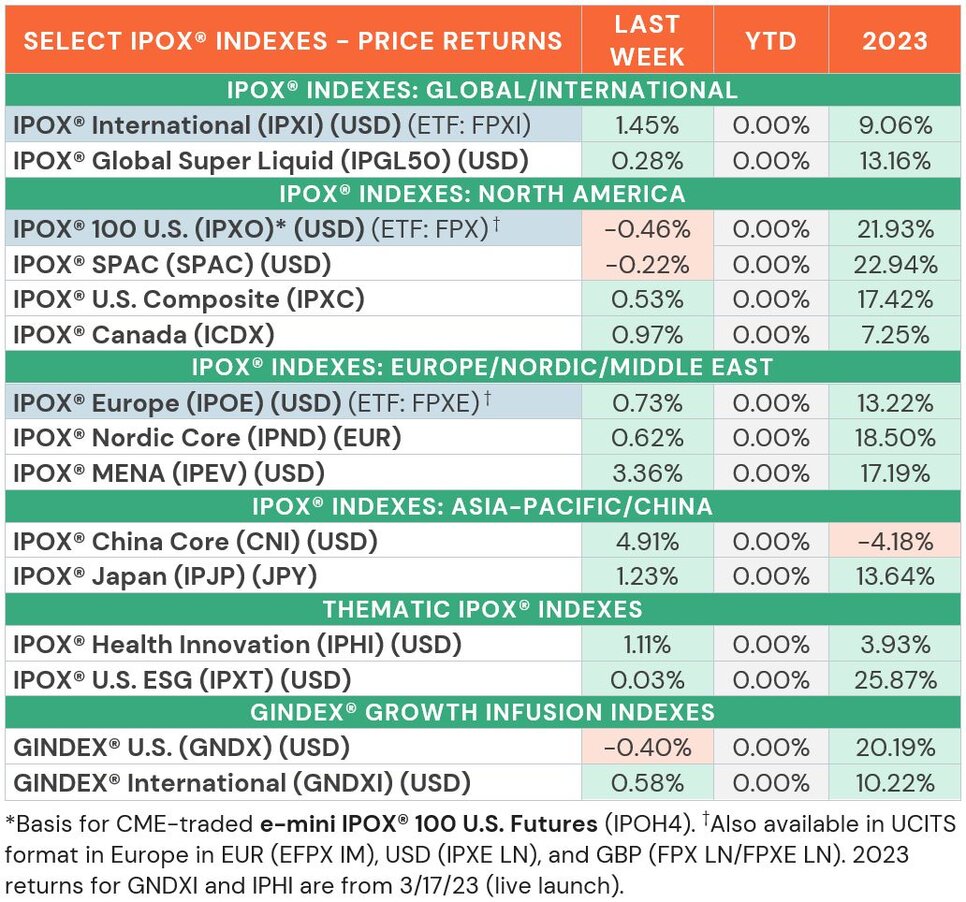

WEEKLY IPOX® PERFORMANCE REVIEW: While the IPO market anticipates a return to more normal levels of activity in 2024, the IPOX® Indexes look back on a largely positive year. Throughout the first half of 2023, U.S. equity performance lagged global markets, impacted by sticky inflation, high interest rates and the fallout of bank failures on growth stocks. Still, big momentum from Q3, fueled by forward-looking optimism for 2024 rate cuts, has propelled the IPOX® 100 U.S. (ETF: FPX) to a gain of +21.93% for this year. While the benchmark for U.S. innovation has lagged the large cap-heavy S&P 500 (SPX: +24.23%), we note a strong outperformance versus U.S. small- and mid-caps, beating the Russell 2000 (RTY: +15.09%) by +684 bps., e.g. Globally, we saw the performance of portfolios capturing non-U.S. domiciled exposure gaining strongly for the most part. Amid continuing uncertainty over the Russia-Ukraine war, e.g., the IPOX® Europe (ETF: FPXE) added +13.22%, underpinned by gains in Scandinavia-domiciled exposure (i.e. IPOX® Nordic, IPND: +18.50%), in particular. Across Asia-Pacific, we also note the good year for the IPOX® Japan (IPJP: +13.64%) which strongly outperformed similar Japan-domiciled tech exposure. The IPOX® International (ETF: FPXI) added +9.06%, weighed down by select China-linked stocks. Specifically, the IPOX® China (CNI: -4.18%) declined slightly in 2023, however, significantly outpaced other China-linked benchmarks as the exodus of international investors from China continued unabated amid more economic and regulatory uncertainty.

In view of the burgeoning IPO activity in the region, we also note strong returns for the Middle East-focused IPOX® MENA (IPEV: +17.19%), beating the regional benchmarks (e.g. Dow Jones MENA (DJMENA) +4.52%). Within the past months, the portfolio has also shown renewed strength on investor appetite for deal flow, with the portfolio recovering fully from a -8% slump following the start of the Israel-Hamas war. Amongst the thematic index range, the continued focus on climate has propelled the IPOX® U.S. ESG (IPXT: +25.87%) past the S&P 500 in 2023. In light of recent shifts in pharma innovation, such as weight loss treatments, we also launched the IPOX® Health Innovation (IPHI: +4.13%). While most of cash-rich big pharma has struggled in 2023, the prospect of a lower rate environment and huge wave of IPO M&A in the sector have propelled the portfolio by a massive +24% since October.

In summary, amid the backdrop of contained inflation driving strong risk appetite for unseasoned stocks, muted economic growth, good earnings, continued IPO M&A, index addition activity and a buyer’s market for most New Listings, we expect the IPOX® Indexes to remain attractive and unique tools to capture strong returns in 2024.

GINDEX® PERFORMANCE REVIEW: This year, we again saw a slew of acquisitions within the IPOX® Indexes universe as incumbent acquirers capitalized anew on opportunities to add businesses and buy-to-grow amid shareholder pressures to successfully modernize into the next generation (“IPO M&A”). Deals included Twinkie maker Hostess Brands by J M Smucker (+35% premium), immunology pharma Prometheus Biosciences by pharma giant Merck & Co. (+81%), cancer drug maker Karuna Therapeutics by Bristol Myers Squibb (+53%) and cloud computing software firm Vmware by chipmaker Broadcom (+37%). Tracking respective acquirers, the innovative and super-liquid GINDEX® U.S. Growth Infusion Index (GNDX: +20.19%) finished 2023 close to its all-time high, now leading the S&P 500 by 860 bps. since its 08/2021 live launch. The portfolio of non-U.S. domiciled firms, the GINDEX® International (GNDXI), climbed +10.22% since its 03/23.

IPOX® PORTFOLIO STOCKS IN FOCUS: Some of our top 2023 portfolio stocks profited from exposure to megatrends. Top to the list ranked heart disease buyout candidate BridgeBio (BBIO US: +432.02%) and Swiss inflammation biotech Moonlake Immunotherapeutics (MLTX US: +495.05%), as well as select big pharma benefiting from surging demand for dietary treatments (e.g. Ozempic, Wegovy), including Novo Nordisk (NOVOB DC: +48.85%) and GINDEX® core holding serial IPO acquirer Eli Lilly (LLY US: +59.29%). Advances around Artificial Intelligence and Industrial automation also propelled select tech exposure, including warehouse robot maker Symbotic (SYM US: +328.39%), data analysis firm Palantir (PLTR US: +168.07%), cybersecurity firm Crowdstrike (CRWD US: +139.77%) and Internet-of-Things specialist Samsara (IOT US: +166.21%). Amid Mobility being a key topic with advances in EV adoption and self-driving, we also note huge post-IPO gains in some of Indonesia’s nickel mining and battery material sector, such as portfolio holdings Amman Mineral (AMMN IJ: +273.22%), Barito Renewables Energy (BREN IJ: +666.67%) and Petrindo Jaya Kreasi (CUAN IJ), which soared +4,799.64% since IPO as the country aims to transform into a green energy leader. In addition, IPOX® International (ETF: FPXI) holding South Korean battery material firm Ecopro BM (247540 KS: +212.70%) surged, supported by a short-selling-ban for Seoul-traded stocks. At the other end of the EV/climate change supply chain, we saw exceptional returns for premier climate play IPOX® heavyweight Carrier Global (CARR US: +39.27%), Li Auto (LI US: +83.73%) and GINDEX® U.S. member Tesla (TSLA US: +101.69%). Notable IPOX® additions included key 2023 IPO and Spin-Off launches, such as record-breaking chipmaker Arm (ARM US: +51.90%), solar tracking solutions firm Nextracker (NXT US: +97.71%), German footwear and mattress make Birkenstock (BIRK US: +7.61%) and innovate household appliances producer SharkNinja (SN US: +71.28%).

IPOX® SPAC Index (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage finished the year with +23.64% in total return, outperforming the de-SPAC Index (DESPACTR Index) by a massive +3,856 bps. A total of 31 SPACs raised approximately $3.7 billion through an IPO, the lowest level in both deal count and proceeds raised since 2017. 106 SPACs announced a potential target in 2023; L Catterton Asia Acquisition (LCAA US: +6.73%) signed the largest deal among all announced agreements with luxury vehicle Lotus Tech at an US$5.5 billion valuation. 101 SPACs approved and/or completed merger in 2023 with Australian carbon fiber wheels manufacturer Carbon Revolution Public (CREV US: +128.28%) performed the best. 186 SPACs announced liquidation in 2023, highest level since 2016. 20 deSPAC were acquired/pending to be acquired by private equity firms or public companies. Among all non-OTC traded active deSPACs, bitcoin miner Cipher Mining (CIFR US: +637.50%) recorded the largest year-to-date return.

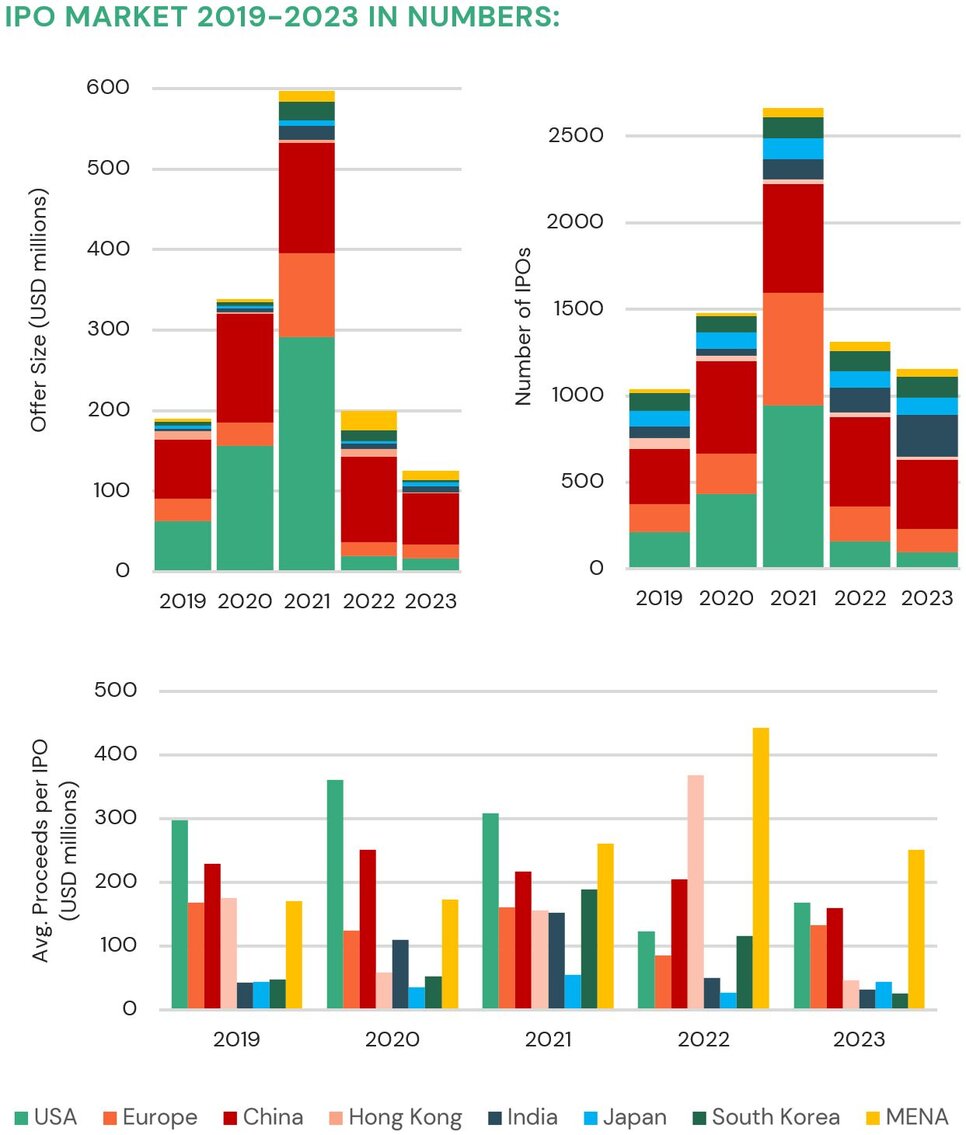

IPO MARKET REVIEW: In 2023, we identified a total of 1,452 IPOs globally, raising a total of $135.76 billion. This represents a decline from the 1,772 firms that launched in 2022 ($215.77 billion accumulative offer size) and still leaving a large gap to the 2021 highs. Focusing on some key statistics of 2023, we note an increase in the average size of U.S. IPOs, while volumes declined as firms delayed ‘going public’. In the U.S., e.g, 95 IPOs raised a total of $15.97 billion at an average offer size of $168 million. Notably, some of the largest listings in the U.S. came from abroad, with British chipmaker Arm (ARM US: +51.90%), German footwear and mattress maker Birkenstock (BIRK US: +7.61%) and Israel-based beauty products online seller Oddity Tech (ODD US: +35.00%) leading the way, underlining the attractiveness of U.S. markets for their deeper pools of liquidity and potentially higher initial valuations.

Outside the Developed Markets, we continue to be excited about the rise in Indian IPO activity, with plans to facilitate access for international investors amid a record number of debuts this year. We also note the solid pace of large listings across the MENA region when compared to the rest of the world. As the region is diversifying away from fossil fuels, ‘going public’ in Saudi Arabia, e.g., is a policy tool to foster equity culture, stimulate economic growth and transform into the next generation, and has been compared to China efforts between 1990-2005.

IPO MARKET OUTLOOK: Amid the supportive macro backdrop, near-record backlog of deals and the need of pre-IPO investors to increase the velocity in their portfolios, we expect strong 2024 deal flow with a focus on specialty firms in growth industries. Potential key listings include social media platform Reddit, fashion firms Shein and Skims, data analytics firm Databricks, fintechs such as payment processor Stripe and buy-now-pay-later lender Klarna, U.K. banking innovators Monzo, Starling Bank and Revolut and payments firm Waystar. Key Spin-offs (GE, BAX, TRP, etc.) are set to add to the attractiveness of the 2024 New Listings vintage. Follow our social media channels and the IPOX® IPO Calendar to stay informed with the latest updates.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.