The IPOX® Week - January 16, 2024

Headlines:

- Most IPOX® Indexes gain across the board as U.S. yields, risk fall.

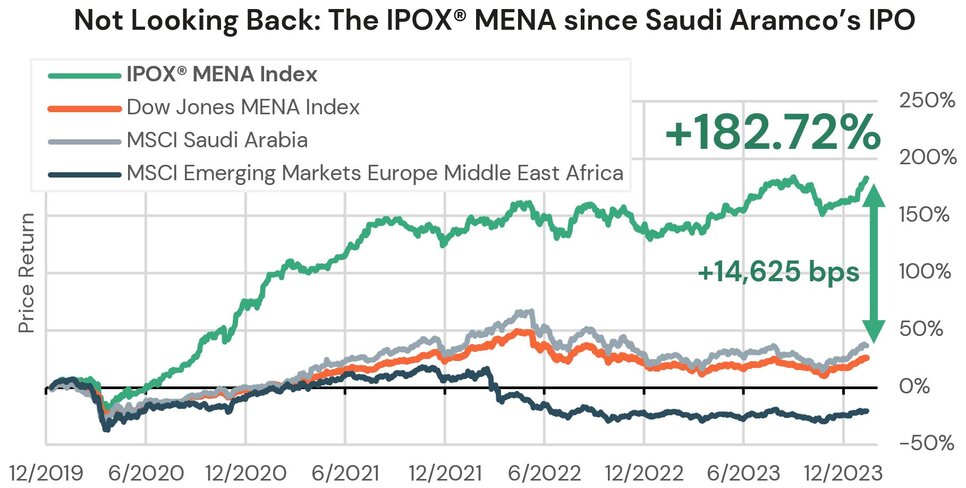

- IPOX® MENA and IPOX® Japan propel IPOX® International (ETF: FPXI).

- M&A Momentum drives strong gains in IPOX® Health Innovation.

- First sizable 2024 U.S. listing off to strong start as IPO window opens up.

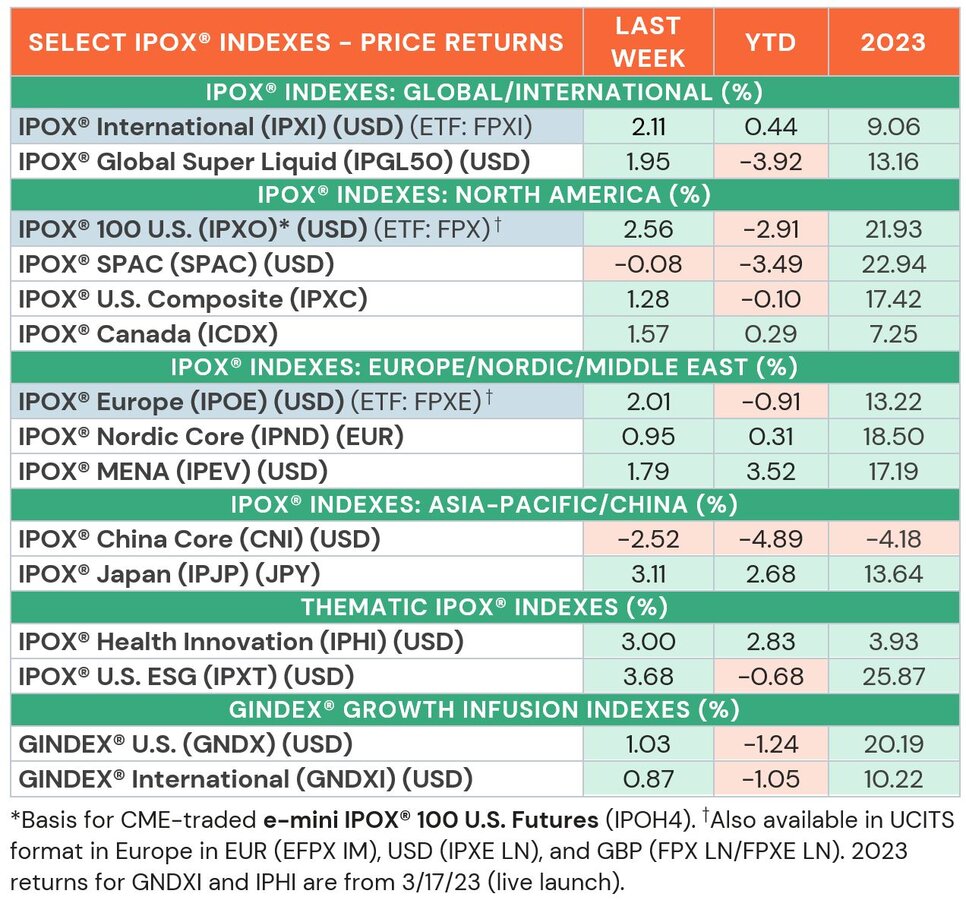

WEEKLY IPOX® PERFORMANCE REVIEW: Ahead of earnings, most IPOX® Indexes rose last week as U.S. yields and risk (VIX: -4.87%) backed off amid mixed inflation data and increased political tensions abroad. In the U.S., e.g., the IPOX® 100 U.S. (ETF: FPX), benchmark for the performance of large U.S. domiciled IPOs and Spin-offs, added +2.56% to -2.91% YTD, outpacing most U.S. equity benchmarks. Strength extended to IPOX® Markets capturing non-U.S. domiciled equity exposure, with strong gains recorded by the IPOX® Europe 100 (ETF: FPXE), IPOX® Canada (ICDX), IPOX® Japan (IPJP) and IPOX® MENA (IPEV). Indeed, asset allocation shifts into the MENA region driven by economic optimism propelled the IPOX® MENA (IPEV) towards the highest close on record with the dividend-heavy portfolio adding +1.79% to +3.52% YTD, extending the relative jump vs. the Dow Jones MENA Index (DJMENA) by +175 bps. to +195 bps. YTD and +1153 bps. Y/Y. In line with other Chinese benchmarks, the IPOX® China (CNI) continued its lackluster showing in the New Year, shedding -2.52% to -4.89% YTD. Amid weakness in small-caps, IPO acquirers pooled in GINDEX® U.S. (GNDX) and GINDEX® International (GNDXI) traded more muted last week.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: IPO M&A fever continued to propel select stocks tracked in the standard IPOX® Indexes, as well as specialty portfolios, including the outperforming IPOX® Health Innovation (IPHI) and IPOX® ESG (IPXT). Across U.S. domiciled exposure, stocks with some of the biggest upside last week included CRM-competitor Braze (BRZE US: +12.38%) and cybersecurity heavyweight Crowdstrike Holdings (CRWD US: +14.50%). Amongst the small- and mid-cap health care targets, we also note the good week in health care services provider Health Equity (HQY US: +6.53%) and eye-care pharma firms Glaukos (GKOS US: +11.86%) and Apellis Pharma (APLS US: +17.82%). Crypto Exchange operator Coinbase (COIN US: -15.07%) and Unity Software (U US: -8.44%) ranked worst last week, while Hertz’s cut-back in its EV fleet pressured embattled EV-maker Rivian (RIVN US: -5.35%). Across non-U.S. domiciled stocks, we note the big gains in select health care stocks tracked in the IPOX® 100 Europe (ETF: FPXE), e.g., including Swedish IPO M&A Swedish Orphan Biovitrum (SOBI SS: +7.85%) and other U.S.-traded pureplay biotech small-caps Moonlake Immunotherapeutics (MLTX US: +6.62%), Pharvaris (PHVS US: +13.12%) and Immatics (IMTX US: +20.44%). The slew of recent mining and utility IPOs launched in Indonesia continued to trade extremely volatile with geothermal energy plant operator 10/2023 IPO Barito Renewables (BREN IJ: -34.95%) plunging, while copper and gold miner 07/07/23 IPO Amman Mineral (AMMN IJ: +13.13%) surged – click here to read the latest IPOX® Watch about the emerging Indonesian mining powerhouse.

IPO MARKET REVIEW: 6 accessible IPOs commenced trading last week, with the average (median) IPO adding +47.68% (+29.31%) between the final offering price and Friday’s close. The biggest deal of last week, Saudi-based media company MBC Group (MBCGROUP AB: +77.00%) was the largest IPO and one of the best performing deals, underpinning big MENA IPO momentum. The IPO window for deals in the U.S. also opened with homebuilder Smith Douglas Homes Corp. (SDHC US: +13.95%) celebrating a successful first week of trading. Deals in Hong Kong (2453 HK and 6959 HK) traded mixed. Micro-caps Indonesian miner Adhi Kartiko Pratama (NICE IJ: +27.85%) and Australia’s Kali Metals (KM1 AU: +142.00%) rose, with the latter in focus after incumbent MinRes (MIN AU) acquired a stake in the firm post-IPO.

NOTABLE IPO DEAL FLOW LINED UP: Amid the shortened U.S. trading week, no significant IPOs are set to commence trading. Amongst the handful of smaller firms which may likely trade, we will follow the U.S. IPO of H.K.-based innovative textile producer J-Long (JL US). Amid the recent wave of good performing Spin-offs across Europe, we added Sodexo Spin-off employee engagement focused Pluxee (PLX FP) to our deal flow watchlist. The company is set to start trading in Paris on February 1, 2024.

IPOX® SPAC INDEX (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation traded in line with U.S. small-caps last week, declining by -0.01% to -3.75% YTD. IPOX® SPAC Leader were clinical stage biotech Disc Medicine (IRON US: +8.27%) and electrical power equipment maker Vertiv (VRT US: +6.93%), while fintech MoneyLion (ML US: -8.60%) and innovative aircraft maker Archer Aviation (ACH US: -6.51%) sank. No SPACs listed last week.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.