The IPOX® Week - July 24, 2023

Headlines:

- Green energy holdings lift IPOX® Europe and IPOX® International higher.

- Select IPOX® Indexes and both GINDEX® Indexes reach new weekly highs.

- IPOX® SPAC (SPAC) rises +1.91%. No SPACs launch in U.S. last week.

- Oddity Tech (ODD US) surges on debut, adding to IPO market optimism.

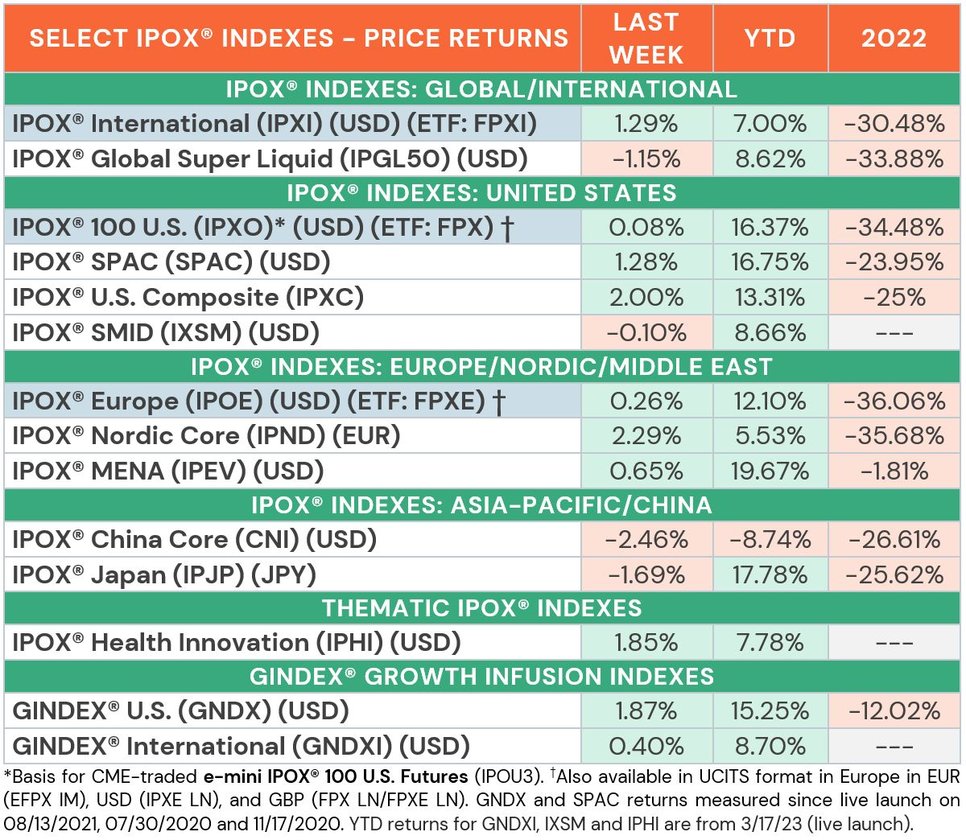

WEEKLY IPOX® PERFORMANCE REVIEW: Most IPOX® Indexes gained during options expiration week. In the U.S., the IPOX® 100 U.S. (+0.08%, ETF: FPX) showed relative strength, taking 98 bps. from the Nasdaq 100 (NDX), as earnings season kicked off with disappointing results for tech heavyweights Tesla and Netflix. Nevertheless, it is likely that the benchmark will regain composure this week, as volatility is expected to subside after its rebalancing concluded Friday. U.S. bond yields remained largely unchanged, with traders anticipating the Federal Reserve’s decision on further rate hikes this Wednesday. Internationally, we see that select holdings in alternative/green energy stocks pushed both the IPOX® Europe (+0.26%, ETF: FPXE) and IPOX® International (+1.29%, ETF: FPXI) higher, to +12.10% YTD and +7.00% YTD, respectively. Our Middle East-focused IPOX® MENA (IPEV: +0.65%) and the biotech-focused IPOX® Health Innovation (IPHI: +1.85%) gained anew, both reaching fresh weekly all-time highs.

GINDEX® PERFORMANCE REVIEW: Our unique strategy focusing on diversified and super liquid acquirers of recent IPOs (IPO M&As), continues to pay off. Both our US-focused GINDEX® U.S. (GNDX: +1.87%) and the recently launched GINDEX® International (GNDXI: +0.40%) reached new all-time highs last week, with the former now beating the S&P 500 (SPX) by 943 bps. since launch in 8/2021.

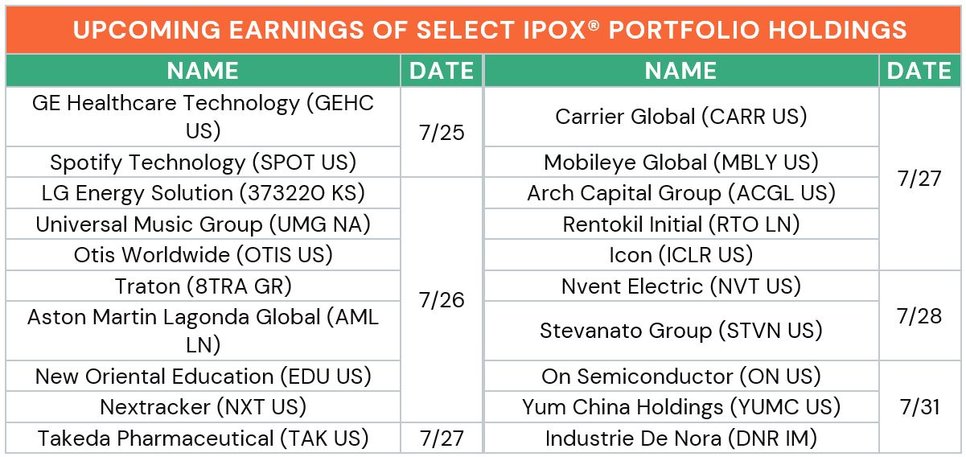

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by Legend Biotech (LEGN US: +7.49%), which gained after reporting a 65% increase in sales of its bone marrow cancer treatment Carvykti. Digital advertising tech firm Integral Ad Science (IAS US: +7.40%) climbed after getting two analyst upgrades. Eye disease pharma firm Apellis Pharmaceuticals (APLS US: -59.30%) plunged as the American Society of Retina Specialists issued a warning of serious side effects from their new drug Syfovre. Energy transition firms led our international indexes, with Finnish EV charging firm Kempower (KEMPOWR FH: +24.71%) topping the IPOX® Europe (ETF: FPXE). South Korean battery heavyweights Ecopro BM (247540 KS: +35.52%) and top holding LG Energy Solution (373220 KS: +4.98%) propelled the IPOX® International (ETF: FPXI) higher last week, with the former reaching a new all-time high. In FPXE, British genome sequencing firm Oxford Nanopore (ONT LN: +22.06%) surged on upgraded revenue forecasts, while FPXE/FPXI double feature Wise (WISE LN: +12.36%) soared as high interest rates create a weekly $6.4m windfall for the cross-border payments provider. Italian electric motor component maker EuroGroup Laminations (EGLA IM: -16.59%) dropped as research firm Kepler Cheuvreux warned of risks. Japanese chipmaker Socionext (6526 JP: -8.25%) is still being weighed down as the exit of former shareholders Fujitsu, Panasonic and the Development Bank of Japan was completed, offering 37.5% of the firm for $1.3b.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 4 sizable IPOs started trading last week, gaining +9.34% from offer price to Friday’s close. The largest IPO was Israeli beauty product maker Oddity Tech (ODD US: +50.17%), which surged after having upscaled their IPO offer twice before launch. The parent of brands Il Makiage and SpoiledChild raised $424m and adds optimism to the resurging IPO market. Read last week’s The IPOX® Week for more information on the firm. The other new listings fell on debut, including Takeda-backed cancer biotech Turnstone Biologics (TSBX US: -8.33%, $80m offer), Japanese construction services firm Nareru Group (9163 JP: -2.64%, $66m) and Malaysian golf reseller MST Golf Group (MSTGOLF MK: -1.85%, $40m).

4 sizable offers are expected this week: Monday: Japanese medical HR firm TRYT (9164 JP, $340m offer), Tuesday: Indonesian coal mining services firm MAHA (MAHA IJ, $33m), Thursday: EV-focused regional air company Surf Air Mobility (SRFM US, $281m) is seeking a direct listing on NYSE on Thursday after a previously cancelled SPAC merger. According to their prospectus, the firm will not receive any proceeds of the listing, as the aim is to allow existing stockholders to sell shares. Friday: Japanese claw machine operator Genda (9166 JP, $96m).

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage added +1.28% to +16.75% YTD. IPOX® SPAC movers included Southeast single-family home builder United Home Group (UHG US: +11.97%). While online video platform Rumble (RUM US: -4.34%) fell. Other SPAC news from last week: 1) 3 SPACs Announced Merger Agreement include Chenghe Acquisition (CHEA US: +0.93%) with precision glass maker Taiwan Color Optics. 2) 2 SPACs Completed Business Combinations include Colombier Acquisition I with “patriotic”/”anti-woke” online marketplace PublicSq (PSQH US: +114.75%). 3) 2 SPACs announced liquidation. 4) deSPAC COVID-19 oral antiviral treatment developer Pardes Biosciences (PRDS US: +16.22%) entered into agreement to be acquired by MediPacific. 5) No SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.