The IPOX® Week - July 3, 2023

Headlines:

- IPOX® 100 U.S. (ETF: FPX) soars past benchmarks towards mid-year end.

- De-SPAC Moonlake leads IPOX® Europe (ETF: FPXE) to +4.67% gain.

- Pre/Post IPOX® SPAC (SPAC) rockets +5.39%. 1 new SPAC launched.

- U.S. IPOs get done as window open. Germany’s Nucera lined up.

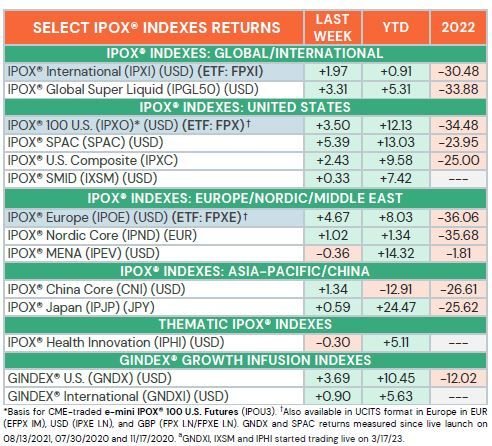

WEEKLY IPOX® PERFORMANCE REVIEW: The key IPOX® Indexes soared ahead of the shortened U.S. trading week, as risk appetite continued to increase amid further signs of decelerating U.S. inflation driving short covering across the broad-based derivatives-heavy benchmark indexes and big outsized moves across individual IPOX® Portfolio Holdings after corporate events and quarterly results. In the U.S., for example, the diversified IPOX® 100 U.S. (ETF: FPX), benchmark for the performance of the largest and typically best performing U.S. domiciled IPOs and Spin-offs, soared +3.50% to +12.13% YTD, a strong +115 bps. ahead of the S&P 500 (ETF: SPY), benchmark for U.S. stocks. (Relative) strength extended to markets abroad with the IPOX® 100 Europe (ETF: FPXE) adding +4.67% to +8.03% YTD, a massive +293 bps. ahead of its regional benchmark, while the broad-based IPOX® Japan (IPJP) rose while all other benchmarks fell on the back of a key corporate action in an IPO M&A, for example.

GINDEX® PERFORMANCE REVIEW: The select list of super liquid and diversified U.S.-domiciled and global acquirers of recent IPOs (IPO M&As) also rose sharply, with the large-cap focused GINDEX® U.S. (GNDX) and the GINDEX® International (GNDXI) adding +3.69% and +0.90%, respectively.

IPOX® PORTFOLIO STOCKS IN FOCUS: Electric car maker Rivian Automotive (RIVN US: b), recently added insurance distributor Fidelity National Spin-off F&G Annuities & Life (FG US: +19.19%) and software maker Unity Software (U US: +15.88%) ranked on top of the list of best performing IPOX® 100 U.S. (ETF: FPX) portfolio holdings, while IPOX® 100 Europe (ETF: FPXE) portfolio holding de-SPAC Swiss domiciled U.S. traded biotech MoonLake Immunotherapeutics (MLTX US: +97.06%) soared amid a positive drug update and USD 250 Million share offering. We also note strong gains in London-traded fintech IPOX® International (ETF: FPXI) holding Wise (WISE LN: +24.19%) on better-than-expected quarterly results, renewed gains in Norway-domiciled U.S.-traded web app development firm Opera (OPRA US: +15.12%) and a good week for beleaguered German alternative energy firm Siemens Energy (ENR GY: +10.44%). In the IPOX® Japan (IPJP), big gains in special chemicals maker IPO M&A heavyweight JSR (4185 JP: +27.09%) on a proposed government buyout drove the portfolios big outperformance. With the exception of all-star IPO M&A Eli Lilly (LLY US: +2.21%), biotech and health care stocks lagged, with Regeneron (REGN US: -7.85%), 06/20 IPO Legend Biotech (LEGN US: -7.07%), Swedens Bioartic (BIOAB SS: -12.53%) and H Lundbeck (HLUND DC: -8.47%) recording significant losses.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: Amid the huge wave in Japan-domiciled micro-cap IPOs coming to market, ca. 10 significantly sized companies went public last week, with the average (median) equally weighted stock adding +30.20% (+6.76%) based on the difference between the final offering price and Friday’s close. Most upside focus was on Tokyo-traded AI IT Services producer small-cap GDEP ADANCE (5885 JP: +203.33%). Respective larger-sized U.S. deals traded mixed with thrift store operator Savers Value Village (SVV US: +31.67%) rising strongly, while energy firm Kodiak Gas Services (KGS US: +1.50%) and Fidelis Insurance Holdings (FIHL US: -2.50%) delivered a more muted debut. Across Europe and Asia, Italy’s luxury yacht maker, H.K.-traded Ferretti (YACHT IM: -4.00%) fell in its Milan debut, while all respective H.K. IPOs rose, including digital pharma platform operator YSB (9885 HK: +1.50%), biotech Laekna (2105 HK: +35.86%) and clinical lab services provider ADICON Holdings (9860 HK: +12.01%).

Amid the U.S. 4th of July holiday week, focus this week is on deals abroad with a number of companies set to debut. The largest deal of the week belongs to Germany’s alternative energy/green hydrogen electrolysis technology firm ThyssenKrupp Nucera AG (NCH2 GR), while Japan is lining up more high-tech AI small-cap deals. Monday: Redox Ltd. (redox.com) (RDX AU). Sector: Distribution/Wholesale. Country: Australia. Offer Size: AUD million. 402.23. Final offer price: AUD 2.55. Wednesday: Bleach Inc. (Bleach.co.jp) (9162 JP). Sector: Advertising. Country: Japan. Offer Size: JPY bn 8.31. Final offer price: JPY 1340 (Top of Range). Friday: 1) Grid Inc. (gridpredict.jp) (5582 JP). Sector: IT/AI Systems. Country: Japan. Offer Size: JPY bn 2.46. Final offer price: JPY 2140 (Top of Range). 2) Thyssenkrupp Nucera AG (thyssenkrupp-nucera.com) (NCH2 GR). Sector: Alternative Energy. Country: Germany. Offer Size; EUR ml 566. Offer range: EUR 19-21.50.

THE IPOX® SPAC (SPAC): The Index of a select list of 50 companies trading at both the pre- and post-consummation rallied +5.39% to +13.03% YTD, closing out the last trading day of the month, quarter and first half strong. IPOX® SPAC Leaders recording upside moves last week included Swiss biotech MoonLake Immunotherapeutics (MTLX US: +97.06%), while last week’s big winner biotech Disc Medicine (IRON US: -15.38%) fell after reported insider (Novo Nordisk-affiliated) sell. Other SPAC news from last week: 1) 5 SPACs Announced Merger Agreement include Semper Paratus Acquisition (LGST US: +0.75%) with biotech Tevogen Bio. 2) 2 SPACs Approved/Completed Business Combinations include GSR II Meteora Acquisition (GSRM US: -53.49% approved merger with bitcoin AUM provider Bitcoin Depot (BTM US: TBD). 3) 4 SPACs announced liquidation. 4) 2 deSPACs received buyout offers including communication services provider Kaleyra (KLR US: +67.25%) and health food firm Whole Earth Brands (FREE US: +28.85%). 5) 1 new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.