The IPOX® Week - July 31, 2023

Headlines:

- IPOX® 100 U.S. and IPOX® International gain momentum to new YTD highs.

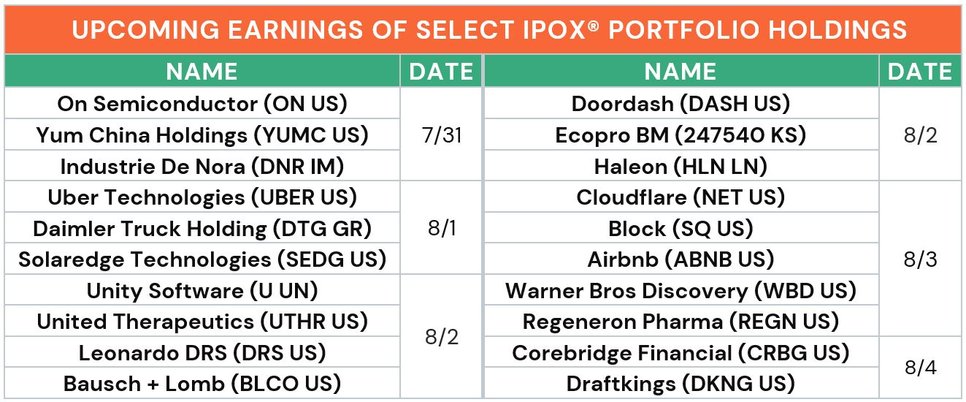

- Earnings week ahead for major IPOX® Holdings, e.g., Airbnb, ON Semi, Uber.

- IPOX® SPAC (SPAC) rises +2.29% to reach 1-year high. Two SPACs debut.

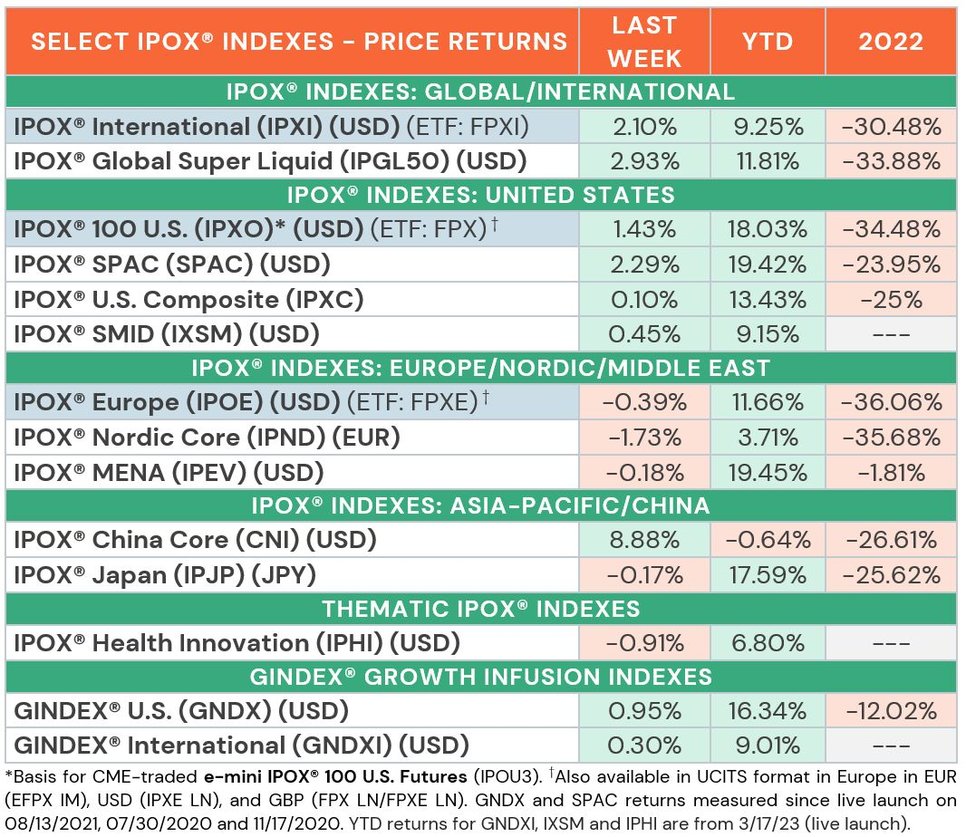

- EcoPro BM: The IPOX® Watch feature gains anew amid short squeeze.

WEEKLY IPOX® PERFORMANCE REVIEW: Most IPOX® Indexes continued last week’s positive trend as earnings season is in full swing, with several major holdings set to report this week. In the U.S., traders digested the Fed’s announcement of another 25 bps. rate hike, pushing long-term treasury yields above the 4% mark yet again. As volatility dropped to its lowest level in over 3 years (VIX: -2.06%), Bloomberg reported improving sentiment on recession fears (see here) after studying trends in company press release wordings. Riding the positive momentum of the last 3 weeks, the IPOX® 100 U.S. (+1.43%, ETF: FPX) gained anew, taking 42 bps. from the S&P 500 (SPX) benchmark to reach its highest week-end position this year, +18.03% YTD. Likewise, our IPOX® International (ETF: FPXI) rose for a 5th week in a row, adding +2.10% to a new YTD high at +9.25%. Last week’s run was fueled by a strong resurgence in our China-domiciled exposure, taking the IPOX® China (CNI: +8.88%) to a fresh 3-month high, as China’s government pledged stimulus measures to help their lagging economy. The IPOX® Europe (ETF: FPXE) fell -0.39% on mixed economic data in various European countries, with better-than-expected inflation numbers in France and Germany feeding hopes of an ECB rate hike pause. Nevertheless, the mood was dampened by quickening inflation in Spain and a 1.5% decline in Swedish Q2 GDP, which sent the Scandinavia-focused IPOX® Nordic (IPND: -1.73%) lower.

GINDEX® PERFORMANCE REVIEW: We note the ongoing strength of our GINDEX® indexes with focus on acquirers of recent IPOs (IPO M&As). The GINDEX® U.S. (GNDX: +1.87%) and GINDEX® International (GNDXI: +0.40%) gained anew to reach fresh all-time highs.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by index heavyweight Carrier Global (CARR US: +9.75%; new post-IPO high) and solar power equipment firm Nextracker (NXT US: +9.23%), which both surged after beating earnings. Big data analytics firm Palantir (PLTR US: +8.40%) climbed after receiving a higher price target at Wedbush, who called the firm “the Messi of AI”. Health resort operator Life Time (LTH US: -15.19%) tumbled as sales missed. French glass packaging maker Verallia (VRLA FP: +12.35%) and Swiss ship engine part maker Accelleron (ACLN SW: +9.23%) both rose to a new post-IPO high, leading the IPOX® Europe (ETF: FPXE) after beating earnings and receiving guidance upgrades. Swedish music streaming giant Spotify (SPOT US: -13.46%) fell after announcing subscription price hikes amid missed revenue outlooks. Exposure to China propelled the IPOX® International (ETF: FPXI) higher last week, with outsized gains in heavyweights e-commerce giant Pinduoduo (PDD US: +17.61%) and Tencent investor Prosus (PRX NA: +8.87%). Amid optimism in the EV sector, car maker Li Auto (LI US: +15.99%) gained alongside South Korean battery firm EcoPro BM (247540 KS: +6.82%). The latest IPOX® Watch feature EcoPro BM ended the week on another new weekly high despite falling up to -37% after a mid-week short squeeze pop.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 5 sizable IPOs started trading last week, gaining +23.10% from offer price to Friday’s close. The largest IPO was that of Japanese medical HR staffing firm Tryt (9164 JP: -23.75%), which fell after raising $340m, followed by compatriot arcade claw machine maker GENDA (9166 JP: +15.08%; $96m). Indonesian coal mining transportation firm Mandiri Services (MAHA IJ: +93.22%, $32m offer size) almost doubled. Two offers launched in Turkey: French fry producer Atakey Patates (ATAKP TI: +20.96%; $41m) and REIT Fuzul GYO (FZLGY TI: +10.00%; $30m) both hit daily upside limits on debut. In the U.S., electric aviation firm Surf Air Mobility (SRFM US: -87.25%) plummeted from its recommended price of $20 to $2.55 on Friday, after launching the largest direct listing on NYSE since 2020. Unlike a traditional IPO, the direct listing offered insiders the chance to sell their shares without a lock-up period, while Surf Air didn’t receive any of the offer’s proceeds.

2 sizable offers are expected this week: Tuesday: Australia’s Abacus Storage King (ASK AU, $152m offer), the self-storage REIT spin-off from Abacus Property Group. Wednesday: Nusantara Sejahtera Raya, the owner of Indonesia’s largest cinema chain Cinema XII (CNMA IJ, $149m offer).

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage added +2.29% to +19.42% YTD, breaking the 560 mark to a new weekly 1-year high. IPOX® SPAC movers included quantum computing IonQ (IONQ: +24.34%) and Swiss biotech takeover candidate Moonlake Immunotherapeutics (MLTX US: +8.16%). Other SPAC news from last week: 1) 3 SPACs Announced Merger Agreements: Compute Health Acquisition Corp (CPUH US: -3.95%) with weight-loss medtech firm Allurion, Genesis Union Capital Corp (GENQ: -8.96%) with waste solutions firm ESGL Holdings and TLG Acquisition One Corp (TLGA US: -34.77%) with energy storage provider Electriq Power. 2) Vietnam EV maker VinFast to list in the U.S. in August after regulator nod. 3) 2 U.S. SPACs launched last week.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.