The IPOX® Week - June 26, 2023

Headlines:

- IPOX® 100 U.S. (ETF: FPX) declines as unseasoned growth stocks fall.

- Best IPOX® Performers get the most deals: Japan and Saudi Arabia in focus.

- IPOX® SPAC (SPAC) sheds -2.26%. 1 SPAC launched in U.S. last week.

- Non-tech U.S. deals in focus as global IPO activity builds Momentum.

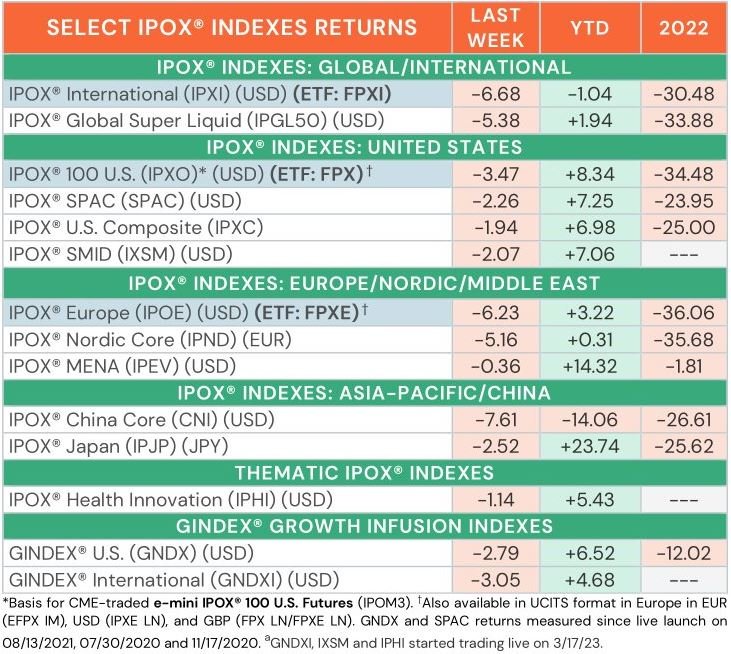

WEEKLY IPOX® PERFORMANCE REVIEW: The IPOX® Indexes fell across the board during the shortened U.S. post-expiration trading week, pressured by profit taking and slowing Momentum across most benchmarks after the big run-up during the previous weeks. Amid stable U.S. yields and continued relative weakness across U.S. small caps, e.g., the IPOX® 100 (ETF: FPX) – benchmark for the performance of the largest U.S. domiciled IPOs and Spin-offs - sank -3.47% to +8.34% YTD, lagging most benchmarks. Declines extended to markets abroad with the IPOX® 100 Europe (ETF: FPXE) and IPOX® International (ETF: FPXI) incurring significant losses, enforced by more declines in the IPOX® China (CNI) which fell back after lack of news on economic stimulus and the worry over faltering growth prospects for the country. Profit taking after unexpectedly strong inflation numbers and a weak currency also pressured the broad-based IPOX® Japan (IPJP) towards the weekend. IPOX® Speciality Exposure continued to display relative strength with the IPOX® Health Innovation (IPHI) declining by just -1.14%, while the small- and mid-cap focused IPOX® SMID (IXSM) shed -2.07%, both outperforming their respective benchmarks. Middle Eastern domiciled IPOX® Exposure continued to rank towards the top of the IPOX® Rankings with the liquid and diversified IPOX® MENA (IPEV) declining to +14.32% YTD, now a massive +1313 bps. YTD ahead of the regional benchmark.

GINDEX® PERFORMANCE REVIEW: U.S.-domiciled and global acquirers of recent IPOs (IPO M&As) also weakened post-expiration, with the GINDEX® U.S. (GNDX) and the GINDEX® International (GNDXI) declining by -2.79% and -3.05%, respectively.

IPOX® PORTFOLIO STOCKS IN FOCUS: In the IPOX® 100 (ETF: FPX), Eli Lilly’s (LLY US) buy out of 09/21 IPO Dice Therapeutics (DICE US) propelled a number of IPOX®-held biotech/pharma to strong weekly gains, including Legend Biotech (LEGN US) and Vaxcyte (PCVX US:), while IPOX® heavyweight Spin-off refrigeration systems maker Carrier (CARR US) recorded notable gains after German authorities approved its deal to buy climate solutions provider Viessmann. A slew of unseasoned high-beta growth stocks fell back sharply, including AI solutions provider C3 AI Inc. (AI US), factory automation equipment maker Symbotic (SYM US) and Spin-off entertainment services provider Madison Square Garden (MSGE US) which declined after announcing a secondary share sale. In the IPOX® 100 Europe (ETF: FPXE) and the IPOX® International (ETF: FPXI), the story of the week belonged to the big slump in alternative/clean energy firm Spin-off Siemens Energy (ENR GY) which plunged after issuing a profit warning, mainly driven by concerns over quality flaws linked to its GAMESA onshore wind turbines.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: The best performing IPOX® Country Indexes, including Japan (IPJP) (4 deals) and Saudi Arabia (IPEV) (5 deals) received the most IPOs last week: In total, 10 notable companies went public, with the average (median) equally-weighted firm adding +46.23% (+39.14%) based on the difference between the final offering price and Friday’s close. Companies in Saudi Arabia included the largest deals with service and health care related companies, such as human resource services provider AlMawarid Manpower (ALMAWARI AB) and pharma firm Jamjoom Pharma (JAMJOOMP AB) doing particularly well. Amid big momentum for Japanese domiciled micro- and small-caps due to some select extreme winners, e.g., IPOX®-held semiconductor maker 10/22 IPO Socionext (6526 JP) and alternative Financial M&A Research Institute (9552 JP), every single IPO debuting in Tokyo last week rose, and exceeded a +50% initial first week gain. Across Europe, we note the successful debut of Norway-domiciled oilfield services provider micro/small-cap DOF Group (DOFG NO). With the IPO window being open across global regions, this week finally promises several larger sized deals with U.S. firms leading the way with 8 sizable offers expected this week in total with at least 3 company debuts in New York. Interestingly, deals are predominantly non-tech. Tuesday: Milan IPO of Hong Kong-listed luxury yacht maker Ferretti (9638 HK, $293m offer size). Wednesday: Chinese pharmaceuticals sales platform YSB (9885 HK, $46m). Thursday: Washington-based thrift store operator Savers Value Village (SVV US, $319m), EQT-owned oil field service provider Kodiak Gas Services (KGS US, $352m), Bermuda-based re-insurer Fidelis Insurance Holdings (FIHL US, $323m) and the Hong Kong listing of Shanghai-based cancer biotech firm Laekna (2105 HK, $101m). Friday: Carlyle-backed Chinese laboratory operator Adicon Holdings (9860 HK, $52m) and Polaris-backed Japanese wedding planner NOVARESE (9160 JP, $46m).

THE IPOX® SPAC (SPAC): The Index of a select list of 50 companies trading at both the pre- and post-consummation stage fell -2.26% to +7.25% YTD during the shortened U.S. trading week. IPOX® SPAC Leaders recording upside moves last week included hematology-focused biotech Disc Medicine (IRON US), while aforementioned robotics and automation company Symbotic (SYM US) fell in tandem with other AI-focused stocks. Other SPAC news from last week: 1) 2 SPACs Announced Merger Agreement include Banyan Acquisition (BYN US) with bowling, bocce court, event spaces all-in-one American bistro chain Pinstripes. 2) 1 SPAC Completed Business Combination as ROC Energy Acquisition completed its merger with Drilling Tools International (DTI US). 3) 1 SPAC announced a liquidation. 4) No new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.