The IPOX® Week - May 1, 2023

Headlines:

- Subdued earnings pressure key IPOX® Indexes towards month-end.

- IPOX® MENA soars +3.96% to end week within range of all-time high.

- IPOX® SPAC (SPAC) drops -2.81%. No U.S. SPACs launched last week.

- J&J’s Kenvue (KVUE US) and Italy’s Lottomatica (LTMC IM) set debut.

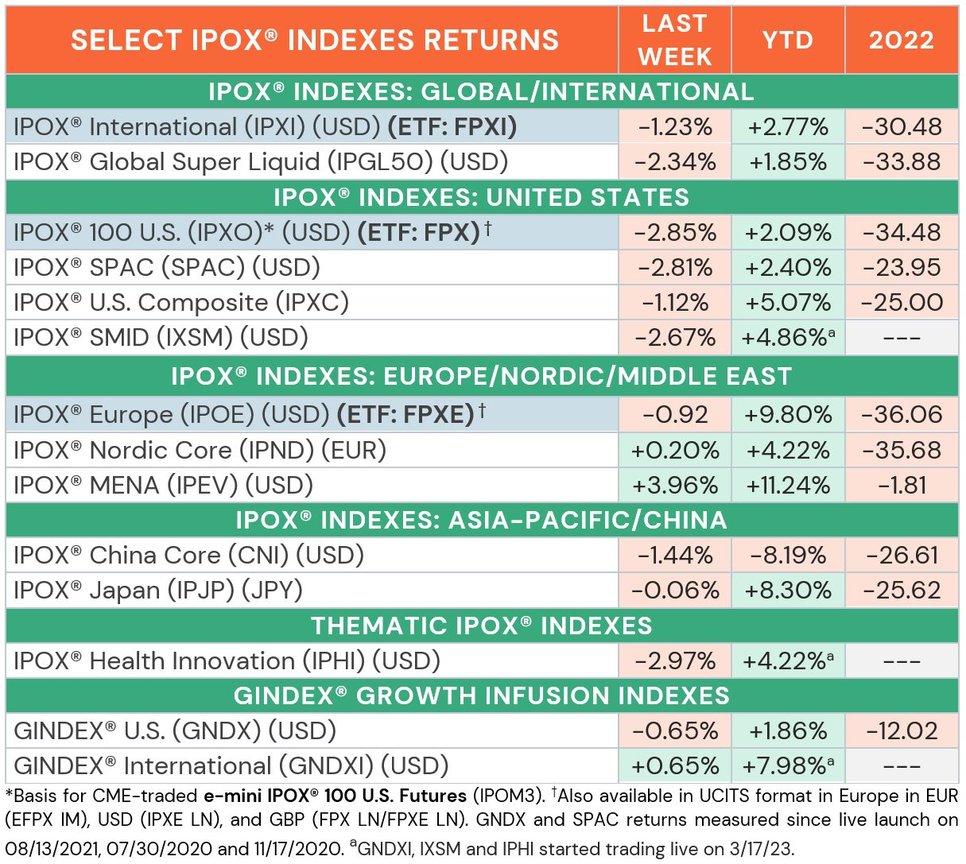

WEEKLY IPOX® PERFORMANCE REVIEW: Most IPOX® Indexes traded lower last week, unable to build on the positive momentum driving the U.S. benchmarks on subdued earnings across some key portfolio holdings. Amid lower U.S. yields across the board and fresh new lows in U.S. equity risk (VIX: -5.90%) ahead of the FED, e.g., the IPOX® 100 U.S. (ETF: FPX) dropped -2.85% to +2.09% YTD, lagging the S&P 500 (ETF: SPY) by a big -372 bps. (Relative) weakness extended to markets abroad. In Europe, e.g., the IPOX® Europe (ETF: FPXE) declined by -0.81% to +9.93% YTD while another week of losses for Chinese equities drove the IPOX® International (ETF: FPXI) lower. We note with interest the round of further gains for the Middle East-focused IPOX® MENA (IPEV: +3.96%) after select portfolio holdings pushed the portfolio towards an all-time high.

GINDEX® PERFORMANCE REVIEW: IPO M&A-focused stocks traded mixed last week. While the GINDEX® U.S. (GNDX) continued to trade in line with the Value Line Dividend Index (ETF: FVD), our GINDEX® International (GNDXI: +0.65%) outperformed its benchmark.

IPOX® PORTFOLIO STOCKS IN FOCUS: Amid earnings and corporate actions, individual portfolio returns were widely distributed last week. In the IPOX® 100 U.S. (ETF: FPX), e.g., we note big gains in sports center operator LifeTime Group (LTH US: +15.76%) and cancer therapy biopharma firm Arcellx (ACLX US: +7.89%), while heavier-weighted social media platform Pinterest (PINS US: -16.03%) and former Intel AI driving unit Mobileye (MBLY US: -15.30%) slumped. Last week’s IPOX® Week feature, air conditioning and heating specialist Carrier Global (CARR US: -7.52%) declined after announcing a landmark deal to purchase German competitor Viessmann for $12 billion. The IPOX® Europe (ETF: FPXE) was led by Norwegian game-based education platform Kahoot! (KAHOT NO: +12.91%) and Swedish bone surgery specialist BoneSupport (BONEX SS: +12.69%), while Israeli-based solar power technology firm SolarEdge (SEDG US: -10.52%) fell sharply after competitor Enphase Energy (ENPH US) reported worse-than-expected Q1 sales. In the IPOX® International (ETF: FPXI), we note a good week for Chinese operator of Japanese-style retail stores Miniso (MNSO US: +12.51%) and a slew of MENA-traded IPOX® portfolio holdings, including MENA Abu Dhabi’s oil field services firm ADNOC Drilling (ADNOCDRI UH Equity: +9.44%), hospital operator Dr. Sulaiman Al Habib Medical Services (SULAIMAN AB: +5.90%) and digital solutions provider Elm (ELM AB: +4.24%) which close out the week at year another fresh all-time high. Chinese e-commerce giant Alibaba (BABA US: -4.98%) dropped as their cloud computing arm Aliyun was reported to have lost market share, while Swedish biotech IPO M&A Swedish Orphan Biovitrum (SOBI SS: -6.24%) dropped after the recent run up and Brazil’s wholesale distributor Sendas Distribuidora (ASAI3 BZ: -5.46%) extended its YTD slump.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 5 notable IPOs started trading last week, gaining an average of +7.39% based on the difference between the final offer price and Friday's close. After raising $676m in the biggest H.K. IPO YTD and the first Chinese baijiu liquor firm to list outside Mainland China, ZJLD (6979 HK: -14.97%) had a disappointing start to trading while Japanese investment management firm Rheos Capital Works (7330 JP: +23.31), Thai car seller Millennium Group (MGC TB: +20.13%), Chinese online physician platform MedSci Healthcare (2415 HK: +7.69%) and Italian gas storage container firm Ecomembrane (ECMB IM: +0.41%) all recorded a positive first week based on final offer, respectively. The key deal of the week belongs to Johnson & Johnson’s spin-off IPO of consumer healthcare unit Kenvue, which will start trading independently under the ticker KVUE on Friday. Indemnified from any talk-related costs absorbed recently by its parent, the maker of brands such as Tylenol, Band-Aid and Listerine will become the largest publicly traded pure-play consumer healthcare firm at approx. $43 billion market capitalization. Priced at the low end of the EUR 9-11 range, the IPO of Apollo Global-backed Italian gaming operator Lottomatica (LTMC IM: $650m offer) is set to commence trading on Thursday.

THE IPOX® SPAC (SPAC): The Index of a selected list of 50 constituents trading at both the pre- and post-consummation stage, fell -2.81% to +2.40% YTD. The IPOX® SPAC Leader recording significant moves last week include storage solutions provider Willscot Mobile Mini (WSC US: +7.20%), while Chipmaker Navitas Semiconductor (NVTS US: -22.53%) dropped after industry leader Texas Instruments posted disappointing earnings. Other SPAC news from last week: 1) 4 SPACs Announced Merger Agreement include ESGEN Acquisition (ESAC US: +1.33%) with Florida-based residential rooftop solar provider Sunergy Renewables. 2) 7 SPACs announced liquidation. 3) No new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.