The IPOX® Week - May 8, 2023

Headlines:

- Strong earnings propel IPOX® 100 U.S. (ETF: FPX) to winning week.

- Small and Mid-cap IPOX® SMID climbs +0.80%, outperforms anew.

- IPOX® SPAC (SPAC) gains +0.33%. 2 U.S. SPACs launched last week.

- J&J’s Kenvue (KVUE US), largest U.S. IPO since 2021, surges and joins FPX.

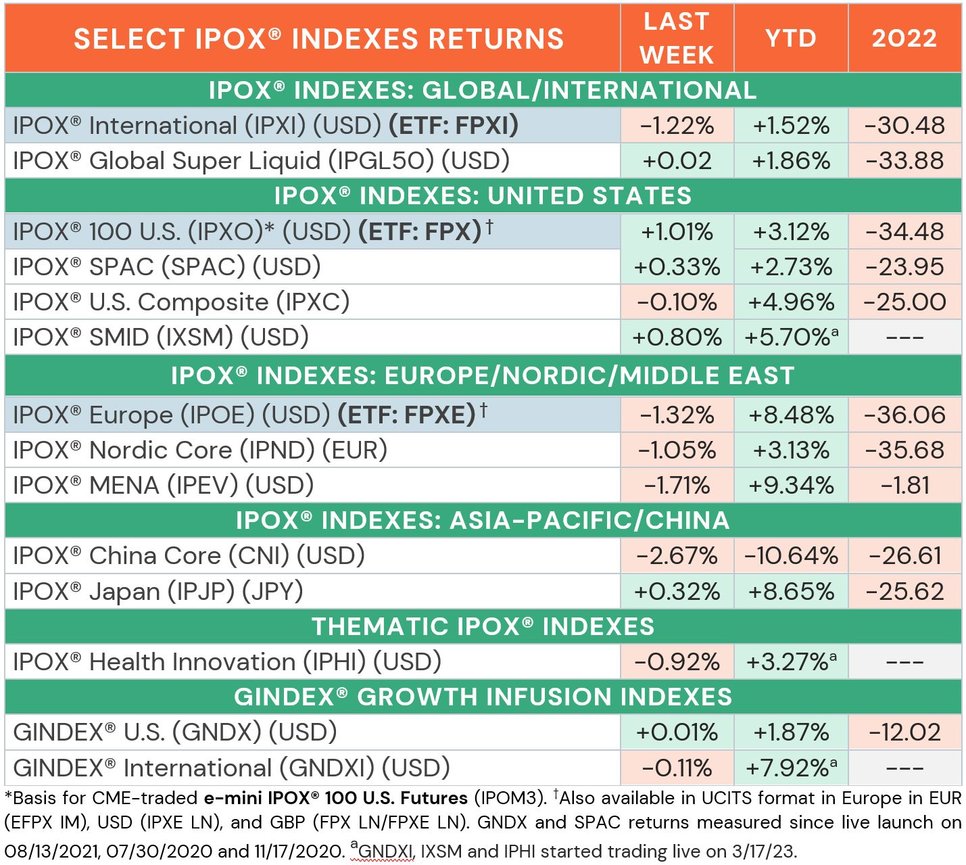

WEEKLY IPOX® PERFORMANCE REVIEW: The IPOX® Indexes traded mixed last week as market participants reacted to various macroeconomic events and earnings reports, leading to a divergence in performance across the board. The Fed’s announcement of a 25 bps. rate hike, coupled with recession-defying job numbers, increased jitters in the bond market, driving long-term treasury yields (e.g., 30-year bonds) higher. In the U.S., equity markets struggled with negative sentiment, reacting with heightened volatility (VIX: +8.94%) as challenges in the banking sector persist after JP Morgan’s takeover of First Republic Bank. Despite this uncertain environment, the IPOX® 100 U.S. (ETF: FPX) outperformed the S&P 500 (ETF: SPY), gaining +1.01% compared to the benchmark’s -0.80% drop last week, as several of our large-cap holdings reported positive quarterly earnings. In addition, our small- and medium cap focused IPOX® SMID (IXSM: +0.80%) also showed relative strength, continuing its momentum to +5.70% since its March 17 launch. In Europe, the IPOX® Europe (ETF: FPXE) faced headwinds, losing -1.32% to +8.48% YTD as the Bank of England and the European Central Bank also announced further rate hikes. Internationally, the IPOX® International (ETF: FPXI) fell -1.22% to +1.52% YTD with Chinese equities continuing to lag, i.e. IPOX® China (CNI: -2.67%), as e-commerce giant Alibaba denied rumors of a planned U.S. IPO for $39b value global unit including AliExpress.

GINDEX® PERFORMANCE REVIEW: IPO M&A-focused stocks traded relatively flat last week. While the GINDEX® U.S. (GNDX: +0.01%) continued to trade in line with the Value Line Dividend Index (ETF: FVD), our GINDEX® International (GNDXI: -0.11%) fell slightly.

GINDEX® PERFORMANCE REVIEW: IPO M&A-focused stocks traded mixed last week. While the GINDEX® U.S. (GNDX) continued to trade in line with the Value Line Dividend Index (ETF: FVD), our GINDEX® International (GNDXI: +0.65%) outperformed its benchmark.

IPOX® PORTFOLIO STOCKS IN FOCUS: With earnings season in full swing, we noted widely distributed returns last week. The IPOX® 100 U.S. (ETF: FPX) was propelled upwards by its second-largest holding, ride-hailing app Uber (UBER US: +20.45%), which surged after reporting a rise in revenue. Our 5th largest holding, chipmaker On Semiconductor (ON US: +11.44%) beat EPS and sales estimates. In the health care sector, biotechs Apellis Pharma (APLS US: +9.48%), Arcellx (ACLX US: +4.92%) both reached new post-IPO highs after earnings, while GINDEX® U.S. (GNDX) and IPOX® Health Innovation (IPHI) holding, pharma giant Eli Lilly (LLY US: +8.07%) jumped to record highs on Alzheimer trial data. Personal finance firm Nerdwallet (NRDS US: -31.98%) lost a third of its value after lowering revenue guidance, citing slower growth, tighter credit conditions and ongoing challenges in the financial services sector. The IPOX® Europe (ETF: FPXE) was led by two firms that gained analyst upgrades, Swiss inflammation-focused biotech MoonLake Immunotherapeutics (MLTX US: +17.37%) and Israeli cross-border e-commerce facilitator Global-E Online (GLBE US: +9.36%). Last week’s top gainer, Norwegian game-based education platform Kahoot! (KAHOT NO: -16.88%) fell as the sector considers the potential impact of A.I. technology on business models. In the IPOX® International (ETF: FPXI), Japanese electronics supplier TDK (6762 JP: +5.17%) gained as their lithium battery customer Apple (AAPL US) reported record iPhone sales. Swedish music streaming service Spotify (SPOT US: +5.22%) climbed as analysts raised price targets. Brazil retailer Assai (ASAI3 BS: -12.96%) continued to drop on missed earnings estimates.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 3 large IPOs started trading last week, gaining an average of +14.95% based on the difference between the final offer price and Friday's close. Italian gambling operator Lottomatica (LTMC IM: -6.16%) started trading in Milan after raising over $660m, largest IPO in Europe in 2023. The sports betting and online casino operator will be added to the IPOX® Europe (ETF: FPXE) from May 10, replacing the soon to be de-listed communication towers firm Vantage Towers (VTWR GR). Our most recent IPOX® Week IPO Pre-Launch feature, Johnson & Johnson consumer health spin-off Kenvue (KVUE US: +21.27%), was the biggest offer last week, raising $3.8 billion in the largest U.S. IPO since Rivian in 2021. Kenvue joined the IPOX® 100 U.S. (ETF: FPX) on Friday, replacing social media platform Pinterest (PINS US). Inflammation drug maker Acelyrin (SLRN US: +30.56%) was another record-breaking debut last week, raising $540m, the biggest offer in the biotechnology sector since 2021. Both listings are seen as positive signs for the re-opening of the biotechnology/pharma IPO window. Two sizable listings are planned for this week, both in Hong Kong: Monday: Cancer-focused biotech Beijing Luzhu Biotechnology (2480 HK, $43m offer). Thursday: Marketing services provider Plus Group Holdings (2486 HK, $37m).

THE IPOX® SPAC (SPAC): The Index of a selected 50 constituents trading at both the pre- and post-consummation stage added +0.33% to +2.73% YTD. The index was led by biopharmaceutical company MoonLake Immunotherapeutics (MLTX US: +17.37%) with a new buy rating at a whopping $51 price target (almost 90% upside based on Friday’s close). While supply chain software provider E2open (ETWO US: -26.55%) plunged on disappointing earnings. Other SPAC news from last week: 1) 4 SPACs Announced Merger Agreement include Corner Growth Acquisition (COOL US: +0.20%) with London-traded IT solutions and services company Noventiq. 2) 1 SPAC Approved Business Combination include Jupiter Wellness Acquisition (JWAC US: -28.17%) with China-based EV manufacturer Chijet. 3) 9 SPACs announced and/or completed liquidation. 4) 2 new SPACs launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.