The IPOX® Week

Headlines:

- IPOX® Europe (ETF: FPXE) adds +1.01% for fifth straight week of gains.

- IPOX® Growth Infusion (GNDX) outperforms S&P 500 anew.

- IPOX® SPAC (SPAC) drops -3.01%. No U.S. SPACs launched last week.

- Acrivon surges 26% after IPO. FPXE/FPXI’s Porsche at new post-IPO high.

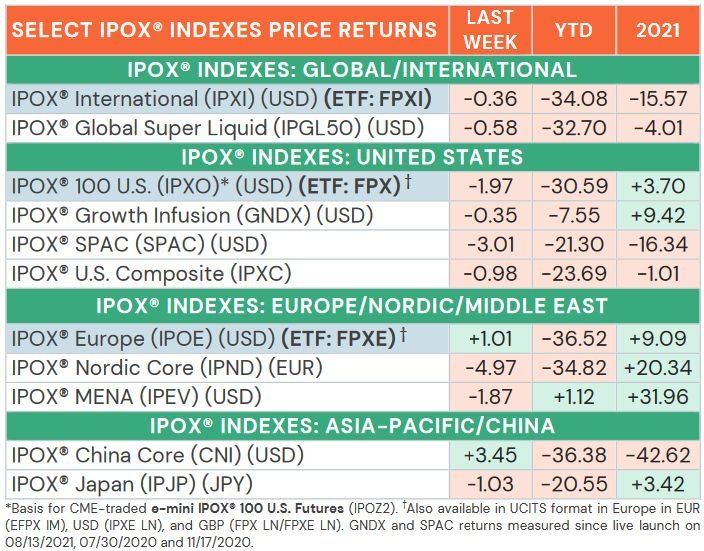

WEEKLY IPOX® PERFORMANCE REVIEW: Amid U.S. options expiration week, increased volatility (VIX: +2.67%), declining interest rates and hawkish FED signaling of more interest rate hikes, the IPOX® Indexes traded mixed last week. In the U.S. e.g, the broad-based IPOX® 100 U.S. (ETF: FPX) shed -1.97% to -30.59% YTD, while the IPOX® International (ETF: FPXI) dropped by -0.58% to -34.08% YTD. Gains were recorded by the IPOX® Europe (ETF: FPXE) which rose by +0.64% to -36.75% YTD and continuing its largest weekly winning streak since April 2020 (+16.50% in the past 5 weeks), while the IPOX® China (CNI: +3.59%) cut its YTD losses further. As the FIFA World Cup kicks off in Qatar, drops in commodities and massive stock overhang weighted on the IPOX® MENA (IPEV: -1.86%). In the U.S., the large-cap heavy and super-liquid IPOX® Growth Infusion (GNDX: -0.35%) dropped slightly to -7.55% YTD and extending the index’s outperformance against benchmarks S&P 500 to +925 bps. YTD before dividends.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: As Q3 earnings season comes to a close, the IPOX® 100 U.S. (ETF: FPX) was led by energy equipment manufacturer Shoals Technologies (SHLS US: +33.95%) and specialty insurance firm Ryan Specialty (RYAN US: +9.94%) which bounced back after dropping last week. The index’s laggards were led by crypto exchange Coinbase (COIN US: -21.23%) amid BofA’s downgrade in response to contagion fears after FTX’s bankruptcy. IPOX® Europe (ETF: FPXE) gainers included UK energy firm Drax (DRX LN: +13.68%) as analysts suggested that windfall tax concerns were “overdone”, while luxury car maker Porsche (P911 GR: +7.59%), latest addition to both IPOX® Europe (ETF: FPXE) and IPOX® International (ETF: FPXI), surged to a new post-IPO high (+30.06%). Furthermore, the IPOX® International (ETF: FPXI) was led by several Chinese firms, including social media app Kuaishou (1024 HK: +13.36%), which surged on news that the firm would join Hong Kong’s Hang Seng index. IPOX® International (ETF: FPXI) holding, Uruguayan payment service provider DLocal (DLO US: -43.86%) plunged on fraud allegations by investment research firm Muddy Waters.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK:8 sizable IPO started trading internationally last week, gaining +7.64% based on the difference between the final offer price and Friday’s close. Pharma company Acrivon Therapeutics (ACRV US: +26.24%) was the only sizable listing in the U.S. last week. China-listed firms Sunwoda (EV batteries, SWD SW: +4.58%) and GreatStar (tools, GSI SW: +14.68%) listed GDRs in Switzerland. South Korean engineering firm Yunsung F&C (372170 KS: +4.49%), Dubai district cooling firm Empower (EMPOWER UH: +1.50%), and Turkish renewables firm Alfa Solar Enerji (ALFAS TI: +32.99%) all gained. Saudi business services firm Perfect Presentation (2P AB: +0.00%) traded flat, while Japanese food subscription service Base Food (2936 JP: -23.38%) plunged.image

In light of the shortened U.S. trading week, at least 3 firms are expected to go public this week. Monday: Saudi telecommunication cables firm Riyadh Cables (RIYADHCA AB: $378m offer). Tuesday: Nevada-based manufacturer of lab-grown diamonds Adamas One (JEWL US: $36m offer). Thursday: Hong Kong listing of Shenzhen-based seller of refurbished electronics LX Technology (2436 HK: $59m offer).

Other news: 1) $1.8b IPO of MENA restaurant operator Americana, largest Saudi IPO this year, to dual list in UAE/KSA on Dec 6. 2) Saudi Wealth Fund mulls IPO of $5b oil & gas drilling firm ADES. 3) Thai pet food maker i-Tail kicks off $588m IPO, country’s second largest listing this year. 4) Vietnamese EV maker VinFast plans $1b U.S. IPO as soon as January. 5) Fintech unit of Chinese e-commerce giant JD.com plans to raise up to $2b in Hong Kong IPO by year-end. 6) China’s Sunshine Insurance gets approval to raise up to $1b in Hong Kong by month-end. 7) Nickel producer Lygend plans to take orders for $700m Hong Kong IPO this week. 8) $1.6b Boston catering firm ezCater mulls 2023 IPO. 9) Volkswagen in talks with pre-IPO investors for EV battery unit. 10) IPOX® Europe (ETF: FPXE) holding, French lottery group FDJ buys online horse race betting firm ZETurf for $181m.

THE IPOX® SPAC (SPAC):The Index of 50 companies trading at the pre- and post IPO stage declined -3.01% to -21.30% YTD last week. IPOX® SPAC Leaders recording big moves last week included Africa-based agribusiness company Forafric (AFRI US: +5.20%) and space-based cellular broadband network provider AST SpaceMobile (ASTS US: -25.25%) which plunged after reporting a large quarterly loss. Other SPAC news from last week: 1) 7 SPACs Announced Merger Agreement include TLG Acquisition One Corp (TLGA US: -0.05%) with home solar battery storage and management company Electriq Power. 2) 5 SPACs Approved or Completed Business Combination include Tiga Acquisition with LGBTQ+ community-focused dating app Grindr (GRND US: +247.29%). 3) 2 SPACs opted to liquidate include G&P Acquisition (GAPA US: $10.17/share) and ION Acquisition Corp 3 (IACC US: $10.08). 4) No new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Indexes continue outperformance of benchmarks amid global rout

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

© 2024 Lightspeed Financial Services Group, LLC. All rights reserved.

Equities, equities options, and commodity futures products and services are offered by Lightspeed Financial Services Group LLC (Member FINRA, NFA and SIPC). Lightspeed Financial Services Group LLC’s SIPC coverage is available only for securities, and for cash held in connection with the purchase or sale of securities, in equities and equities options accounts. You may check the background of Lightspeed Financial Services Group LLC on FINRA’s BrokerCheck.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses.