The IPOX® Week - November 28, 2022

Headlines:

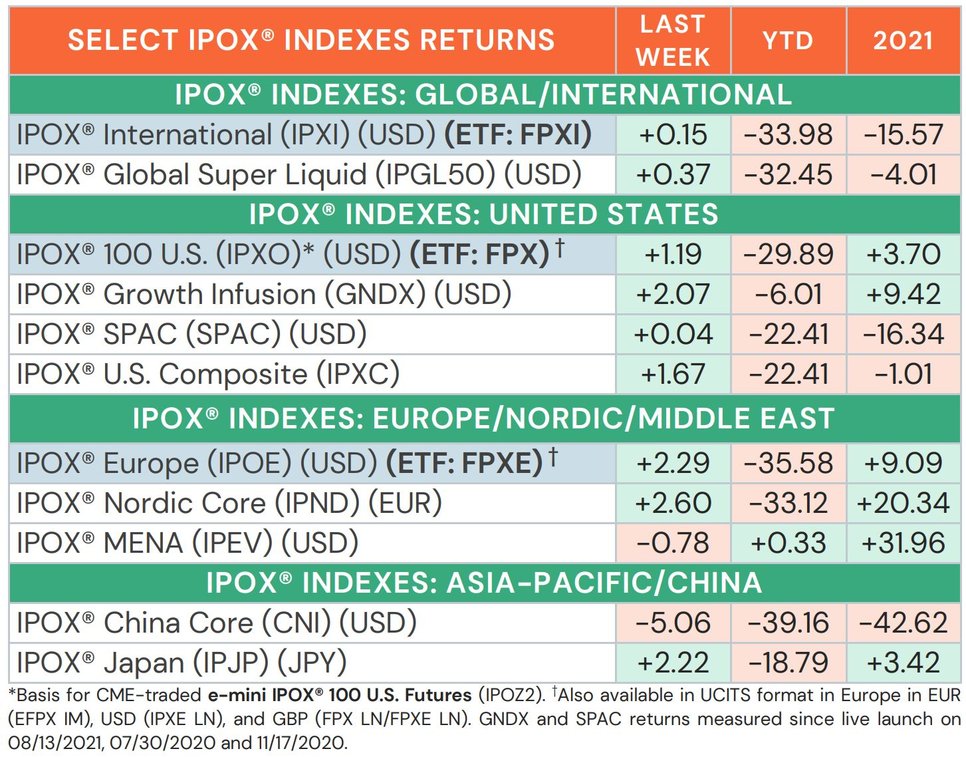

- All major IPOX® Indexes gain. IPOX® 100 U.S. (ETF: FPX) adds +1.19%.

- IPOX® Europe (ETF: FPXE) gains +2.29%, continuing streak for 6th week.

- IPOX® SPAC (SPAC) gains +0.04%. No U.S. SPACs launched last week.

- UAE/KSA ready $1.8b IPO of Americana. EV firm Vin-fast plans $4b U.S. IPO.

WEEKLY IPOX® PERFORMANCE REVIEW: Amid a shortened trading week in the U.S., Japan and Saudi Arabia, drastically decreased volatility (VIX: -14.33%) and the continued decline in U.S. interest rates, all major IPOX® Indexes gained last week. In the U.S. e.g, the broad-based IPOX® 100 U.S. (ETF: FPX) gained +1.19% to -29.89% YTD. The IPOX® Europe (ETF: FPXE) continued its rally for the 6th week, gaining +2.29% to -35.58% YTD, maintaining its largest weekly winning streak since April 2020 (+18.23% in the past 6 weeks). The IPOX® International (ETF: FPXI) gained slightly by +0.15% to -33.98% YTD, weighted down by stocks that are also represented in the IPOX® China (CNI: -5.06%), which fell as China reported the most daily COVID-19 cases since the start of the pandemic. With the FIFA World Cup under way in Qatar, continued stock overhang weighted on the IPOX® MENA (IPEV: -0.78%). In the U.S., the innovative, large-cap heavy and super-liquid IPOX® Growth Infusion (GNDX) gained +2.07% to -6.01% YTD, edging ahead of the S&P 500 benchmark last week, which it now outperforms by +925 bps. YTD, before dividends.

IPOX® PORTFOLIO HOLDINGS IN FOCUS:The IPOX® 100 U.S. (ETF: FPX) was led by solar energy equipment firm Array Technologies (ARRY US: +14.30%). Amid increasing natural gas prices, LNG firms such as Excelerate Energy (EE UN: +12.44%), Constellation Energy (CEG US: +7.90%) and New Fortress Energy (NFE US: +6.42%) were well represented amongst the index leaders. The index’s laggards were led by crypto exchange Coinbase (COIN US: -9.24%) for the second week in a row, while online meeting platform Zoom Video (ZM US: -8.71%) disappointed on earnings. IPOX® Europe (ETF: FPXE) constituent, German online remote access software firm TeamViewer (TMV GR: +13.18%) surged amid speculation that the firm could save costs on exiting its shirt sponsorship contract with English soccer club Manchester United (MANU US) as the club looks for a buyer. The IPOX® International (ETF: FPXI) was led by Uruguayan payment service provider DLocal (DLO US: +34.91%), which bounced back after dropping -43.86% in the week prior, due to fraud allegations. Most recent IPOX® Week feature, Thai hospitality management firm Asset World (AWC TB: +8.55%) jumped on positive sentiment in the country’s tourism sector. Japanese pharma giant Takeda (TAK US: +4.67%) gained after its dengue fever vaccine was submitted for FDA fast track review, while Indonesian super-app GoTo (GOTO IJ: -16.67%) fell ahead of its lock-up period expiry on Nov. 30.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: As Thanksgiving cut the trading week short, 3 sizable IPO started trading internationally last week, gaining +8.17% based on the difference between the final offer price and Friday’s close. Turkish appliance retailer Sanica Isi Sanayi (SNICA TI: +21.02%) and $895m IPO of Saudi cooling firm Marafiq (MARAFIQ AB: +3.48%) gained, while Hong Kong electronics reseller LX Technology (2436 HK: +0.00%) traded flat. image

At least 6 firms are expected to go public this week. Monday: Taiwanese disposable contact lens manufacturer Visco Vision (6782 TT, $38m offer). Tuesday: UAE education firm Taaleem (TAALEEM UH, $204m offer) and Hong Kong listing of Chinese lending firm 360 DigiTech (3660 HK, $62m offer). Thursday: Finnish sawmill operator Koskisen (ticker pending, $30m offer), H-Shares offer of Chinese nickel producer Lygend (2245 HK, $595m) and U.S. listing of lab-grown diamond maker Adamas One (JEWL US, $36m).

Other news: 1) Americana’s landmark Saudi-UAE IPO draws $105 Billion in orders. 2) Saudi Aramco base oil unit Luberef gets approval for $1b IPO. 3) Vietnam EV maker VinFast ships first cars to California amid plan to raise $4b in January U.S. IPO. 4) Colorado-based LNG producer BKV files for $100m U.S. IPO. 5) Bausch Health subsidiary Solta Medical withdraws IPO. 6) Pharma giant Merck extends blood cancer portfolio through acquisition of 07/2021 IPO and IPOX® Composite (IPXC) member Imago Biosciences (IMGO US: +97.02%). 7) Alibaba affiliate, Chinese fintech firm Ant said to revisit IPO after $1b fine is seen as end to regulatory rectification. 8) Hong Kong-listed Italian luxury firms, clothes brand Prada and yacht maker Ferretti mull secondary listing in Milan. 9) Private equity firm Vista explores acquisition of business finance software firm Coupa (COUP US).

THE IPOX® SPAC (SPAC): The Index, composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage, added +0.04% on shortened trading week to -21.27% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include crop productivity agritech Bioceres Crop Solutions (BIOX US: +5.09%) rose while mobile medical services and transportation provider DocGo (DCGO US: -5.47%) fell. Other SPAC news from last week: 1) 2 SPAC Announced Merger Agreement include Western Acquisition Ventures (WAVS US: +0.05%) with cybersecurity platform provider Cycurion. 2) 2 SPACs Approved or Completed Business Combination include ACE Convergence Acquisition automation software developer Tempo Automation (TMPO US: -33.33%). 3) A whooping 10 SPACs opted to liquidate include Austerlitz Acquisition II (ASZ US: $10.00/share), the largest SPAC that has not announced a merger and the 5th largest SPAC on record. 4) No new SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Indexes continue outperformance of benchmarks amid global rout

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.