The IPOX® Week - October 17, 2022

Headlines:

- IPOX® U.S. 100 (ETF: FPX) lags amid higher-than-expected U.S. inflation.

- IPOX® Growth Infusion (GNDX) down -1.36%, takes +20 bps. from S&P 500.

- IPOX® SPAC (SPAC) falls -1.69%, 3 SPACs launched in the U.S. last week.

- Japan chip-maker Socionext surges on open. MENA IPOs lining up.

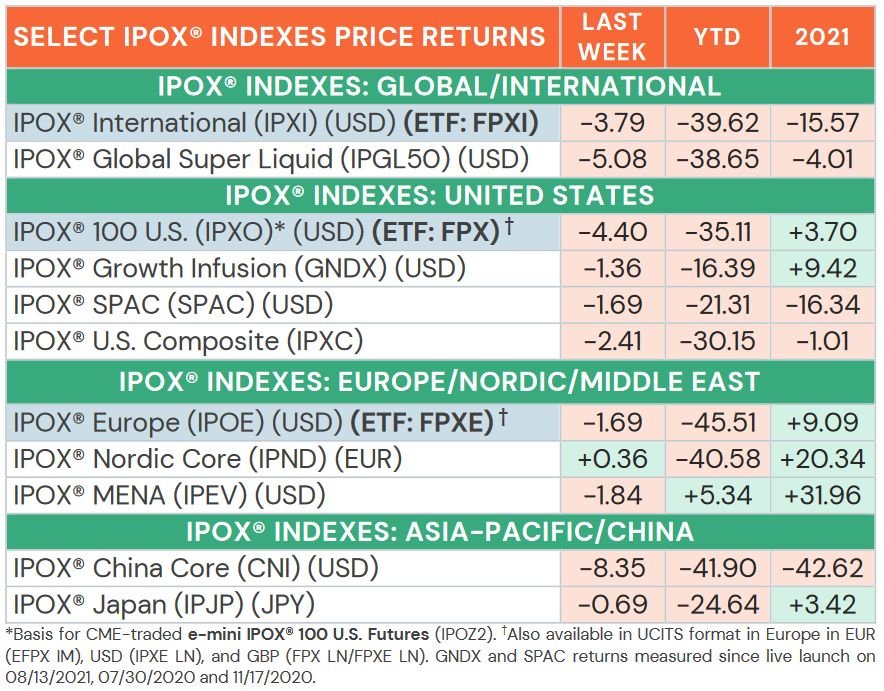

WEEKLY IPOX® PERFORMANCE REVIEW: Most IPOX® Indexes declined last week, pressured by rising year-ahead inflation expectations and higher-than-expected year-on-year U.S. consumer prices reported Thursday. As volatility reached a 3-month high on Tuesday (VIX: +2.07%), the growth-sensitive IPOX® 100 U.S. (ETF: FPX, -4.43%), e.g., posted losses versus the benchmarks. Moreover, as the IMF issued new warnings of “stormy waters” for the global economy, the IPOX® International (ETF: FPXI) fell -3.79%. Amid the IMF’s reduced growth outlook for the Chinese economy, we also note big losses for the IPOX® China (CNI: -8.35%) as traders returned from the country’s Golden Week holiday ahead of the Communist Party Congress. In Europe, the Scandinavia-focused IPOX® Nordic (IPND: +0.38%) gained strength while the IPOX® 100 Europe (ETF: FPXE) dropped -1.69%. Markets in the Middle East fell with a drop in commodity prices (WTI Crude: -7.42%), pressuring the IPOX® MENA (IPEV: -1.84%). In light of another big week for U.S. IPO M&A activity, the M&A-focused, large-cap heavy and super-liquid IPOX® Growth Infusion (GNDX: -1.36%) continued its outperformance against the S&P 500, adding +20 bps to +749 bps. YTD last week.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: Ahead of Q3 Earnings Season, last week’s IPOX® Portfolio Movers were influenced by several high-impact news events. The IPOX® 100 U.S. was led by two firms that announced M&A deals: Cybersecurity education firm KnowBe4 (KNBE US: +9.63%) surged on the takeover deal with Vista Equity at $24.90 per share, while supermarket chain Albertsons (ACI US: +7.29%) gained after Kroger agreed to acquire the company in a $24.6bn deal. Financial services firm Payoneer Global (PAYO US: +3.89%) climbed after inclusion in the S&P SmallCap 600 on Monday, while EV maker Rivian (RIVN US: -15.43%) dropped as the firm issued a recall for almost all of their shipped cars, citing suspension issues. The IPOX® International (ETF: FPXI) was led by this week’s IPOX® Watch feature, Brazilian supermarket chain Sendas Distribuidora (ASAI3 BZ: +5.14%), while Indonesian ride-hailing and delivery super app GoTo (GOTO IJ: -17.21%) plunged amid a 30% hike in domestic subsidized fuel prices. Within the IPOX® Europe (ETF: FPXE), oil and gas firm Var Energi (VAR NO: -10.70%) fell after issuing a production guidance warning, while other energy firms, including Acciona Energia (ANE SQ: -8.39%), lagged amid news of climate models predicting a mild European winter.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 3 sizable IPOs launched internationally last week, with the average equally weighted deal adding +13.76% based on the difference between the final offer price and Friday’s close. UAE healthcare provider Burjeel (BURJEEL UH: +20.00%) also rose after raising $300m in Abu Dhabi. Chinese medical device firm Jenscare Scientific (9877 HK: +0.18%) also raised $29m. Former Panasonic-Fujitsu chip design business Socionext (6526 JP: +21.10%) surged after raising $467m in Japan’s largest offering this year. 4 sizable IPOs are planned internationally this week. Tuesday: Metaverse firm Flowing Cloud Technology (6610 HK: $100m offer) in Hong Kong and battery materials firm Top Material (360070 KS: $44m) in South Korea. Wednesday: Aircraft and ship leasing firm SBI Leasing Services (5834 JP, $45m) in Japan. Friday: Singapore-based operator of Indonesian gas fields Conrad Asia Energy (ticker pending: $30m) in Australia; Israeli video compression software specialist Beamr Imaging (BMR US: $36m) on Nasdaq. Other news include: 1) American Towers and Cellnex show interest in IPOX® 100 Europe (ETF: FPXE) constituent, Vodafone’s telecommunications tower unit Vantage Towers (VTWR GR). 2) IPOX® U.S. Composite (IPXC) member, 2021 IPO cybersecurity firm ForgeRock (FORG US) to be bought by Thoma Bravo in $2.3b deal. 3) GE HealthCare (GEHC US) spin-off valued at $37b, to include imaging, patient care and diagnostics in early 2023 listing. 4) China’s Sinopec mulls to revive IPO of retail unit, may raise $5b in Hong Kong. 5) Saudi Marafiq Utility’s $897m IPO fully covered within hours. 6) Kakao-linked game studio Lionheart halts $422m IPO. 7) Battery arm of Finland’s Valmet to open up Nordic IPO market in $140m listing.

THE IPOX® SPAC (SPAC) The Index, currently composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage, fell -1.69% to -21.23% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include bowling lane operator Bowlero (BOWL US: +12.06%) soared on expansion plan despite market volatility and recession fear, while online sports betting company DraftKings (DKNG US: -24.74%) plunged on California legalization news. Other SPAC news from last week: 1) 6 SPACs Announced Merger Agreement include Chelsea Football Club owner Todd Boehly’s Horizon Acquisition II (HZON US: -0.30%) with subscription-based private jet service provider Flexjet. 2) No SPAC Approved or Completed Business Combination. 3) 6 SPACs opted to liquidate include Hunt Companies Acquisition (HTAQ US: $10.16/share) making it a total of 38 SPACs to dissolve YTD. 4) 3 SPACs Terminated Merger include G Squared Ascend I (GSQD US: +0.35%) with digital freight broker Transfix. 5) 3 SPACs launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Indexes continue outperformance of benchmarks amid global rout

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.