The IPOX® Week - October 23, 2023

Headlines:

- IPOX® Indexes trade lower as risk-averse investors dodge growth stocks.

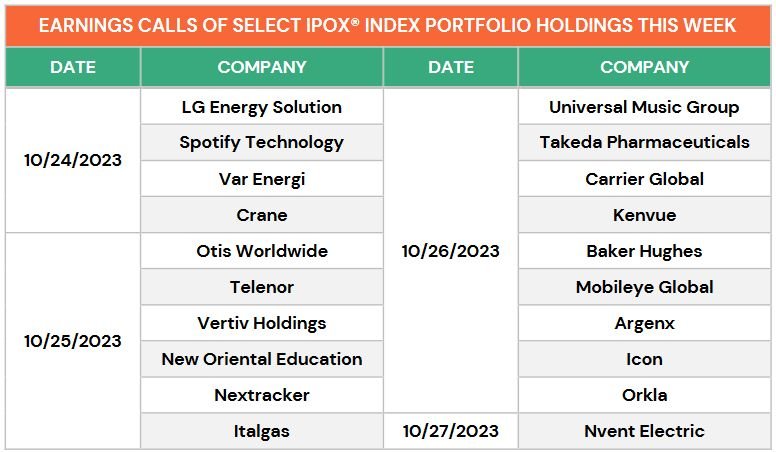

- IPOX® Portfolio holdings in focus this week as Q3 Earnings Season begins.

- Kokusai Electric set for the largest Japanese IPO since Softbank in 2021.

- IPOX® SPAC (SPAC) dips 2.94%. No SPAC launches in the U.S. last week.

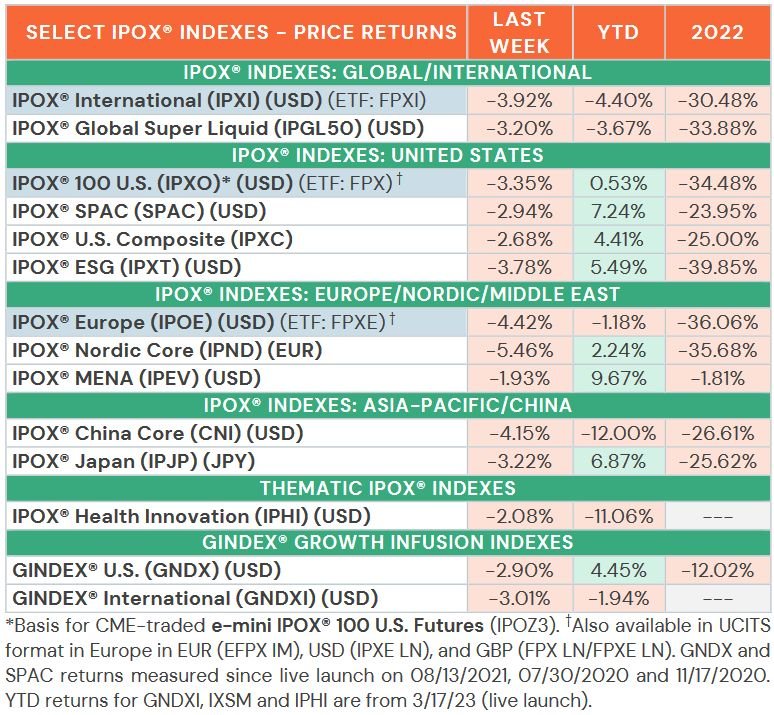

WEEKLY IPOX® PERFORMANCE REVIEW: Amid options expiration week, global equity markets grappled with heightened uncertainty due to the intensifying Israel-Hamas conflict, which continued to steer investors toward more traditional safe-haven assets like bonds and gold. Consequently, select newly-listed, high-potential companies within the IPOX® Indexes experienced falling share prices, as unseasoned growth stocks faced selling pressure due to heightened risk aversion. While long-term U.S. treasury yields rose sharply above the 5% mark, the S&P 500 fell below the key 200-day average, with volatility (VIX: +12.37%) climbing to the highest level since March. On a positive note, as firms in the benchmark start to disclose their Q3 earnings, 74% of reporting firms have outperformed analyst predictions so far. With the IPOX® 100 U.S. (ETF: FPX) trading -3.35% lower last week, it is therefore notable that a substantial portion of companies within the IPOX® portfolios are yet to announce results (see table below). International markets also face geopolitical and economic worries, e.g., with debt-laden Italy announcing tax cuts and increased public spending amid yields at 11-year highs, and continued concerns on China’s property sector. The IPOX® Europe (ETF: FPXE) dropped -4.42%, while the IPOX® International (ETF: FPXI) fell -3.92%.

IPOX® PORTFOLIO STOCKS IN FOCUS: The IPOX® 100 U.S. (ETF: FPX) was led by recently added biotech firm Neumora Therapeutics (NMRA US: +5.75%) after disclosing findings on the first novel mechanism-of-action drug in major depression in decades. Work management software firm Asana (ASAN US: +4.44%) climbed as CEO Moskovitz bought $6.2m worth of shares. EV maker Rivian (RIVN US: -13.37%) slumped as disappointing earnings by rival Tesla sparked concerns on growth in the sector, which may also have had additional impact on IPOX® Europe (ETF: FPXE) holding Kempower (KEMPOWR FF: -29.05%) as the Finnish EV charger firm dropped after earnings. While solar stocks plunged amid SolarEdge’s warning on demand in Europe, diversified Portuguese biomass, wind and solar renewable energy specialist Greenvolt (GVOLT PL: +11.68%) bucked the trend. Polish HR firm Grupa Pracuj (GPP PL: +8.30%) gained as the country’s recent elections were won by a centre-left coalition. German sandal maker Birkenstock (BIRK US: +6.38%) was added to the IPOX® Europe (ETF: FPXE) on Wednesday. Amid rising commodity prices on fears of escalating tension in the Middle East, Norwegian oil and gas firm Vår Energi (VAR NO: +5.90%) led the IPOX® International (ETF: FPXI) for the second week. British pest control and hygiene firm Rentokil Initial (RTO LN: -23.75%) dropped after earnings, revealing weaker forecasts for revenues in North America.

IPO Review: 10 sizable IPOs listed last week, gaining an average +6.37% from offer price to Friday’s close. The most notable listings included Taiwanese semiconductor giant MediaTek’s wireless communication subsidiary Airoha Technology (6526 TT: +0.38%), raising $235m in last week’s largest IPO. Paris-listed French pharma firm Abivax (ABVX US: -28.45%) plunged after raising $216m from an ADS offer on Nasdaq. Swedish non-food discount retailer Rusta (RUSTA SS: +2.22%, $186m) gained in the country’s first IPO this year. Other listings included, e.g., Australian child care provider Nido Education (NDO AU: -2.00%, $104m) and Nebraskan Home Federal Bank, listing as Central Plains Bancshares (CPBI US: -9.00%, $41m).

IPO Market Outlook: 4 sizable firms are expected to list this week. Tuesday: Thai plastic surgery clinic Aesthetic Connect (TRP TB, $37m). Wednesday: Oklahoma oil and gas producer Mach Natural Resources (MNR US, $210m) and Japanese KKR-backed semiconductor production equipment maker Kokusai Electric (6525 JP, $734m), the country’s largest listing since SoftBank in 2021. Friday: Tencent-backed courier J&T Global Express (1519 HK, $501m) is set to launch in Hong Kong. Pushing for market domination through aggressive marketing, the firm hired football legend Lionel Messi as spokesperson last year.

THE IPOX® SPAC (SPAC): The Index of 50 constituents trading at both the pre- and post-consummation stage fell -2.94% to +7.24% YTD last week. Warehouse robotic provider Symbotic (SYM US: +5.43%) continued to rise, while Bitcoin miner Bitdeer Technologies (BTDR US: -28.89%) fell anew despite bitcoin testing $30000 level amid potential spot bitcoin ETF approval. Other SPAC news: 1) 4 SPACs Announced Merger Agreement include RF Acquisition (RFAC US: -0.09%) with Singapore-based video games producer and distributor GCL Asia. 2) 4 SPACs Approved/Completed Business Combinations as Athena Consumer Acquisition completed merger with German EV maker Next.e.GO (EGOX US: -85.00%). 3) No SPAC announced liquidation. 4) No new SPACs launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.