The IPOX® Week - October 24, 2022

Headlines:

- IPOX® 100 U.S. (ETF: FPX) surges +6.15%, outperforms benchmarks QTD.

- IPOX® Portfolio Team hits home run with de-SPAC Archaea Energy (LFG).

- IPOX® SPAC (SPAC) adds +1.89%, No SPACs launched in U.S. last week.

- $820m IPO of Intel self-driving spin-off Mobileye set to debut Thursday.

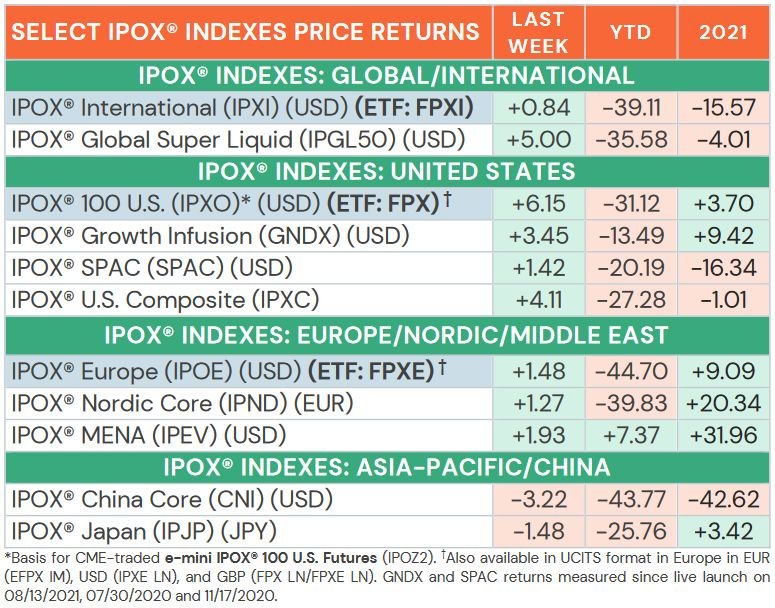

WEEKLY IPOX® PERFORMANCE REVIEW: Most IPOX® Indexes gained during last week’s U.S. options expiration week, as equities won the latest tug-of-war vs. U.S. yields, which closed higher for the 12th consecutive week (!!!). Amid lower volatility (VIX: -6.65%), most upside focus was on the outstanding showing of the broad innovation and corporate actions focused IPOX® 100 U.S. (ETF: FPX) which surged a massive +6.15%, +141 bps. ahead of the S&P 500 (SPX) to top the QTD diversified ETF performance rankings. We also note big gains for the large-cap heavy IPOX® Global Super Liquid (IPGL50), adding +5.00%, while the ex-U.S. IPOX® International (ETF: FPXI; +0.84%) also rose. Across Asia-Pacific, the IPOX® Japan (IPJP: -1.48%) declined and the IPOX® China (CNI: -3.22%) fell anew amid a surprising blackout on China GDP data, casting doubt on the country’s economic outlook. Elsewhere, we noted gains in the IPOX® Europe (ETF: FPXE; +1.48%), the Scandinavia-focused IPOX® Nordic (IPND: +1.27%) as well as the Middle East-focused IPOX® MENA (IPEV: +1.93%). Amid a busy IPO M&A market, the large-cap heavy and super-liquid IPOX® Growth Infusion (GNDX) gained +3.45%, +677 bps. YTD ahead of the S&P 500 (SPX).

IPOX® PORTFOLIO HOLDINGS IN FOCUS: Indicative of the unabating trend towards IPO M&A and the significant value in select de-SPACs, the IPOX® portfolio management team hit a home run with de-SPAC U.S. renewable gas producer Archaea Energy (LFG US: +52.57%) last week. The firm, added to the IPOX® 100 U.S. (ETF: FPX) on Sep. 16, soared on oil & gas giant BP’s buyout offer. Other big movers in the IPOX 100 U.S. (ETF: FPX) included video game maker Roblox (RBLX US: +21.09%) and restaurant management software Toast (TOST US: 21.79%), which both surged after upbeat company news and respective analyst upgrades. Winners in the IPOX® International (ETF: FPXI) included Swedish digital bank Nordnet (SAVE SS: +12.97%), Chinese agricultural firm Pinduoduo (PDD US: +10.11%), as well as Saudi exchange operator Tadawul (TADAWULG AB: +10.24%) as IPO activity remains brisk across the MENA region and ahead of the FIFA World Cup. Indonesian super app GoTo (GOTO IJ: -0.99%) fell after negotiating a controlled $1b stake sale by early backers Alibaba and SoftBank. Big Pharma firm serial IPO acquirer Eli Lilly (LLY US: +2.43%) gained after announcing the acquisition of IPOX® constituent Akouos (AKUS US: +79.03%). We also note big strength in recent IPOX® International (ETF: FPXI) and IPOX® Europe (ETF: FPXE) addition German car maker Porsche (P911 GR: +10.21%), adding +16.73% since IPO.

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: 5 sizable IPOs launched internationally last week, with the average equally weighted deal gaining +6.32% based on the difference between the final offer price and Friday’s close. Deals included Metaverse firm Flowing Cloud Technology (6610 HK: +5.88%), EV battery firm Top Material (360070 KS: +19.33%), ship and aircraft leasing firm SBI Leasing Services (5834 JP: +18.96%), $175m US-IPO of genetic medicine firm Prime Medicine (PRME US: -7.29%), energy grid firm Precise Corp (PCC TB: -14.50%) and renewable fertilizer firm Cinis Fertilizer (CINIS SS: +34.48%).

2 large IPOs are planned internationally this week. Tuesday: Saudi oil drilling firm Arabian Drilling (ticker pending, $711m offer). Thursday: Intel AI driving spin-off re-IPO Mobileye (MBLY US, $820m offer) after slashing valuation.

Other news: 1) Instacart pauses IPO plans to go public in 2022. 2) Saudi Aramco to push ahead with IPO of trading unit. 3) Thai food producer Betagro prices Nov. 2 IPO to raise $453m. 4) PE-firm Silver Lake backs $171m IPO of Abu Dhabi geodata analytics firm Bayanat on Oct. 31. 5) Austrian parking firm Best in Parking plans to raise up to $400m in rare Q1 2023 Vienna IPO. 6) IPOX® Europe (ETF: FPXE) holding, Swedish PE-firm EQT to explore sale of U.S. bus operator First Transit.

THE IPOX® SPAC (SPAC) The Index, currently composed of a selected 50 high conviction plays trading at both the pre- and post-consummation stage, added +1.42% to -20.19% YTD. IPOX® SPAC Leaders recording upside/downside moves last week include oil and gas company Magnolia Oil & Gas (MGY US: +13.28%), while space-based cellular broadband satellite network company AST SpaceMobile (ASTS US: -12.64%) fell sharply. Other SPAC news from last week: 1) 8 SPACs Announced Merger Agreement include Technology & Telecommunication Acquisition (TETE US: +0.10%) with Malaysian fintech Super Apps. 2) 2 SPACs Approved or Completed Business Combination include Executive Network Partnering (ENPC US: -6.19%) with oil & gas company Granite Ridge (GRNT: 10/25). 3) 2 SPACs opted to liquidate include H.I.G Acquisition (HIGA US: $10.04/share) and Sanaby Health Acquisition (SANB US: $10.22/share) making it a total of 40 SPACs to dissolve YTD. 4) 1 SPACs Terminated Merger include Benessere Capital Acquisition (BENE US: +0.29%) with hydrogen-based fuel supplier eCombustible. 5) No SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Indexes continue outperformance of benchmarks amid global rout

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.