The IPOX® Week - October 31, 2022

Headlines:

- IPOX® 100 U.S. (ETF: FPX) gains +3.90%, zooms past Nasdaq 100 YTD.

- IPOX® Growth Infusion extends 2022 lead vs. S&P to massive +870 bps.

- IPOX® SPAC (SPAC) adds +1.65%, No SPACs in the U.S. last week.

- Mobileye soars +29% as recent IPOs score big post-IPO gains.

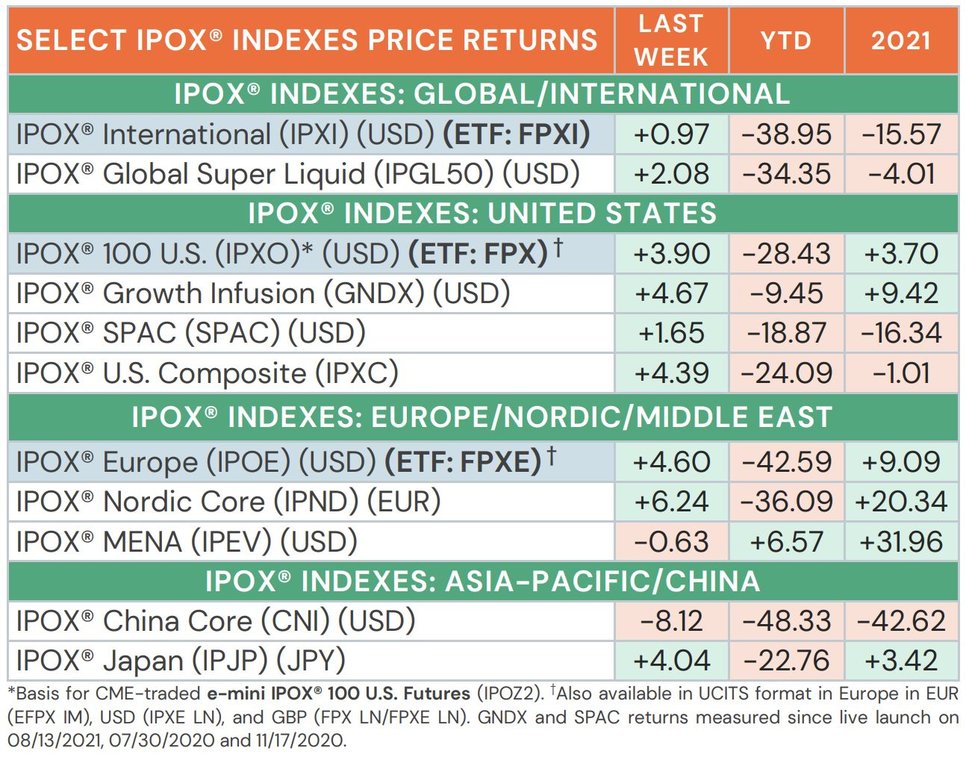

WEEKLY IPOX® PERFORMANCE REVIEW: Most IPOX® Indexes rose strongly last week after a modest decline in global interest global rates improved underlying sentiment for equities towards month-end. Ahead of a huge week for earnings with 44 portfolio holdings set to report this week, e.g., the innovation-focused, FANG-free IPOX® 100 U.S. (ETF: FPX) added +3.90%, in line with the S&P 500 (SPX) and a large +180 bps. ahead of the Nasdaq 100 (NDX), benchmark for growth stocks. Gains extended to markets abroad with the IPOX® Nordic (IPND) and IPOX® Europe (ETF: FPXE) surging +6.24% and +4.60%, respectively. The ex-U.S. IPOX® International (ETF: FPXI; +0.20%) and IPOX® Japan (IPJP: +4.04%) also had a firm week, while the IPOX® China (CNI: -8.12%) fell anew amid liquidation selling across China-domiciled exposure. Across MENA, the Middle East-focused IPOX® MENA (IPEV: -0.63%) declined as Saudi Arabia’s sovereign wealth fund PIF announcement of more share sales pressured sentiment ahead of the FIFA World Cup. With IPO M&A at brisk pace, we note more gains for the IPOX® Growth Infusion (GNDX), adding +4.67% and extending its YTD lead vs. the S&P 500 (SPX) to +870 bps.

IPOX® PORTFOLIO HOLDINGS IN FOCUS: Amid earnings, portfolio stocks recording big moves last week included energy solutions providers, i.e., ChampionX (CHX US: +22.06%), IPOX® Europe (ETF: FPXE) holding gas utility Italgas (IG IM: +11.17%) as well as a slew of biotech/pharma plays, such as Verve Therapeutics (VERV US: +27.19%), Prometheus Biosciences (RXDX US: +13.11%) and BoneSupport (BONEX SS: +20.57%), while success of recent IPO genetic medicine firm Prime Medicine (PRME US: +18.33%) has been quoted as a sign of a recovery in the biotech IPO market. Corporate actions in the IPOX® U.S. Composite (IPXC) universe included the buyout offer for Chicago-based BBQ grill maker Weber (WEBR US: +28.24%) and glass repair unit of IPOX® Europe (ETF: FPXE) holding, automotive glass firm D’Ieteren (DIE BB: +8.51%). IPOX® International (ETF: FPXI) and IPOX® Europe (ETF: FPXE) constituent insurance company Arch Capital (ACGL US: +17.52%) surged after being added to the S&P 500, replacing Twitter. Last week’s IPOX® ETF laggards included the slew of China-domiciled firms, such as Chinese data center firm Chindata (CD US: -19.06%) and Tencent-backing tech investor Prosus (PRX NA: -15.89%).

GLOBAL IPO DEAL FLOW REVIEW AND OUTLOOK: The spin-off IPO of Intel self-driving car unit, U.S.-traded Mobileye (MBLY US) was the only sizable IPO last week, gaining +28.57% based on the difference between the final offer price and Friday’s close. Click here to read the latest edition of The IPOX® Watch, featuring insights on Mobileye.

5 international IPOs are expected to start trading this week. Monday: Abu Dhabi’s Bayanat AI (BAYANAT UH: $171m offer), a Silver Lake-backed geospatial data analysis unit of AI firm Group 24. Wednesday: Thailand’s meat producer Betagro (BTG TB: $502m offer). Friday: Hong Kong listing of Chinese skincare firm Giant Biogene (2367 HK, $80m offer) and two Indonesian firms: Disposable medical device manufacturer OneMed (OMED IJ: $83m) and palm oil firm Citra Borneo Utama (CBUT IJ: $52m).

Other news: 1) Owner of Indonesian e-commerce firm Blibli raises $513m in upsized IPO, trading to start Nov. 7. 2) North Sea Oil & Gas firm Ithaca Energy confirms plan to raise $1b in London IPO. 3) Welkin China Private Equity pauses $300m London IPO. 4) Nasdaq halts IPOs of small Chinese firms as it probes stock rallies. 5) Recent IPOs surge to reach new highs: Socionext (6526 JP: +2.92%), IPOX® U.S.-tracked Corebridge (CRBG US: +6.33%), Prime Medicine (PRME US: +18.33%) and new IPOX® International (ETF: FPXI) and IPOX® Europe (ETF: FPXE) member Porsche (P911 GR: +4.10%) all gained substantially.

THE IPOX® SPAC (SPAC): The Index, currently composed of a select list of 50 high conviction opportunities trading at the pre- and post-consummation stage, added +1.65% to -18.87% YTD. IPOX® SPAC Leaders recording big moves include crop productivity AgriTech company Bioceres Crop Solutions (BIOX US: +15.19%), while “last mile” mobile health and transportation services provider DocGo (DCGO US: -11.00%) fell. Other SPAC news from last week: 1) 4 SPACs Announced Merger Agreement include Jupiter Wellness Acquisition (JWAC US: 0.00%), with Chinese car maker Chijet Motor. 2) 8 SPACs Approved or Completed Business Combination include a) BOA Acquisition with Gen-Z focused vacation and co-working accommodation provider Selina Hospitality (SLNA US), surging as much as +442% after debuting and b) Ignyte Acquisition with Satellite communication systems developer SatixFx Communication (SATX US), soaring as much as +534%. 3) 3 SPACs opted to liquidate include Benessere Capital Acquisition (BENE US: $10.45/shares) just days after deal termination, making it a total of 43 SPACs to dissolve YTD. 4) No SPAC launched last week in the U.S.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.

Futures trading involves the substantial risk of loss and is not suitable for all investors.

Each investor must consider whether this is a suitable investment since you may lose all of or more than your initial investment.

Past performance is not indicative of future results.

Indexes continue outperformance of benchmarks amid global rout

Latest posts

Never miss a beat

Stay on top of the latest news and market insights

Trade stock, options and futures

Lightspeed offers active and professional traders highly accurate market data, complex order management, fast executions, and multiple routing destinations.

Lightspeed Financial Services Group LLC is not affiliated with these third-party market commentators/educators or service providers. Data, information, and material (“Content”) are provided for informational and educational purposes only. This content neither is, nor should be construed as an offer, solicitation, or recommendation to buy or sell any securities or contracts. Any investment decisions made by the user through the use of such content are solely based on the user's independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Lightspeed Financial Services Group LLC does not endorse, offer or recommend any of the services or commentary provided by any of the market commentators/educators or service providers, and any information used to execute any trading strategies are solely based on the independent analysis of the user.